The European Union Pay Transparency Directive (Directive (EU) 2023/970, the “Directive”) is a key component of the broader, fast-moving global shift towards greater workplace equity and accountability. Once implemented, larger organizations will be required to begin reporting gender pay gap data for 2026. This means employers should act now by collecting data and addressing any significant gender pay gaps by 2025. This is also a crucial opportunity for employers to align their benefits strategies with the evolving transparency standards in the Directive, particularly those that apply to all employers, regardless of size. Doing so can strengthen recruitment and retention efforts and foster a more engaged workforce. Being prepared now will allow businesses to stay ahead and turn a potential compliance challenge into a strategic advantage.

The key elements of the Directive are outlined below, along with insights on how employers can effectively prepare for its implementation to avoid compliance risks and potential costly pay gap remedies.

Background

The goal of the Directive is to further reduce or eliminate gender pay inequity within the EU through measures aimed at countering gender pay discrimination, including:

Collecting and disclosing pay gap data

Providing compensation to those affected by pay discrimination

Imposing penalties on employers for non-compliance

The Directive entered into force on 6 June 2023 and requires each individual EU member state to pass local legislation by 7 June 2026, meeting at least the minimum standards outlined in the Directive. EU member states are free to enhance the minimum provisions, so pay transparency requirements may vary by country.

Thirteen EU member states had already introduced mandatory pay gap reporting obligations at the national level prior to the Directive. For example, Ireland introduced its gender pay gap reporting obligation in 2022 (see Lockton article here (opens a new window)). However, regulatory standards vary significantly, targeting different employers and establishing different legal requirements.

The Directive significantly strengthens pay transparency obligations for EU employers. Following its adoption, binding pay transparency measures will need to be introduced in the 14 member states where pay gap reporting is absent today and the patchwork of existing pay gap reporting obligations in the other 13 member states will be harmonized.

Key details

The centerpiece of the Directive is a requirement that all employers with more than 100 employees must regularly report detailed information regarding the organization’s gender pay gap across the organization as a whole, and within each category of workers who do the same work or work of equal value (“category of workers”). Employers are also obligated to take measures (explained in more detail below) to resolve gaps of 5% or more between the pay of male and female workers in any category of workers.

The Directive also gives employees and prospective employees individual pay transparency rights by banning hiring employers from asking salary history questions and requiring that they advertise salary ranges and provide information on what comparable employees are paid upon request. These rights (explained in more detail below) will take effect as soon as the Directive is put into local legislation.

It is important to note that employer size thresholds only apply for the gender pay gap reporting requirement and not for the other pay transparency rights in the Directive. All employers, irrespective of size, will need to comply with the other pay transparency rights.

The Directive covers all employees and job applicants.

Elements of “Pay,” including Employee Benefits

Under the Directive, “pay” includes all elements of remuneration, whether cash or in-kind, received by employees directly or indirectly. This includes direct compensation (salary, wages, etc.), as well as variable and complementary items (bonuses, long-term incentives, overtime, travel facilities, housing and food allowances, occupational pensions, sick pay, compensation for attending training, severance, statutory required compensation, etc.).

Notably, the expansive definition of “pay” means that all forms of employee benefits are explicitly included as elements of pay. These could include leave, life, health and disability insurances, wellbeing benefits, pension contributions and other perks. In collecting data to produce the gender pay gap reports, employers will need to identify and measure all the benefits offered to employees.

Determining “Categories of Workers”

As it may be difficult to specifically determine whether work is of equal value for the purpose of determining a “category of workers,” the Directive states that non-discriminatory and objective gender-neutral criteria, such as skills, working conditions, effort, and responsibility (without undervaluing relevant soft skills) should be used; but other criteria may be used if relevant.

The Directive outlines the following requirements, amongst others, that must be contained in EU member state legislation:

Pre-employment

Employers must ensure that job titles and vacancies are gender-neutral and provide the initial salary or salary range of the vacant position, either in the job listing or prior to the interview. In every case, it must be provided before an employment contract is concluded. Additionally, the employer is prohibited from asking the job seeker about their own salary history, and applicants are entitled to a non-discriminatory recruitment process.

Information on Pay Levels

The employer will have an obligation to be transparent about how pay levels are set and how an employee can move to a higher pay level. “Pay level” refers to gross annual pay and the corresponding gross hourly pay. Employees will have a right to access the criteria that are used to determine pay, pay levels and pay progression, which must be objective and gender-neutral.

Workers will have the right, upon request, to receive information regarding their individual pay level and average pay levels for workers in the same category of workers, categorized by gender. Employers will be required to respond within two months of such request. Employers are also required to inform employees of this right on an annual basis.

Employees will also have a right to disclose pay to colleagues for the purposes of enforcing equal pay rights.

Pay Gap Reporting Requirements

The gender pay gap reporting requirement for a company will vary by size. Companies with 250 or more employees will be required to report annually; companies with 150 to 249 employees will be required to report every three years. These two categories of companies must submit their initial report on data for the 2026 calendar year by 7 June 2027. The threshold for employers required to report every three years will eventually be reduced to companies with 100 or more employees, which must submit their initial report on data for the 2030 calendar year by 7 June 2031.

Companies with fewer employees may report at their own discretion, although each EU member state could lower the threshold for mandatory reporting when they enact local legislation.

Employers above the required headcount threshold will be required to report on pay gaps between female and male workers within each category of workers. Reporting must include the following:

The gender pay gap in both direct compensation and variable or complementary compensation.

The median gender pay gap in both direct compensation and variable or complementary compensation.

The proportion of female and male workers receiving complementary or variable components.

The proportion of female and male workers in each quartile pay band.

The gender pay gap between workers by categories of workers, broken down by ordinary basic wage or salary and variable or complementary components.

Employers must report this information to national authorities and publish the report on their website or make it available through any other public manner. Employers must also provide information on the gender pay gap between workers by categories of workers, broken down by ordinary basic wage or salary and variable or complementary components to all their employees and to the employee representatives, as well as, upon request, to the labor inspectorate and the national equality body.

Joint Pay Assessments

An employer will need to carry out a joint pay assessment in collaboration with employee representatives where the following apply:

Reporting reveals a gap of 5% or more between the pay of male and female workers in any category of workers.

The pay gap is not or cannot be justified by objective and gender-neutral criteria.

The employer does not resolve the unjustified pay gap within six months of the date of submission of the pay report.

Joint pay assessments are meant to lead to the elimination of gender-based pay discrimination through the adoption of remedial measures and must include the following:

An analysis of the proportion of female and male workers in each category of workers.

Information on average female and male employees’ direct-pay levels as well as complementary or variable components for each category of workers.

Any differences in the average pay levels between female and male workers in each category of workers, and any reasons for these differences based on objective and gender-neutral criteria as established jointly by the employee representatives and the employer.

The proportion of female and male employees who benefited from any improvement in pay following their return from maternity or paternity leave, parental leave or carers’ leave, if any improvement occurred in the relevant category of workers during the period in which the leave was taken.

Measures utilized to address differences in pay if these are not justified based on objective and gender-neutral criteria.

An evaluation of the effectiveness of measures from previous joint pay assessments.

Employers must share the joint pay assessment with their employees, the employee representatives, and the dedicated national authority (to which pay must be reported), as well as, upon request, with the labor inspectorate and the national equality body.

Pay Discrimination Compensation

Local legislation enacting the Directive must include provisions for victims of pay discrimination including full recovery of back pay, related bonuses, and related payments in kind. Compensation due may also consider lost opportunities or benefits accruing to a particular pay level as well as pay discrimination based on gender which intersects with other protected grounds of discrimination such as race or disability.

It is important to note that under the Directive, the burden of proof will shift from an employee needing to prove that an employer engaged in pay discrimination to an employer having to prove that they have not violated the Directive or EU member state’s equal pay and pay transparency legislation.

Penalties

Penalties imposed against employers for non-compliance will be determined under each member state’s legislation subject to the Directive’s guidance that penalties must be effective, proportionate, and dissuasive. Penalties may include, but may not be limited to, fines. Penalties may take various items into account such as intersectional discrimination or the level or frequency of violations and may be scaled accordingly.

Employer action: ACT

As each member state will need to pass or amend legislation by or before 7 June 2026, employers should track legislation for any EU member state in which they have operations.

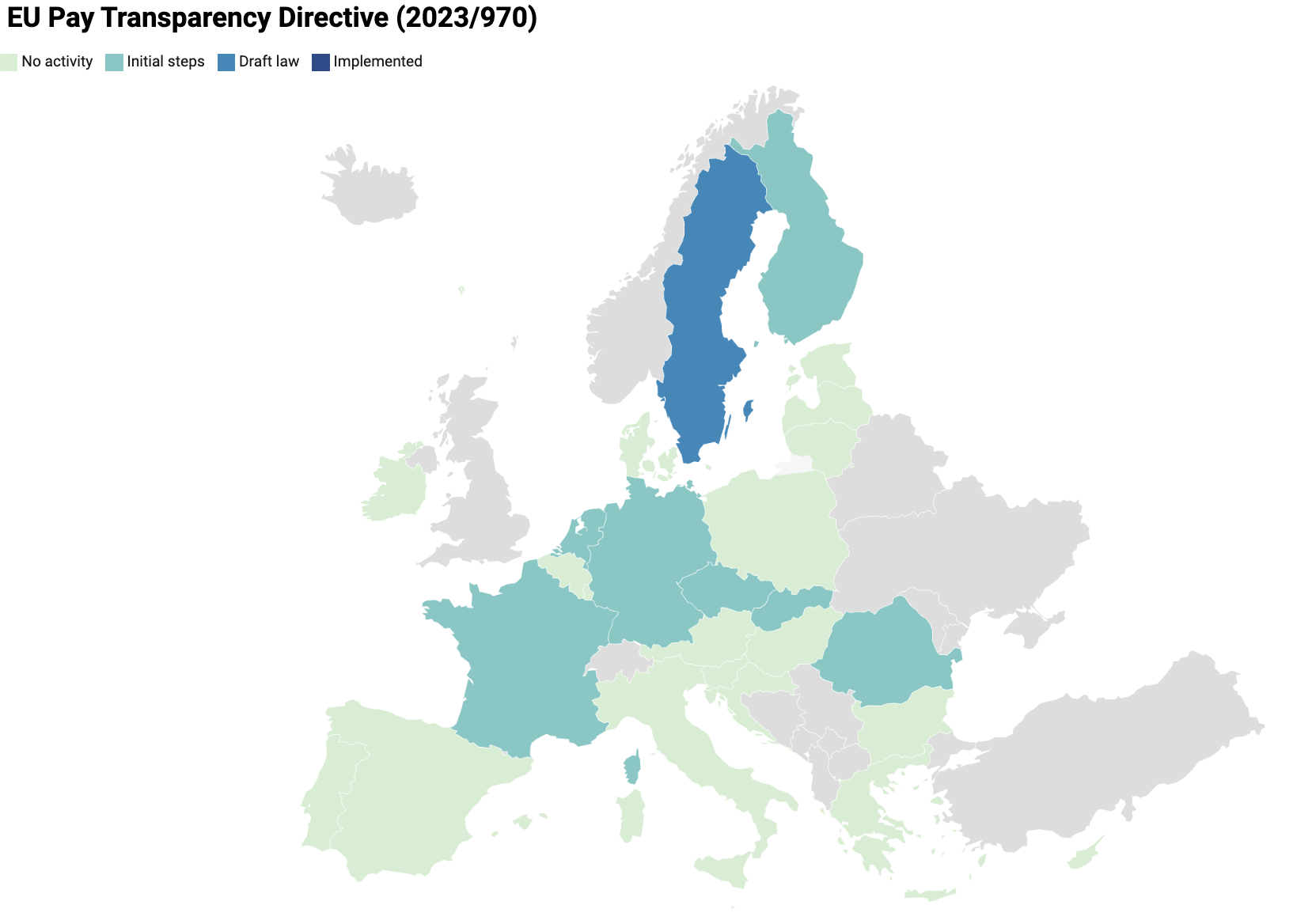

Employment law experts from Ius Laboris have compiled a map (opens a new window) showing the status of implementation across the EU member states. (Full interactive map also displayed at the bottom of this piece)

Legislation passed by each member state may go beyond the minimum requirements under the Directive. For example, companies of smaller sizes could be required to participate.

The biggest potential risk for employers is the pay gap reporting obligation. If reporting demonstrates a difference in the average pay level between female and male workers of at least 5% in any category of workers, employers will be obliged to remedy unjustified differences in pay. Moreover, a report demonstrating a pay gap of more than 5% may attract pay discrimination claims from employees, who will benefit from the shift of the burden of proof.

Without appropriate preparation, therefore, this obligation may result in costly pay gap remedies and legal claims. To avoid this, employers must take steps to prepare well before the transposition deadline of 7 June 2026. Employers who begin collecting data and calculating their pay gap for the first time after the Directive is implemented risk facing immediate liabilities with limited time to address them.

Creating a roadmap for pay transparency

Employers may opt to wait until local legislation is implemented before establishing specific protocols. However, this will leave little time to take action. We strongly recommend developing a roadmap as soon as possible outlining the steps needed to prepare for compliance. Employers in countries that have already codified gender pay transparency should continue complying with that legislation unless, or until, it is amended. In the meantime, employers should create a roadmap of steps to be taken to prepare for the 2026 deadline. Possible actions could include some of the following:

Check headcounts: determine which new obligations will apply to your organization based on the employee headcount size thresholds.

Anticipate the new obligations that will apply to all employers:

Create salary ranges and add them to vacancy notices.

Ensure vacancy notices, including their content and stated job titles, are gender-neutral.

Check employment contracts, work rules and policies for pay confidentiality clauses, and remove any terms restricting pay disclosures for the purposes of enforcing equal pay rights.

Review the criteria used to determine workers’ pay and benefits eligibility, pay and benefit levels, and pay and benefits progression.

Review and potentially harmonize pay and benefits approaches across legacy businesses within your organization.

Prepare a pay policy with these criteria and the obligations concerning the right to information.

Review recruitment processes to ensure they are led in a non-discriminatory manner and remove any questions or requests about pay history.

Address the new obligations that will apply to employers with 100 or more employees:

Determine the basis for categorizing employees.

Collect data and calculate existing pay gaps, at company-level and per possible category of workers.

Map possible justifications and build evidence for identified pay gaps, and

Remedy unjustified pay gaps by 2025.

Consider adopting a Diversity and Inclusion Policy, including measures to ensure compliance with the Directive.

How Lockton can help

Your Lockton Global People Solutions team can assist in reviewing your benefits strategy to align with Directive requirements. They can also help assess how employee benefits in the EU, such as retirement plans, healthcare and wellbeing benefits, fit into your pay transparency roadmap, as these benefits are considered part of “pay” under the Directive for reporting purposes.

Contact your Lockton Consultant for more information on solutions that can help you get ahead of the compliance curve in time for the implementation of the Directive.

Written in collaboration with Tom Heys and David Lorimer of Lewis Silkin, United Kingdom, Síobhra Rush of Lewis Silkin Ireland LLP, Ireland, Inger Verhelst and Didier Houttequiet of Claeys & Engels, Belgium, and Aldo Palumbo of Toffoletto De Luca Tamajo, Italy

EU Directive 2023/970 on pay transparency - EUR-Lex (opens a new window)

Pay Transparency Directive FAQs - Ius Laboris (opens a new window)