Over the past 24 months, the property and casualty insurance industry has been intensely focused on economic inflation. Overall inflation, as measured by the Bureau of Labor Statistics’ Consumer Price Index (CPI) (opens a new window), reached a 40-year high of 9.1% year over year in June 2022.

Since then, the Federal Reserve has taken steps to contain inflation; the CPI rose 3.7% year over year in August 2023. But this remains well above the Fed’s 2% target, and it appears inflation will remain high for a long period of time.

As insurers have grappled with rising loss costs for commercial property, homeowners and auto repair, they are also facing a more troubling concern: social inflation.

Social inflation fueling adverse loss development

Social inflation refers to the dramatic increase in the size of claim settlements and verdicts associated with civil litigation. This has best been exemplified by the dramatic rise in the frequency and size of so-called “nuclear” verdicts of $10 million or more.

Social inflation’s causes are varied and complex, but include socioeconomic, legal and behavioral factors such as:

A greater propensity for litigation across the U.S.

A well-funded and organized plaintiffs’ bar.

Third-party litigation funding.

Evolving and expanding theories of liability.

Lax evidentiary standards that permit the consideration of “junk science.”

Rising anticorporate bias among prospective jury members and evolving theories of fairness.

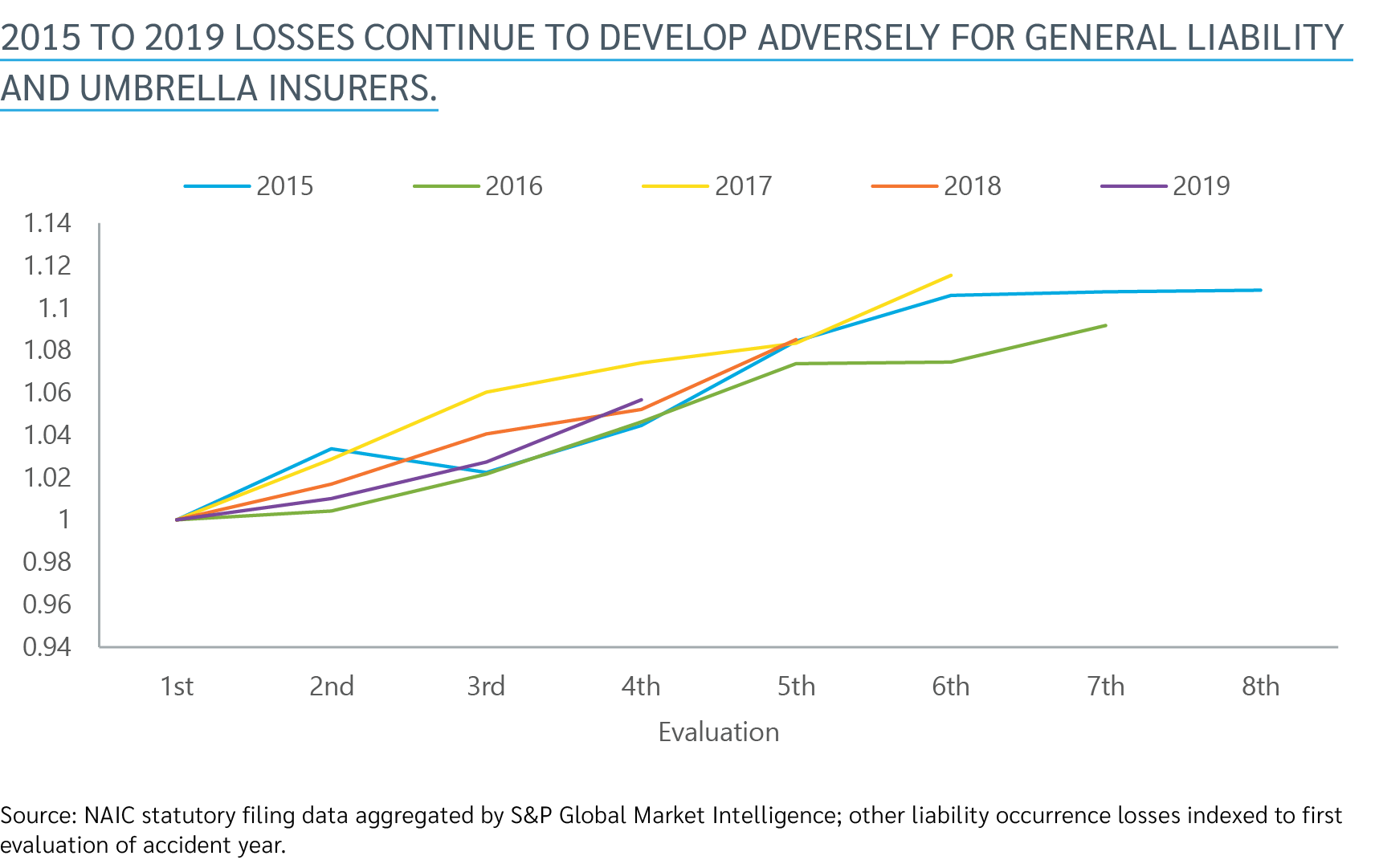

These trends have contributed to an increasing deficiency in industry reserves associated with third-party liability losses. In recent years, liability insurers have underestimated expected losses and are now seeing significant adverse reserve development at each valuation.

The trend from the 2015 to 2019 accident years is particularly stark — and the problem appears to be getting worse. Adverse development in 2022 for accident years 2017 through 2019 was the highest it had ever been. Conventional wisdom would suggest that after two to four years of significant adverse development, those years should begin to plateau. Instead, the trend appears to be accelerating.

Losses eroding primary and umbrella limits

In 2019, insurers reacted to rising loss severity by tightening risk selection standards, reducing capacity, increasing retentions and attachments and raising rates. Although these actions helped restore some measure of profitability, insurers have continued to watch loss rates trend even higher.

The median nuclear verdict against corporate defendants rose from $21.5 million in 2020 to $41.1 million in 2022 — a staggering increase of 95%, according to Marathon Strategies. More troublingly, the number of verdicts above $100 million has also continued to climb. Since 2009, 48 verdicts of $500 million or more have been recorded, including 23 of $1 billion or more.

As verdicts grow in size and frequency, losses are going through primary and umbrella limits far more regularly (and quickly), often extending deep into excess layers. By some estimates, the loss trend for third-party liability is now 8% to 12% each year — far above economic inflation. Combined with a higher cost of capital, this has renewed pressure on program structures and pricing.

Using analytics to aid decision-making

The net result of these trends is a market environment for third-party liability that continues to evolve. Entering the fourth quarter of 2023, insurers signaled a renewed focus on the adequacy of rates, attachments and limits. Liability insurance buyers with large fleets, significant product exposure and/or adverse loss histories will feel the impact as insurers try to stay ahead of trend.

For buyers, the emphasis remains on:

Using analytics to differentiate themselves and guide decisions around attachments and limits.

Understanding the financial efficiency and potential for volatility associated with various program options, which can also facilitate the use of alternative risk strategies to mitigate the impact of market changes.

Closely evaluating limits to ensure they remain sufficient to protect against rising loss severity and the potential for nuclear verdicts.

For more on this topic, read our recent white paper, How Much is Enough? (opens a new window) And for more on the state of the insurance market, explore our September 2023 Lockton Market Update (opens a new window).