Skip to main content

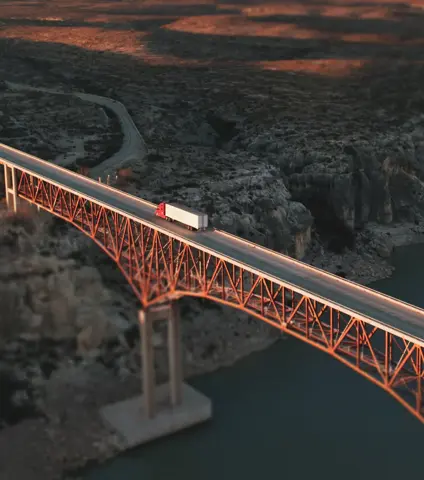

TRANSPORTATION & LOGISTICS with more than 30 years of industry experience with custom insurance solutions that drive down costs

— RISK MANAGEMENT

Transportation and logistics

Lockton's experience with custom insurance solutions that drive down costs

Focused on making your business better

The trucking industry continues to navigate significant challenges — from rising commercial auto jury awards and organized fraud rings to increased retentions, escalating premiums, and constrained insurance capacity. For over 30 years, our Transportation and Logistics Practice has been at the forefront of addressing these complexities. Today, it stands as one of the largest and most experienced teams in the nation dedicated to transportation insurance. We specialize in placing and servicing large, complex transportation risks, delivering tailored solutions that help protect and grow your business.

Transportation & Logistics Practice at a glance

Coverage knowledge

Auto liability

Broker liability

Cargo

Errors and omissions

General liability

Nontrucking liability

Occupational accident

Physical damage

Property

Shipper’s interest

Stock throughput

Umbrella and excess liability

Warehouse legal

Workers’ compensation

Industry knowledge

LTL

Truckload

Dry van

Drayage

Refrigerated

Moving and storage

Flatbed

Tanker

Bulk

Charter/school bus

Car hauler

Driveaway

Towing

Limousine

Gig economy

Matt Payne named U.S. Transportation Practice Leader

Delivering even greater value to our transportation and logistics clients.

Read moreWhat sets us apart

Advocacy

We are actively involved in many industry groups at a national, state, and local level to bring change to the transportation industry and fight the forces attacking your business.

Global reach

Not only do you get the depth and breadth of our transportation experts, but you also get the full backing of Lockton’s global capabilities, including specialty wholesalers and reinsurers.

Specialized expertise

With over 30 transportation specialists, we have the expertise and capabilities to service even the most complex businesses.

Let's talk insurance for your company

Learn more about our industry-leading transportation and logistics risk solutions.

Talk to our team