Starting in 2025, employers are no longer required to furnish Forms 1095-C to individuals if they provide proper notice, unless it is requested. Although furnishing Forms 1095-C is not a second quarter requirement, we’re providing it now as it was not available when our first quarter alert was released.

The notice of availability must be posted on the employer’s website by March 2 of each year (the same due date as the Form 1095-C furnishing date, plus the automatic 30-day extension) and remain posted until Oct. 15. The notice must be clear and conspicuous, and be reasonably accessible to all responsible individuals, stating that Form 1095-C is available upon request. The notice must provide the contact information to request the form, and forms must be provided within 30 days of the request (or by Jan. 31, whichever is later).

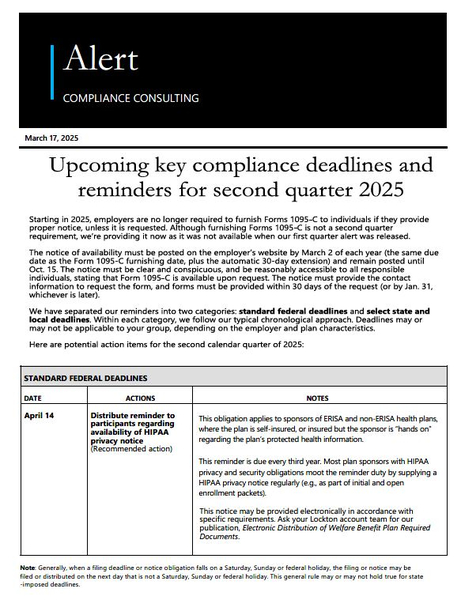

We have separated our reminders into two categories: standard federal deadlines and select state and local deadlines. Within each category, we follow our typical chronological approach. Deadlines may or may not be applicable to your group, depending on the employer and plan characteristics.

Here are potential action items for the second calendar quarter of 2025:

STANDARD FEDERAL DEADLINES

April 14 - Distribute reminder to participants regarding availability of HIPAA privacy notice (recommended action)

This obligation applies to sponsors of ERISA and non-ERISA health plans, where the plan is self-insured, or insured but the sponsor is “hands on” regarding the plan’s protected health information.

This reminder is due every third year. Most plan sponsors with HIPAA privacy and security obligations moot the reminder duty by supplying a HIPAA privacy notice regularly (e.g., as part of initial and open enrollment packets).

This notice may be provided electronically in accordance with specific requirements. Ask your Lockton account team for our publication, Electronic Distribution of Welfare Benefit Plan Required Documents.

April 15 - Make final HSA contributions toward 2024 HSA limits and/or make HSA corrections related to 2024 calendar year

Applies to employers who provide HSA enrollment. Employers and individuals have until the individual's tax filing deadline to make HSA contributions and corrections related to the tax filing year.

April 30, May 31 and June 30 - File Form 5500 for plan years ending Sept. 30, Oct. 31 and Nov. 30, 2024, respectively (due on the last day of the 7th month after end of the plan year)

ERISA plans must file a Form 5500 at least annually unless the plan is exempted from the filing requirement. Filing is accomplished electronically through the Department of Labor’s (DOL) EFAST (opens a new window) portal.

Form 5500 extensions are available by filing a Form 5558 (opens a new window) with the DOL on or before the filing’s initial due date. Filing Form 5558 allows the plan up to an additional 21/2 months to complete the filing.

June 1 - Submit prescription/medical plan cost reporting to CMS (RxDC)

Applies to all employers. The Consolidated Appropriations Act requires group medical plans to file a report with CMS reflecting a variety of cost and other medical data with respect to the group health plans’ prescription drug and other benefits. Does not apply to excepted benefits.

The filing is completed electronically through the CMS Enterprise Portal (opens a new window). If the employer plan sponsor is filing any part of the filing, the employer will need to establish an HIOS account. However, most third-party administrators and/or pharmacy benefit managers contracted to provide services to the group health plan will assist and/or submit filings on behalf of the group health plan.

STATE AND LOCAL DEADLINES

April 30 - Submit Forms 1095-C and/or 1095-B, with Form 1094-C or 1094- B, to Washington D.C. Office of Tax and Revenue

Applies to employers who provided medical coverage to District of Columbia residents in the prior calendar year.

Employers that provided medical coverage to at least 50 full-time employees, including at least one District resident, during the prior calendar year must file with the Office of Tax and Revenue copies of the Forms 1094-C and 1095-C, or Forms 1094-B and 1095-B, that the employer filed with the IRS with respect to any employee for whom the employer withholds D.C. taxes, and to any employee who has a mailing address in D.C., whether or not the employer withholds and reports D.C. taxes.

April 30 - Make San Francisco HCSO contributions for prior calendar quarter

Applies to fully insured employers subject to the San Francisco Healthcare Security Ordinance. Quarterly true-up contributions, if due for the quarter ending March 31, are due by April 30.

Self-funded employers have the option of utilizing an annual true-up method in lieu of quarterly filings. Annual true-up payments for self-insured plans are due by Feb. 28 each year.

April 30 - File annual San Francisco HCSO reporting form for the prior calendar year

Applies to all employers subject to the San Francisco Healthcare Security Ordinance.

Note: Employees who telework within the limits of San Francisco will be covered employees for purposes of this rule.

April 30 - Washington Cares Tax

Applies to fully insured and self-insured ERISA plans. Employers collect premiums from employees via after-tax payroll withholdings to support WA Cares long-term care insurance program for all employees who work primarily in Washington.

Employers must remit payroll tax withholdings to the Employment Security Department the same way they do for Paid Family and Medical Leave. Employers report for both programs at the same time on the same report through the quarterly payroll reporting process.

Payments must be submitted to the state by the last day of the month following the calendar quarter in which premiums were withheld.

Reports and payments for Q1 (Jan., Feb., and March) are due April 30 of the following quarter.

May 15 - WAPAL Fund

Applies to all assessed entities with covered lives in Washington, including Washington employers and out-of-state employers with covered lives in Washington. Applies to self-insured ERISA plans.

Assessed entities must log in to the WAPAL Fund and submit a report reflecting the total number of covered lives for each month in the prior calendar quarter and pay fees consisting of the employer/insurer’s share of WAPAL program costs.

Reports are due 45 days after the close of each calendar quarter. For Q1 (Jan.-March), reporting opens April 1 and payments are due May 15.

Note: Generally, when a filing deadline or notice obligation falls on a Saturday, Sunday or federal holiday, the filing or notice may be filed or distributed on the next day that is not a Saturday, Sunday or federal holiday. This general rule may or may not hold true for state-imposed deadlines.

Not legal advice: Nothing in this alert should be construed as legal advice. Lockton may not be considered your legal counsel, and communications with Lockton's Compliance Consulting group are not privileged under the attorney-client privilege.

For more alerts, insights and additional information, click here (opens a new window) to visit Lockton's ERISA Compliance Consulting page.

Download alert (opens a new window)

Download alert (opens a new window)