Memorial Day this week marks the unofficial start of summer in the U.S. And June 1 will bring the beginning of another season of significance for businesses with properties in the U.S.: hurricane season. With above-average activity forecast for 2024, it’s important for businesses to be ready.

Active season expected

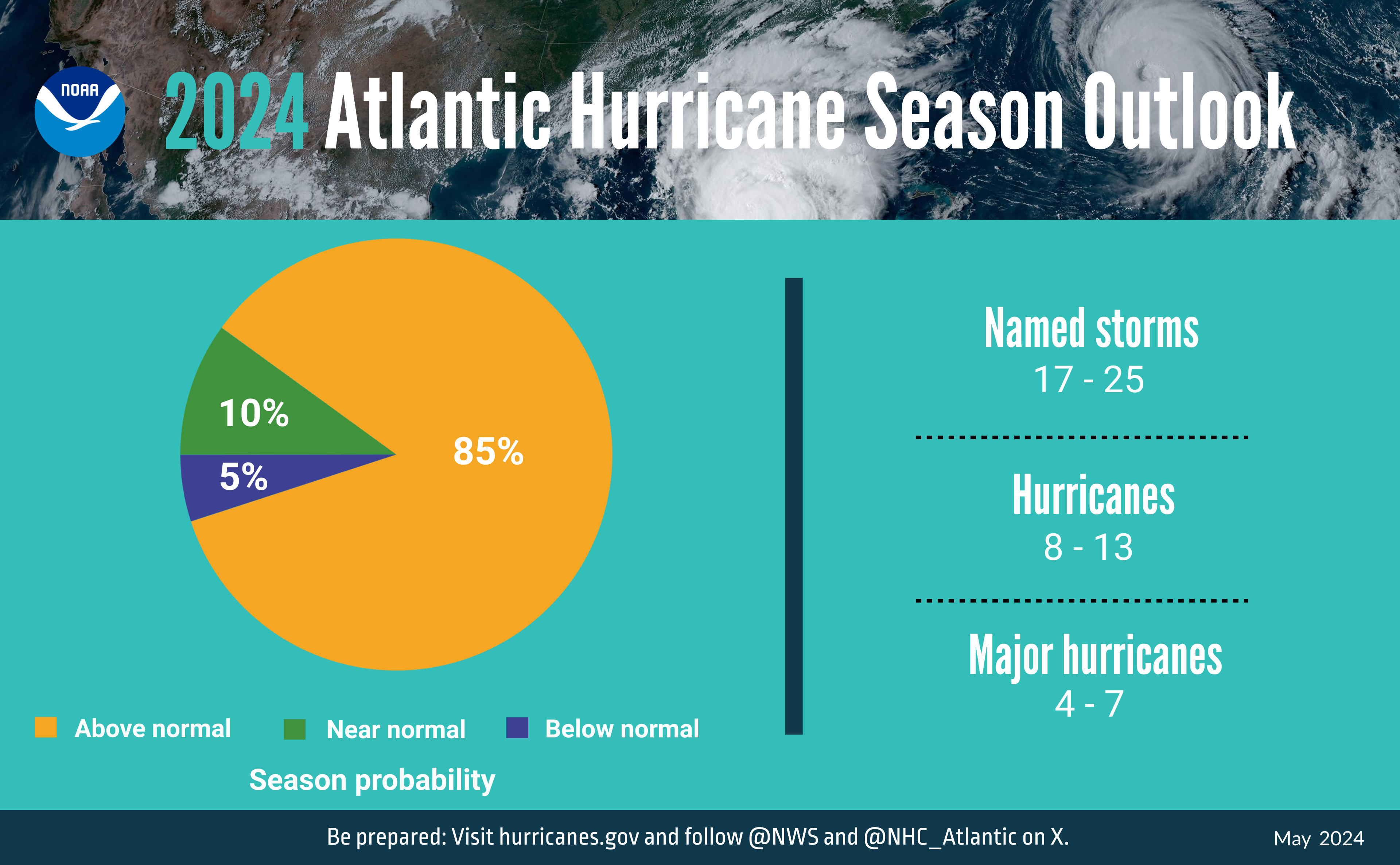

In its recently released annual outlook, the National Oceanic and Atmospheric Administration (NOAA) forecast an 85% chance of above-normal activity during the Atlantic hurricane season (opens a new window), which runs through November 30. Specifically, NOAA forecasts 17 to 25 named storms, including eight to 13 hurricanes, of which 4 to 7 will be major stories (category 3, 4, or 5).

Source: National Oceanic and Atmospheric Administration

A key factor driving NOAA’s 2024 outlook is near-record warm water temperatures in the Atlantic. The development of La Nina conditions in the Pacific, which tend to reduce wind shear in the tropics, could also help fuel the creation of storms.

How analytics can help you prepare for storms

You may already understand how data and analytics can inform the design and purchase of commercial property insurance programs. But have you considered data and analytics may also improve decision-making when a storm is imminent?

For example, after named storms have formed, NOAA’s National Hurricane Center will publish projections of their paths and provide regular updates, including around wind speeds and potential storm surge exposures. Two leading hurricane modeling firms — Moody’s RMS and Verisk (formerly AIR) — will also release event footprints that provide even more detailed information to help businesses anticipate potential losses and prepare for possible claims filings.

Your broker may also be able to provide more detail and support. For example, Lockton delivers to our clients real-time EigenRisk alerts that provide information about the locations and total insured values (TIV) individual organizations have within predicted wind bands. These alerts, which are updated every six hours based on newly released NOAA forecasts, can provide important context to businesses as they prepare for and respond to storm activity.

These valuable tools can help organizations mitigate possible storm damage, shorten potential periods of business interruption, and more efficiently and effectively resolve claims after storms have passed. But analytics solutions are only as good as they data behind them.

To get the most out of these tools, it’s vital that you work with your brokers to ensure you have accurate and complete data about any and all of your properties that could be at risk this hurricane season. Before a storm hits, ensure the following is correct and up-to-date:

Construction, occupancy, protection, and exposure information (commonly known as COPE data), which are critical to how both underwriters evaluate risk and claims adjusters estimate losses. Among other pieces of information, make sure you have an accurate inventory of the primary materials used in construction of buildings and other properties; how buildings and other properties are used and who typically occupies them; what kind of protection exists for properties against various hazards, including fires; and what exposures could arise from surrounding areas.

Secondary characteristics, such as roof types, window ratings, opening protection, and elevation of first floors (to estimate exposure to storm surge). Although these data points are not essential to most hurricane models, they can help to finetune model outputs, which can help organizations and their brokers to more accurately forecast potential losses and reduce uncertainty.

Insured values, which include the total cost of physical structures, their contents — including machinery and equipment or stock/inventory — and business interruption values, but are often underestimated, which can lead to gaps in coverage. These values should be reviewed when policies are placed and when they are renewed. Be sure to include inflation or other financial impacts to your business year over year and update the values accordingly.

Advance planning is crucial

Before a storm arrives, it’s also essential to ensure you have a business continuity or disaster recovery plan that you can quickly put into action. This plan should catalog loss prevention steps that should be taken when a storm is imminent, including plans for actions to safeguard your employees, buildings and other properties, physical assets, and operations, and include information about carriers, all relevant insurance policies, and claims reporting instructions.

Any organization’s plan should be as specific as possible. Plans should consider potential damage that could result from a hurricane; types of physical damage such as wind and flood; and the ultimate impacts of various events, including power and service interruptions and limitations on ingress and egress that could contribute to business interruption.

It’s important for organizations to recognize that what may seem self-evident to them, such as the nature and cause of damage to properties, may not be to insurers. To ensure a claim is fully and quickly paid out, detailed documentation — including photos and videos — is critical. It’s important that any claimant’s insurer fully understands what damage has occurred, what properties and assets have been damaged, and what specifically caused that damage.

Organizations can also expedite their recovery and claims resolutions by building connections with key team members and other stakeholders before an event arises. For example, get to know your insurance claims advocate and internal team members who might be providing documentation and other information to you. And identify outside consultants — such as restoration companies, forensic accountants and roof repair vendors — beforehand, so you can jump into action as soon as the danger of a storm has passed.

Whether you’re planning ahead or facing an imminent storm, Lockton is here to help. For more information or for assistance, contact a member of your Lockton team.