Economic and social inflation have contributed to an escalation of loss trends in today's liability insurance market, creating tension between buyers and insurers. While buyers may prefer to renew the same program structure each year, insurers may seek increased retentions, attachments and rates.

For buyers, however, it is important to understand why simply renewing the same program structure year after year may not make sense.

Over time, inflationary pressures drive losses higher, but the impact to various layers of the program is uneven. Losses under the deductible generally experience the smallest percentage change while higher layers feel an outsized impact. This concept is known as leveraged trend.

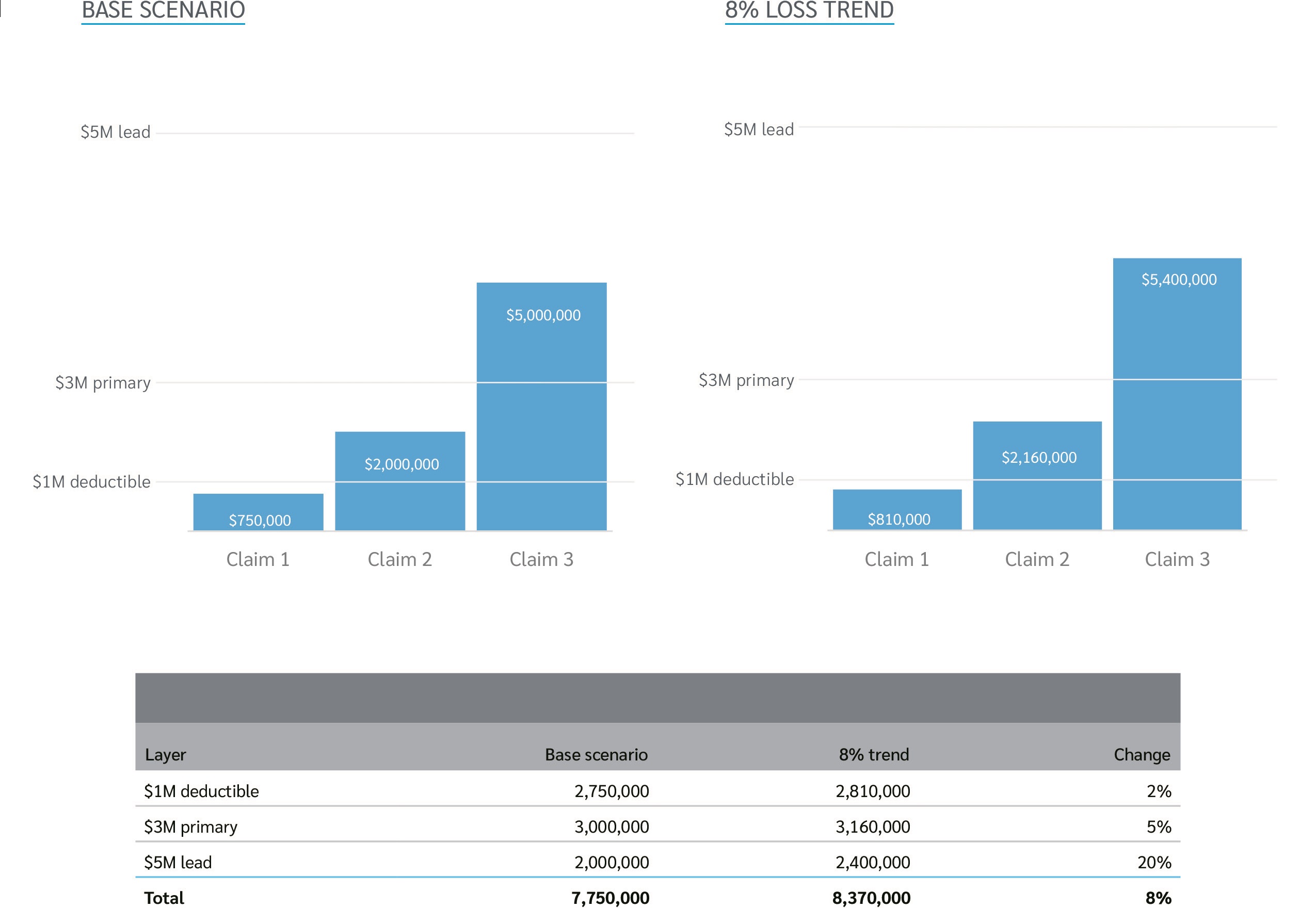

In the simplified example below, assume a liability program consists of a $1 million deductible, $3 million primary policy, and $5 million lead umbrella. During the year, the program experiences three losses of $750,000, $2 million, and $5 million. Let’s assume those same three losses happen again a year later but cost 8% more due to inflationary trends.

As shown in the table, losses under the deductible only increased 2% since claims 2 and 3 were capped at $1 million. In contrast, losses in the $5 million lead umbrella layer jumped 20% — even though the overall trend was only 8%. Insurers may adjust pricing and capacity deployment to account for this reality.

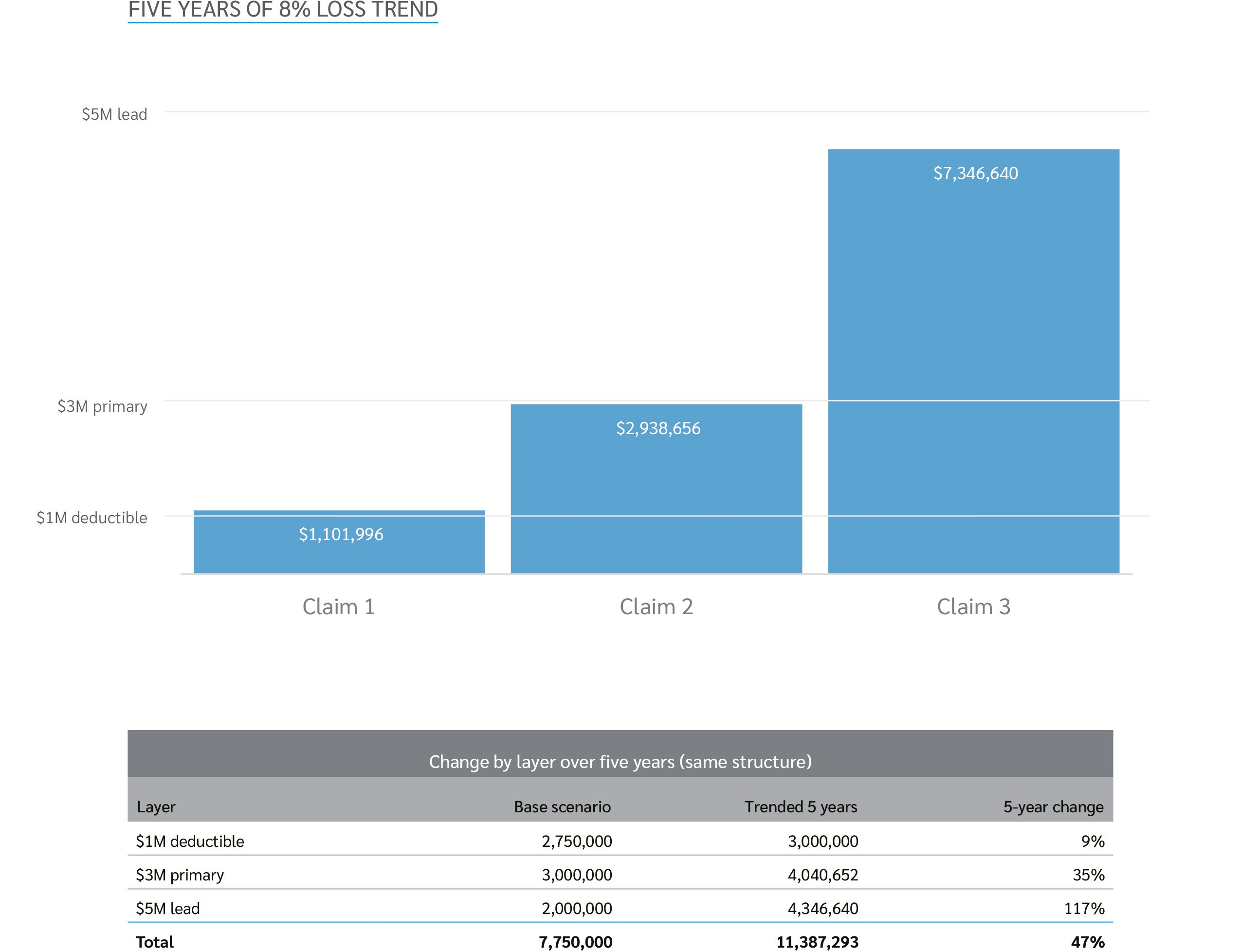

This phenomenon becomes even more exaggerated when looking over multiple years. If the same three claims happen five years later after growing in size by 8% annually — 47% in total — and the structure remains the same, the amount of loss in the $5 million lead umbrella layer would go up nearly 120%!

This example illustrates why it is critical to evaluate the financial efficiency of your program design each year. Absent this, your program could become unsustainable as increasing loss costs and/or challenges in accessing reinsurance might lead insurers to reduce capacity or substantially increase premiums.

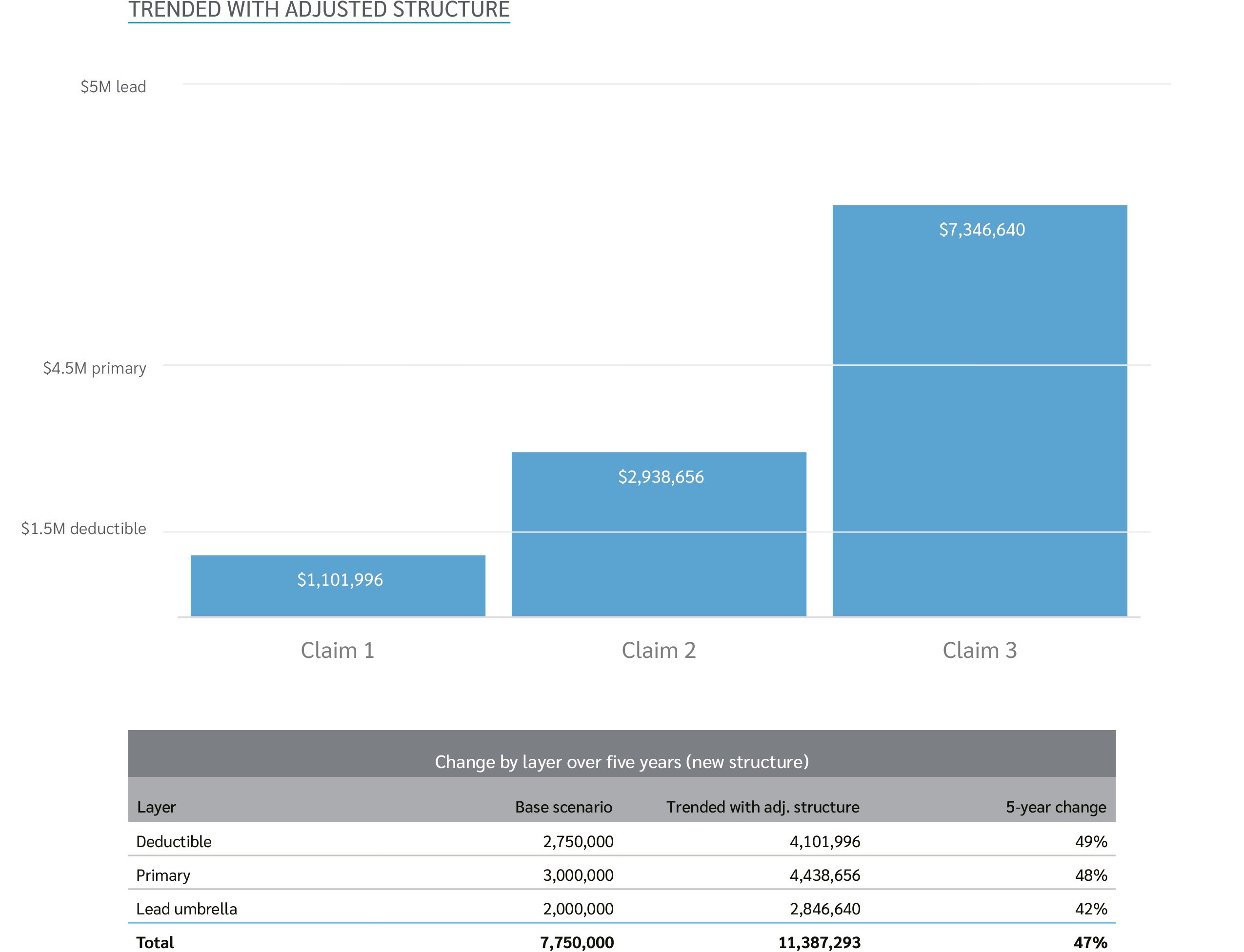

If the deductibles, attachments, and limits adjust to keep up with trend, however, the impact felt by each layer becomes more balanced. Using the same data but increasing the deductible to $1.5 million and the primary limit/umbrella attachment to $4.5 million, the five-year change experienced in each layer more closely resembles the overall 47% change to losses.

As the P&C industry continues to grapple with inflation, insurers will continue to press for changes to insurance programs. It is important, however, that organizations carefully and continually evaluate their risk to ensure they are getting a fair trade.

In many situations, a reset of the program structure may result in lower premiums and increased market stability. On the other hand, any potential increase in retained risk should be well-understood, adhere to the organization’s risk appetite, and represent the most cost-effective use of its capital.

Lockton Analytics provides clients with transparency into this risk/reward tradeoff so they can make the best decision for their organizations. For more information, contact your Lockton broker.