Skip to main content

ARTICLES / DECEMBER 16, 2025

Turning the tide on social inflation and rising liability insurance costs

4 MIN READ

Social inflation is fueling escalating litigation costs and a surge in nuclear verdicts, which is reshaping the risk landscape for businesses across the U.S. Pressure on both insurers and corporate defendants is contributing to growing liability insurance costs and greater caution by insurers. Here’s how businesses can respond.

Troubling litigation environments

Last week, the American Tort Reform Foundation published its latest update on “judicial hellholes” around the country (opens a new window). The organization describes these jurisdictions as “places where judges in civil cases systematically apply laws and court procedures in an unfair and unbalanced manner… Some are known for nuclear verdicts [of $10 million or more] and allowing innovative lawsuits to proceed or for welcoming litigation tourism, and in all of them state leadership seems eager to expand civil liability at every given opportunity.”

This year’s list includes:

Los Angeles.

New York City.

South Carolina, specifically regarding ongoing asbestos-related litigation.

Louisiana, specifically regarding litigation alleging coastal erosion from oil and gas drilling activities.

The Philadelphia Court of Common Pleas.

St. Louis.

Illinois, Cook County, home to Chicago, and Madison and St. Clair counties, within the St. Louis metropolitan area.

King County, home to Seattle, and the Washington Supreme Court.

Social inflation’s persistent threat

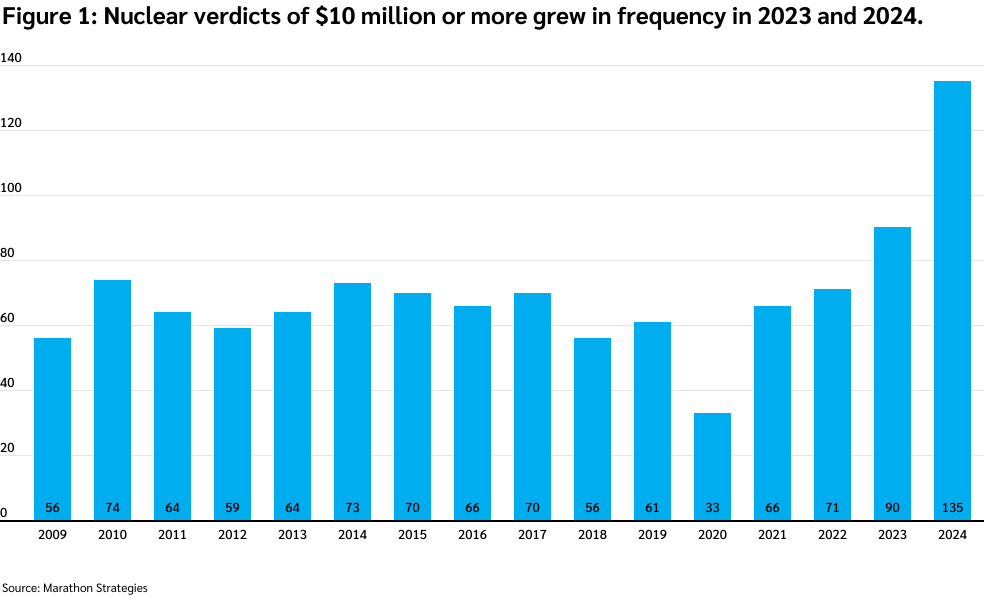

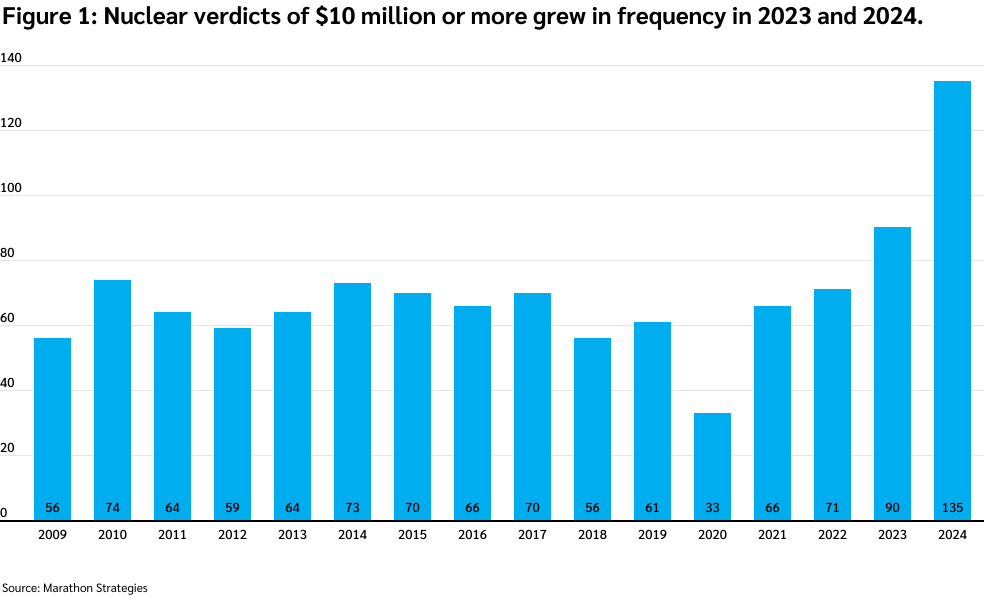

More plaintiff-friendly environments in these jurisdictions have been driven in large part by social inflation, a phenomenon characterized by the proliferation of nuclear verdicts of $10 million or more and rising defense costs for companies defending litigation. In 2024, 135 lawsuits against corporate defendants resulted in nuclear verdicts (opens a new window), according to Marathon Strategies, the most since Marathon began tracking nuclear verdicts in 2009. Awards from 2024’s nuclear verdicts totaled $31.3 billion, more than double the awards from nuclear verdicts in 2023. (See Figure 1.)

In addition to larger verdicts being handed out, litigation settlement values are also growing. In 2024, the cumulative value of the ten largest class-action litigation settlements was $42 billion (opens a new window), according to law firm Duane Morris. This was the third-largest total for a calendar year in the last two decades, trailing only 2022 ($66 billion) and 2023 ($51 billion).

Several trends are fueling social inflation, including:

An aggressive, sophisticated, and well-funded plaintiffs’ bar, backed by third-party litigation financing.

Changing juror sentiments, including heightened anticorporate biases.

The rise of novel legal theories and growing acceptance of “junk science” by courts and juries.

The persistent effects of social inflation have had a dramatic impact on the liability insurance marketplace, with the effects being felt even for organizations without significant operations and/or exposures in judicial hellholes. As loss rates have gone up, insurers’ reserves have come under pressure, prompting greater discipline and selectivity.

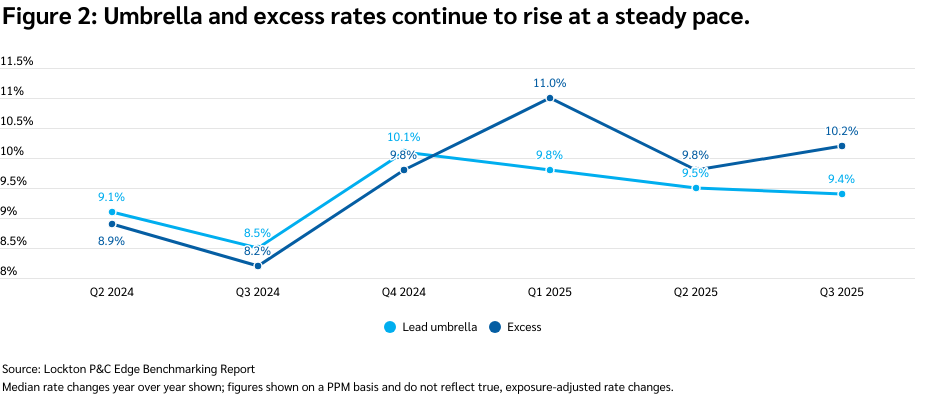

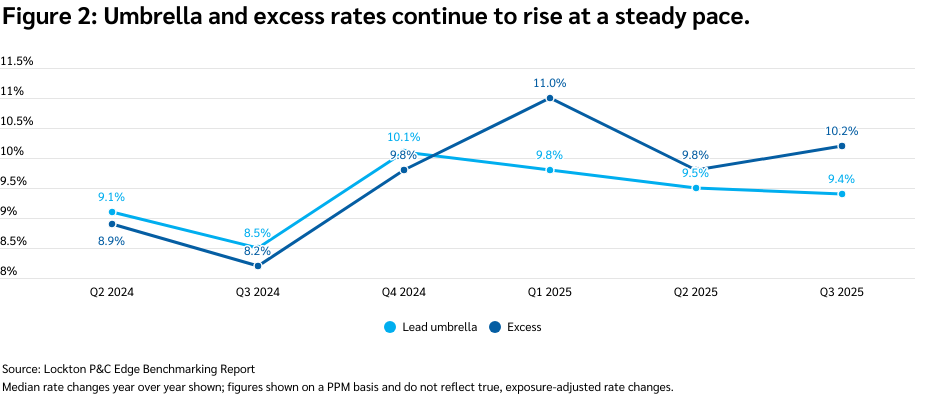

For insurance buyers, this has translated to higher premiums. Liability rates continued to rise in the third quarter (opens a new window), according to the latest Lockton Market Update, particularly for umbrella and excess coverage. (See Figure 2.) In addition to higher insurance pricing, buyers may see reduced capacity or higher retentions, particularly for those in high-risk industries such as transportation.

Taking action

For insurance buyers, this highlights a need for greater attention to insurance programs and risk management. Among other actions, buyers should work with their insurance brokers to:

Ensure insurance programs keep pace with loss trends. An annual review of program design and efficiency — focusing on deductibles, attachment points, and limits — can help prevent programs from becoming unsustainable as loss costs increase.

Ensure accuracy in loss estimates. Thoroughly examine all assumptions in underlying models, including exposures, changes in operations, losses, and any actuarial assumptions. Also model different program structures, evaluating the impact of varied retentions, attachments, and limits to optimize your use of risk capital.

Be proactive in managing risk. Prioritize high-severity exposures, such as product and auto liability. And deploy safety measures like telematics, cameras, speed governors, and stronger driver training. This can not only help reduce the frequency and severity of potential losses, but also enable you to tell a better story during renewal discussions with underwriters.

Take a smarter approach to claims. Early intervention is critical: In conjunction with insurers and brokers, businesses should work to quickly triage claims and decide between litigation or settlement. Speedy resolutions can help prevent the “aging” of claims, which correlates strongly with higher costs.

Explore alternative risk options. Structures like captives, corridors, buffers, and structured programs can help organizations secure stable coverage where traditional market offerings are limited, and present opportunities for customization and capital control.

For more info

Jessica Cullen

Head of Excess US Casualty & Operations