Imagine running a business where you are required to price your product without knowing your cost of goods sold until years in the future. This is the reality for commercial auto liability insurers. To meet this challenge, they rely on actuarial techniques that use historical patterns to predict ultimate cost. But what happens when loss drivers fundamentally change over time?

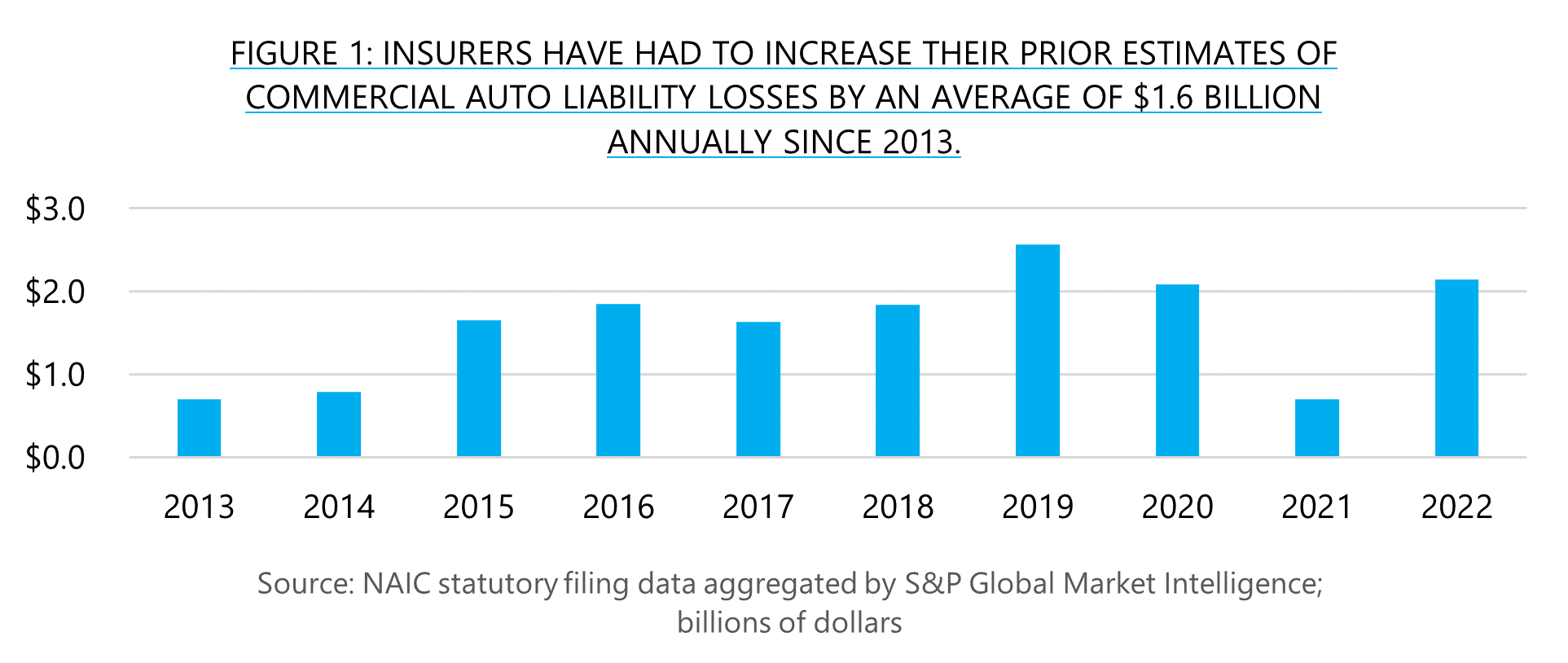

Over the last decade, increases in social and economic inflation have caused the industry to consistently underestimate losses. Commercial auto insurers have been forced to increase their prior estimates by at least $700 million every year for the past decade, as losses continue to outpace expectations (see Figure 1). While 2021’s COVID-19-influenced correction offered hope that insurers had started catching up to these trends, the increase of more than $2 billion in 2022 shows they still have a long way to go.

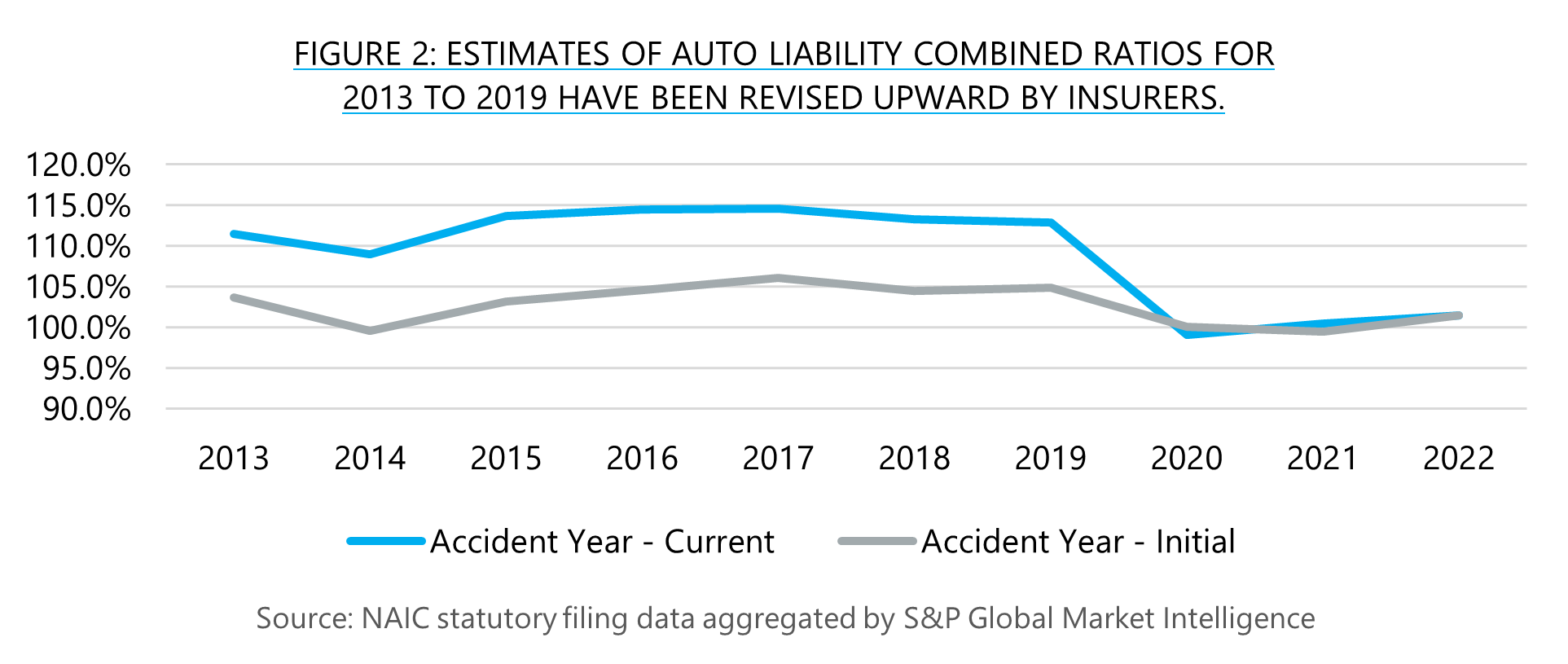

These increased estimates have a direct impact on profitability, as reflected in changes between the combined ratio estimates from each policy year’s initial valuation and the current valuation (see Figure 2). For the years 2013 to 2019, commercial auto policies will cost 8 to 10 cents more per dollar of premium than was initially assumed at the end of the first year.

Although estimates for 2020 to 2022 suggest the combined ratio has flattened, it is worth noting that many courts were closed in 2020 and 2021 and losses have not fully matured. Further, just getting to a breakeven combined ratio of 100 has required annual premium increases of 13% to 14% across insurer portfolios to stay abreast of social and economic inflation. Although not every policyholder will experience this level of increase, P&C executives are watching loss trends closely and are anxious to ensure that rates continue to keep pace.

For more information, explore Lockton’s June 2023 Market Update. (opens a new window)