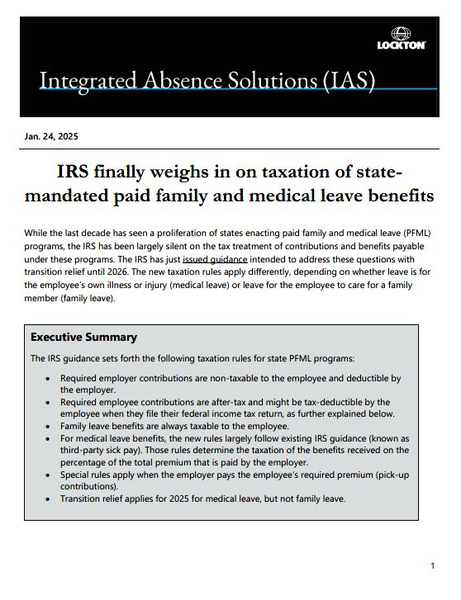

While the last decade has seen a proliferation of states enacting paid family and medical leave (PFML) programs, the IRS has been largely silent on the tax treatment of contributions and benefits payable under these programs. The IRS has just issued guidance (opens a new window) intended to address these questions with transition relief until 2026. The new taxation rules apply differently, depending on whether leave is for the employee’s own illness or injury (medical leave) or leave for the employee to care for a family member (family leave).

Executive Summary

The IRS guidance sets forth the following taxation rules for state PFML programs:

Required employer contributions are non-taxable to the employee and deductible by the employer.

Required employee contributions are after-tax and might be tax-deductible by the employee when they file their federal income tax return, as further explained below.

Family leave benefits are always taxable to the employee.

For medical leave benefits, the new rules largely follow existing IRS guidance (known as third-party sick pay). Those rules determine the taxation of the benefits received on the percentage of the total premium that is paid by the employer.

Special rules apply when the employer pays the employee’s required premium (pick-up contributions).

Transition relief applies for 2025 for medical leave, but not family leave.

The state of PFML

Fourteen states and the District of Columbia have mandatory PFML programs. The PFML benefits are paid through a state fund, or an approved self-insured or fully insured private plan. Most state PFML programs, but not all, require employee after-tax contributions toward the program cost. If an employer voluntarily pays the required employee contributions, these are referred to as “pick-up” contributions and are addressed in the IRS guidance.

IRS Guidance

Contributions: With respect to required contributions to PFML, required employee contributions are after-tax and may be tax deductible to the individual to the extent they itemize their taxes and do not exceed the ceiling for deducting state and local taxes (SALT). Those contributions are also tax-deductible by the employer. Employer required contributions, including pick-up contributions, are tax deductible to the employer.

Benefits payable: In a nutshell, family leave benefits are always taxable, but not necessarily so for medical leave. For medical leave, the new rules largely follow existing IRS guidance (known as third-party sick pay). Those rules determine the taxation of the benefits received on the percentage of the total premium that is paid by the employer. Stated differently, if the employee pays part of the premium with after-tax dollars, that portion of the benefits are tax-free. For example, if the total premium is $600 and the employee pays $300 post tax toward the premium costs, then 50% of any benefit received is taxable.

The following illustrates the tax treatment of contributions, including pick-up, and the taxation of benefits:

Contributions for PFML

Required employee contributions for PFML

Federal income tax applies? Yes, contributions must be after-tax.

Are contributions tax-deductible? Deductible by the employee (if employee itemizes and does not exceed SALT deduction limit). Also deductible by the employer.

Employment tax (FICA) applies? Yes.

Required employer contributions for PMFL

Federal income tax applies? Not taxable to employee.

Are contributions tax-deductible? Deductible by the employer.

Employment tax (FICA) applies? No.

“Pick-up” contributions made by employer

Federal income tax applies? Yes, reported as taxable to employee on IRS Form W-2.

Are contributions tax-deductible? Deductible by the employee (if employee itemizes and does not exceed SALT deduction limit). Deductible by the employer.

Employment tax (FICA) applies? Yes.

PFML Benefits received by Employee

Family leave benefit payments

Federal income tax applies? Yes, and reportable on Form 1099.

Employment tax (FICA) applies? No.

Medical leave benefit payments

Federal income tax applies? Depends on ratio of the total premium paid post-tax by the employee (vs. employer contribution).

Employment tax (FICA) applies? Depends on ratio of the total premium paid post-tax by the employee. In any event, FICA does not apply to benefits received more than six months after the last day worked. If the employee returns to work, then goes back on leave, the six-month period starts over.

Pick-up contributions

Federal income tax applies? Amount attributable to pick-up contributions is nontaxable.

Employment tax (FICA) applies? No, for amounts attributable to pick-up contributions.

Action plan

The employer’s plan administrator must ensure that taxes are withheld from any family leave benefits paid in 2025. For medical leave benefits, the rules grant transition relief for 2025 for taxes owed for pick-up contributions and benefits payable with respect to medical leave.

While the new rules do not apply to private plans, we expect most employers will use the new rules to determine the tax treatment for those benefits. Going forward, state plans must track leave types (medical or family) to determine the tax treatment of benefits payable to the employee.

Not legal advice: Nothing in this alert should be construed as legal advice. Lockton may not be considered your legal counsel, and communications with Lockton's Compliance Consulting group are not privileged under the attorney-client privilege.