Overall capacity in the product recall insurance market is robust, and pricing is generally stable for most U.S. buyers. Despite a challenging and uncertain regulatory landscape — and an uptick in losses — insurers are intensely competing for business and generally offering favorable terms.

Competitive marketplace

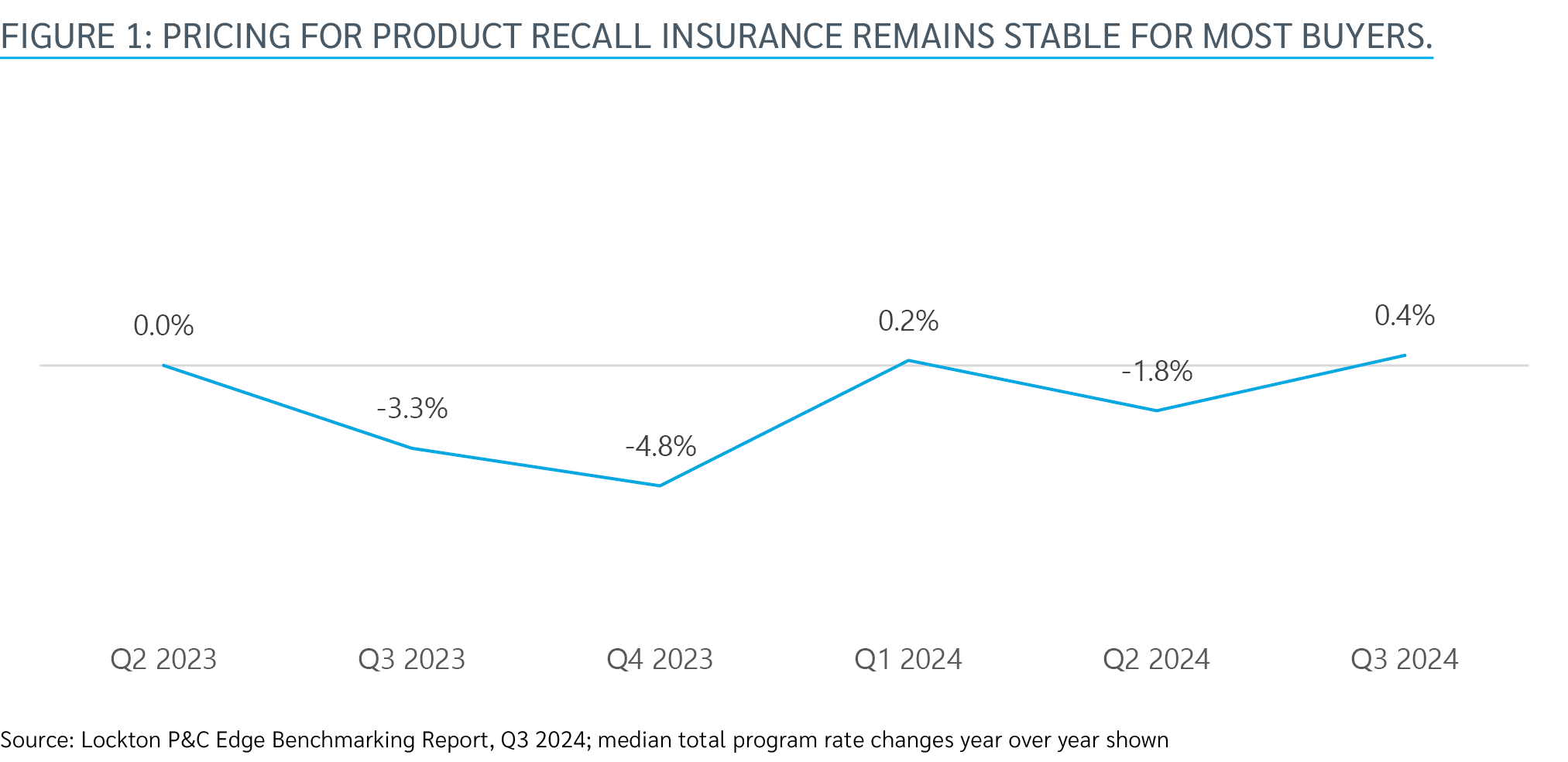

In the third quarter of 2024, median total pricing for product recall insurance rose 0.4% in the U.S., according to Lockton data (see Figure 1). Pricing has generally remained close to flat for the last several quarters, with insurers hesitant to push rates due to the competitive landscape.

With plentiful capacity in the market, buyers — especially those without adverse loss histories — can often negotiate broad terms and conditions. A number of recent losses, however, could soon prompt more insurers to push for rate increases. At least one product recall insurer is already seeking rate increases, while others are striving to maintain current pricing levels.

Although some companies have historically self-insured their product recall risks, more companies are purchasing or considering purchasing product recall insurance — and reevaluating policy limits — in part as a response to losses they or their competitors have experienced.

A key challenge for companies facing recall risks is that gathering information for and executing a recall — from containment to getting products off the shelves, paying settlements and restoring brand reputation — typically takes time. In many industries, such as automotive, customers may respond at different times, which can extend recalls and expose companies to risk for longer periods.

Recall losses, meanwhile, are growing more severe as regulations tighten and litigation becomes more expensive. And while companies are not required by law to purchase product recall insurance, more companies are mandating that their suppliers purchase recall insurance via indemnification language in contracts.

Protection by design

Product recall insurance is designed to protect businesses from the financial and reputational risks associated with recalling defective or unsafe products. It provides coverage for costs associated with removing a product from the market, including loss of gross profits, third-party recall liability, notifying customers, testing products, replacing inventory and destroying recalled items, and addressing reputational damage through crisis communication.

Product recall insurance is available to companies in several industries, including the automotive, food and beverage, manufacturing, retail, restaurant, and pharmaceutical sectors, where safety and regulatory compliance are tightly reviewed and regulated. Component parts manufacturers and suppliers can also purchase product recall policies.

Greater scrutiny by underwriters

As product recalls become more costly, underwriters are being more diligent in their operations reviews to ensure companies are fully compliant with changing regulations and safety standards, especially for companies that have experienced losses in the past. specifically, underwriters are looking closely at:

Contractual agreements.

Quality control processes.

Safety and lab testing.

Supply chains.

Regulatory compliance.

Business continuity plans.

This is contributing to an increase in quota sharing and layering of towers. Although this requires buyers to work with more insurers to build effective product recall insurance programs, those programs are, in theory, more stable, as potentially sizable losses are shared by multiple insurers rather than being borne by an individual carrier.

New challenges on the horizon

One possible threat to determining liability for product malfunctions or contamination is the increasing use of artificial intelligence (AI). While AI allows for more automation and efficiency in certain areas of manufacturing and product development, it can also lead to errors, misinterpretations and bias. Traditional product recall and liability models may not address the unique risks associated with AI. The use of data input into AI tools is also an area of uncertainty, which could leave companies exposed to confidentiality leaks, intellectual property concerns and compromised security.

Working with the right broker

The challenge and cost of managing a product recall is significant, driving more companies to consider protection. While general liability policies can provide limited cover for 1st party recall-related costs, it is critical that companies seek the advice and support of an experienced insurance broker that specializes in product risks and can ensure that product recall policies dovetail with other types of coverage to ensure a smooth claims process.

Product recall products are highly customizable and able to be catered to a company’s specific risk. It is important that companies work with brokers who understand their unique needs, can look beyond topline premium expenses to assess the true value of coverage, and can negotiate relevant and favorable terms and conditions on their behalf.

An effective broker can also:

Offer insights and expertise from professionals with consulting, broking, and underwriting backgrounds, which can inform choices about insurance program terms and conditions, limits, and other features.

Coordinate coverage across all lines to ensure product recall policies close gaps and work seamlessly in a claim scenario.

Help insureds secure favorable outcomes from complex and potentially costly claims.

As companies increasingly recognize the value in product recall insurance products, those companies that have been reluctant to purchase coverage should reconsider their choice, especially as product recall insurance is increasingly required by contractual requirements. Purchasing insurance now — before a potentially significant product issue is discovered — could help a company proactively address an issue before it becomes uninsurable and build relationships with insurers that could be vital in the event of a challenging claim.