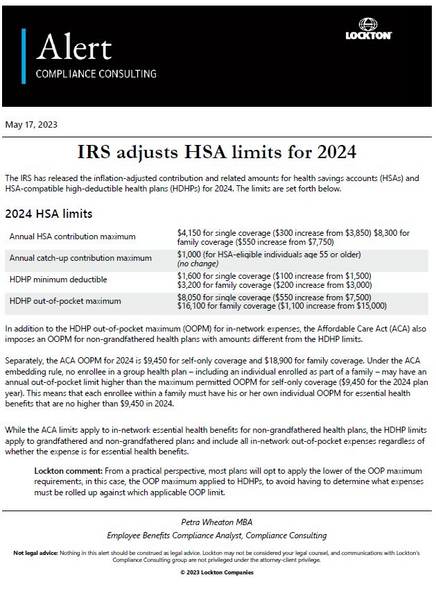

The IRS has released the inflation-adjusted contribution and related amounts for health savings accounts (HSAs) and

HSA-compatible high-deductible health plans (HDHPs) for 2024. The limits are set forth below

2024 HSA limits

Annual HSA contribution maximum

$4,150 for single coverage ($300 increase from $3,850)

$8,300 for family coverage ($550 increase from $7,750)

Annual catch-up contribution maximum

$1,000 (for HSA-eligible individuals age 55 or older)

HDHP minimum deductible

$1,600 for single coverage ($100 increase from $1,500)

$3,200 for family coverage ($200 increase from $3,000)

HDHP out-of-pocket

$8,050 for single coverage ($550 increase from $7,500)

$16,100 for family coverage ($1,100 increase from $15,000)

Lockton comment: As a reminder, for non-calendar year plans, the HDHP deductible and OOPM apply based on the calendar year in which the plan year starts. Those limits then extend for the entire plan year. For example, an HDHP with a July 1 plan year would not be subject to the 2024 $1,600/$3,200 minimum deductible amounts until the plan year of July 1, 2024, which continues through June 30, 2025. In contrast, the HSA contribution limits are based on the calendar year, even for non-calendar year plans.

In addition to the HDHP out-of-pocket maximum (OOPM) for in-network expenses, the Affordable Care Act (ACA) also imposes an OOPM for non-grandfathered health plans with amounts different from the HDHP limits.

The ACA OOPM for 2024 is $9,450 for self-only coverage and $18,900 for family coverage. Under the ACA embedding rule, no enrollee in a group health plan – including an individual enrolled as part of a family – may have an annual out-of-pocket limit higher than the maximum permitted OOPM for self-only coverage ($9,450 for the 2024 plan year). This means that each enrollee within a family must have his or her own individual OOPM for essential health benefits that are no higher than $9,450 in 2024.

While the ACA limits apply to in-network essential health benefits for non-grandfathered health plans, the HDHP limits apply to grandfathered and non-grandfathered plans and include all in-network out-of-pocket expenses regardless of whether the expense is for essential health benefits.

Lockton comment: From a practical perspective, most plans will opt to apply the lower of the OOP maximum requirements, in this case, the OOP maximum applied to HDHPs, to avoid having to determine what expenses must be rolled up against which applicable OOP limit. Download article (opens a new window)

Download article (opens a new window)

Not legal advice: Nothing in this alert should be construed as legal advice. Lockton may not be considered your legal counsel, and communications with Lockton's Compliance Consulting is not privileged under the attorney-client privilege.