Recent headlines about P&C insurance have been dominated by concerns about the increased frequency of natural catastrophe events and social inflation. In contrast, workers’ compensation has largely been ignored.

But it shouldn’t be. Workers’ compensation accounts for approximately 5% of total P&C premiums and is among the largest controllable expenses for many organizations. It also has a material impact on the overall profitability of the insurance industry.

In May, the National Council on Compensation Insurance (NCCI) published its annual State of the Line Report (opens a new window), analyzing the newest year of data on the workers’ compensation market. The report highlights a very healthy market poised to continue its positive trajectory. For buyers, this is a welcome relief and may present opportunities to help offset pricing pressures elsewhere in their insurance programs.

Loss drivers

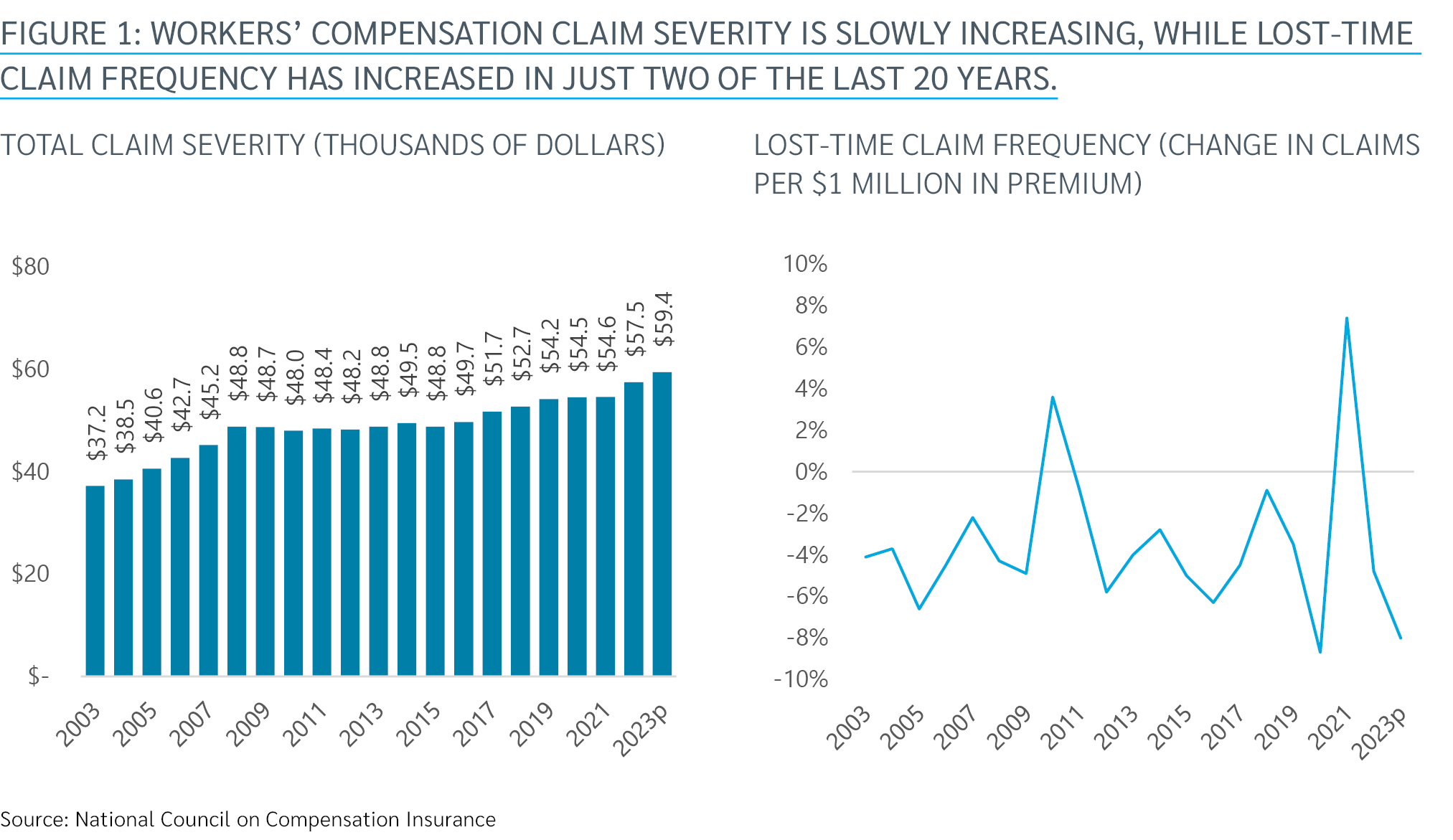

Unlike liability lines, where claim costs have rapidly escalated due to both economic and social inflation, workers’ compensation has benefitted from highly stable loss trends, with annual severity increases at or below general inflation (see Figure 1).

Lost-time claims — those involving injuries that cause employees to lose time from work — drive the majority of costs in the workers’ compensation system. With the exception of slight upticks in 2010 and 2021 as the industry rebounded from the Great Recession and COVID-19 pandemic, respectively, NCCI found that the frequency of such claims has consistently fallen over the last two decades.

Better yet, the pace of that improvement has been accelerating, with 2022 and 2023 seeing significantly larger decreases than the long-term average.

When losses do occur, the costs generally fall into two buckets:

Medical benefits covering treatments to injured workers; and

Indemnity, or wage replacement, benefits.

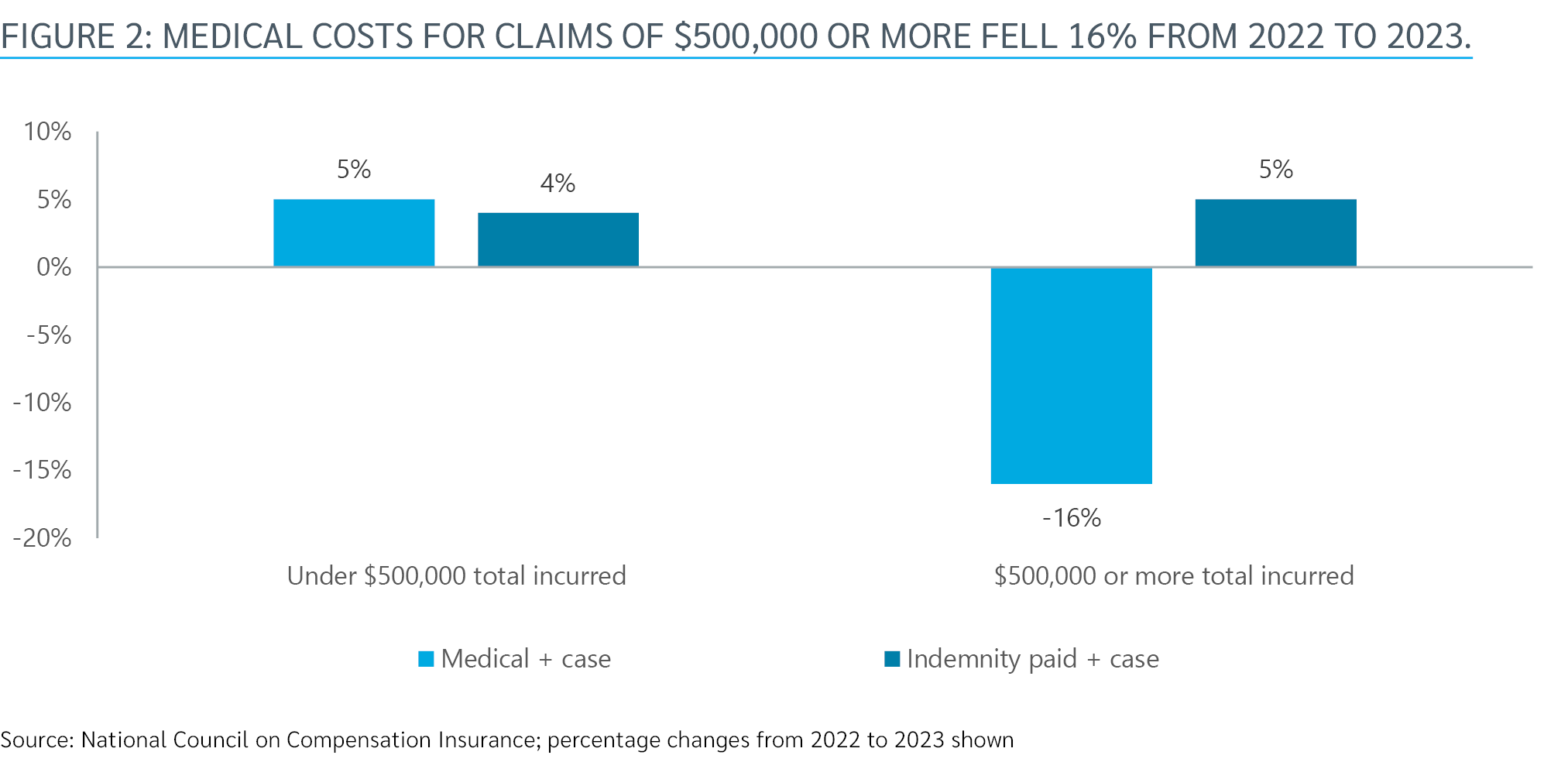

Medical claim severity in workers’ compensation rose just 2% in 2023, surprising many who expected a far greater increase due to inflation. This is due in large part to state fee schedules and other measures that have helped to limit cost increases. Insurers and employers have been especially successful at containing medical costs on claims of $500,000 or more (see Figure 2).

Indemnity severity, meanwhile, increased 5% from 2022 to 2023, which largely reflects an uptick in wage inflation. As payrolls go up, so do average weekly wages — resulting in higher indemnity costs.

Higher payrolls, however, result in more premium for insurers, which counters the negative impacts of increased severity. That’s far different from what’s happening in, for example, auto liability; without the same natural inflation hedge, increasing loss severity has had a devastating impact on that line.

Favorable Trends = Lower Premiums

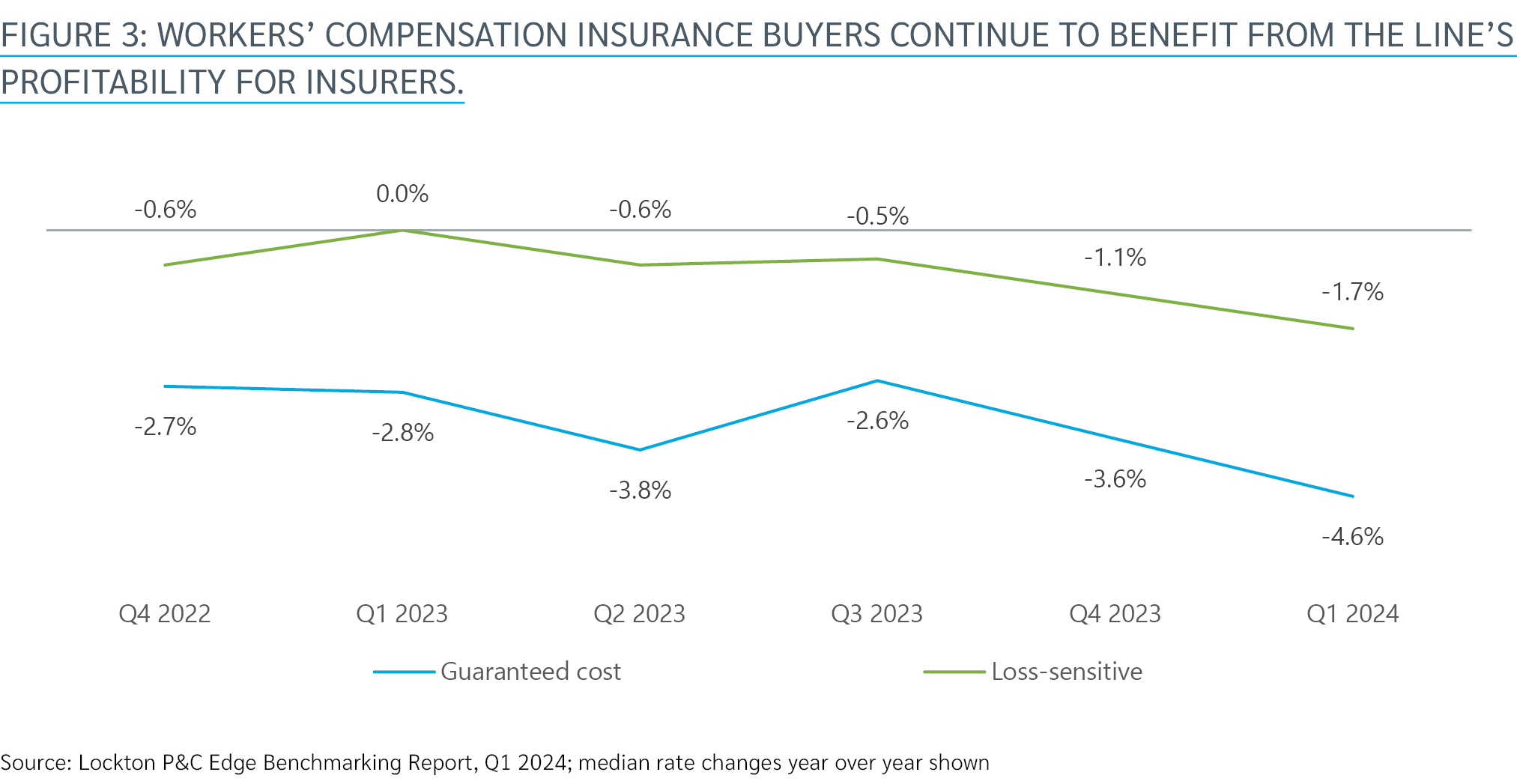

Given these trends, workers’ compensation remains extremely competitive for buyers. Stable conditions and long payout patterns have insurers eagerly competing for new business, and employers are benefiting. In the first quarter of 2024, median rates fell 4.6% for guaranteed cost buyers and 1.7% for loss-sensitive buyers (opens a new window) (see Figure 3).

Beyond its data collection activities, NCCI also publishes advisory loss costs/rates that insurers can incorporate into their premium algorithms. NCCI filed rate reductions in 2024 for all 38 states in which it provides these ratemaking services.

Individual account characteristics — including exposure changes, loss experience, operational changes, and improvements in safety and claims management — will ultimately determine an insured’s premium change. But this action by NCCI reflects the general expectation that the workers’ compensation insurance market will remain favorable to most buyers in 2024.

Profitable Outlook

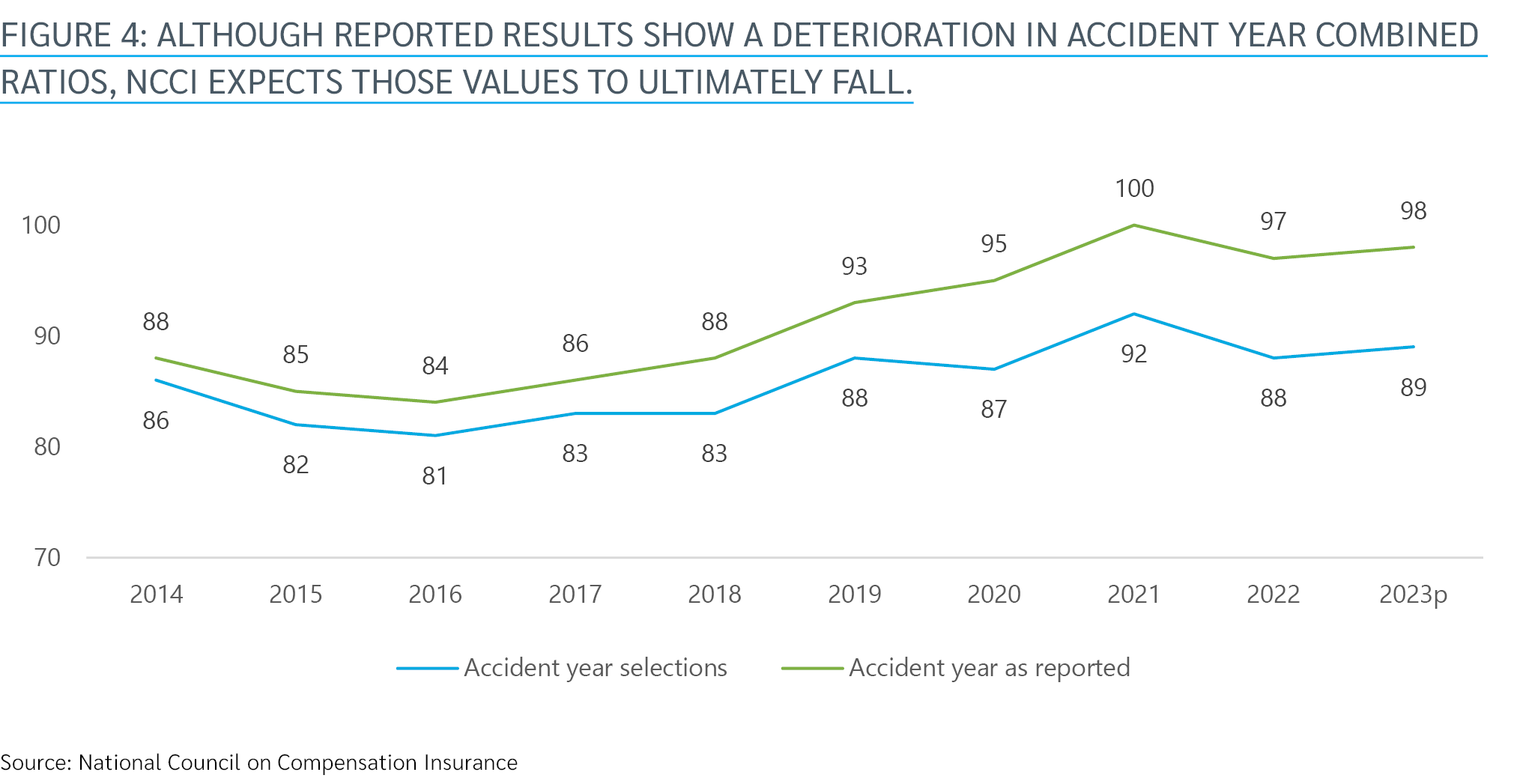

Calendar year 2023 also marked the seventh consecutive year that the workers’ compensation combined ratio — (losses + expenses)/premium — for private carriers has been in the 80s and the 10th consecutive year it has been below 100%.

Recent experience has been bolstered by favorable development in prior years. Industry observers point to recent accident year combined ratios moving closer to 100%.

At face value, that deterioration in accident year combined ratios might be considered an indication of impending profitability struggles. NCCI analysis, however, suggests that the higher values for recent accident years is driven by reserving conservatism; over time, those values are projected to drop 8 or 9 points into the high 80s(see Figure 4). In fact, NCCI estimates there is an $18 billion reserve redundancy (in other words, reserve conservatism) for the line as a whole, the highest it has been over the last 20 years.

These data points suggest workers’ compensation will continue its run of profitability for the foreseeable future. More importantly, continued favorable development will help the industry offset a significant portion of the adverse development being seen in liability lines.

Strategic buyers can use this favorable workers’ compensation outlook to make their overall insurance programs more financially efficient. For example, liability or property risks that are difficult to place may become more palatable for an underwriter if quoted in conjunction with workers’ compensation.

Of course, no two insurance buyers are exactly the same. To ensure optimal results, every business needs personalized advice and guidance from its insurance broker.

Lockton specialists help analyze key trends, benchmark program performance and highlight opportunities to improve renewal outcomes. We can help businesses aggressively address their loss drivers, reduce retained losses, and improve their collateral positions. And we can quantitatively evaluate the efficiency of an existing program structure and help find the optimal balance of risk-taking in the workers’ compensation program relative to risk-taking across other lines.

For more on how to build more effective workers’ compensation and overall insurance programs, contact your Lockton advisor. And for more insights on the state of the commercial insurance market, explore our June 2024 Lockton Market Update (opens a new window).