Most of us understand the important role a fiduciary plays in overseeing an investment portfolio or a retirement plan.

But, while it’s always been a requirement, the emphasis on being a fiduciary over a health and welfare benefit plan is fairly new – and it’s a shift in mindset that employers must adopt. That’s because addressing ever-rising plan costs isn’t just a financial concern; it’s an obligation to plan participants and beneficiaries that is required by law. And, as you might have read in the news, it’s also on the radar of many plaintiff attorneys.

Fiduciary breach class-action litigation by plan participants against their employer plan sponsors is on the rise. To reduce the risk of being targeted in an upcoming lawsuit (or even having the Department of Labor come knocking on the door), company leaders must actively demonstrate strong fiduciary governance over their health and welfare benefit plans, showing that plan costs are reasonable and are aligned with the best interests of participants. And if company executives or board members haven’t named a fiduciary or a governing body to oversee the management of their health plan, guess what? They themselves may be considered the legal fiduciaries.

The increased focus on health plan fiduciary responsibilities under the Employee Retirement Income Security Act (ERISA) arose after new transparency requirements were passed under the Consolidated Appropriations Act of 2021 (CAA). The CAA amplified government scrutiny, created new disclosure and data-driven rules, and reinforced employers’ responsibility to make informed decisions in their plans’ cost management. This is because under ERISA, plan sponsors have a legal obligation to ensure that all benefit plan arrangements — medical, pharmacy, and beyond — are cost-effective and provide clear value.

In addition to reducing risks, strengthening fiduciary governance also creates opportunities for health plan sponsors, including greater control over plan costs, improved care for employees and gaining more leverage over players that are contributing to rising costs.

Unfortunately, not all plan sponsors are ramping up their fiduciary efforts. Some are only faintly aware of the need to do so. Ignoring this obligation, however, could lead to costly litigation or millions of dollars in penalties.

Concerns about rising healthcare costs

Why is fiduciary governance over health and welfare benefits suddenly making headlines? The answer is twofold: rising costs and a push for greater transparency.

For many years after Congress passed ERISA in 1974, the focus of fiduciary governance mostly had to do with employers effectively stewarding their workers’ retirement plans - ensuring proper investment of funds and reasonable fees for defined benefit and defined contribution plans.

However, with the skyrocketing costs of health care, concerns of mismanagement of health and prescription arrangements, and numerous new transparency laws like the CAA, the tides have turned, and all eyes are on health and welfare benefit plans.

In 2025’s elevated cost market, the risk of litigation underscores the need for fiduciary oversight, especially regarding pharmacy benefits. High-profile examples from the past year include the class-action lawsuits against Johnson & Johnson, Wells Fargo and JP Morgan for allegedly not ensuring reasonable plan costs and failing to exercise prudence when selecting and monitoring pharmacy benefit managers (PBMs).

Initial dismissal of some of this litigation was based on procedural grounds and stopped short of weighing in on ERISA fiduciary breach allegations. Continued back-and-forth with litigation is anticipated, including more dismissals and more filings. More legal activity is expected in 2025, as states continually introduce hundreds of bills intent on regulating PBMs, and litigation could extend beyond pharmacy. Therefore, it’s important that employers must continue to prioritize implementing and following a proper fiduciary governance plan.

Although litigation has shone the spotlight on the importance of fiduciary responsibly, regulatory action is also possible for employers that don’t take fiduciary governance seriously. In 2024 alone, there were 729 civil investigations closed by the Department of Labor, leading to $1.384 billion in recoveries directed to employee benefit plans, participants and beneficiaries. The department’s 177 criminal investigations last year led to indictments against 49 individuals, and 63 guilty pleas.

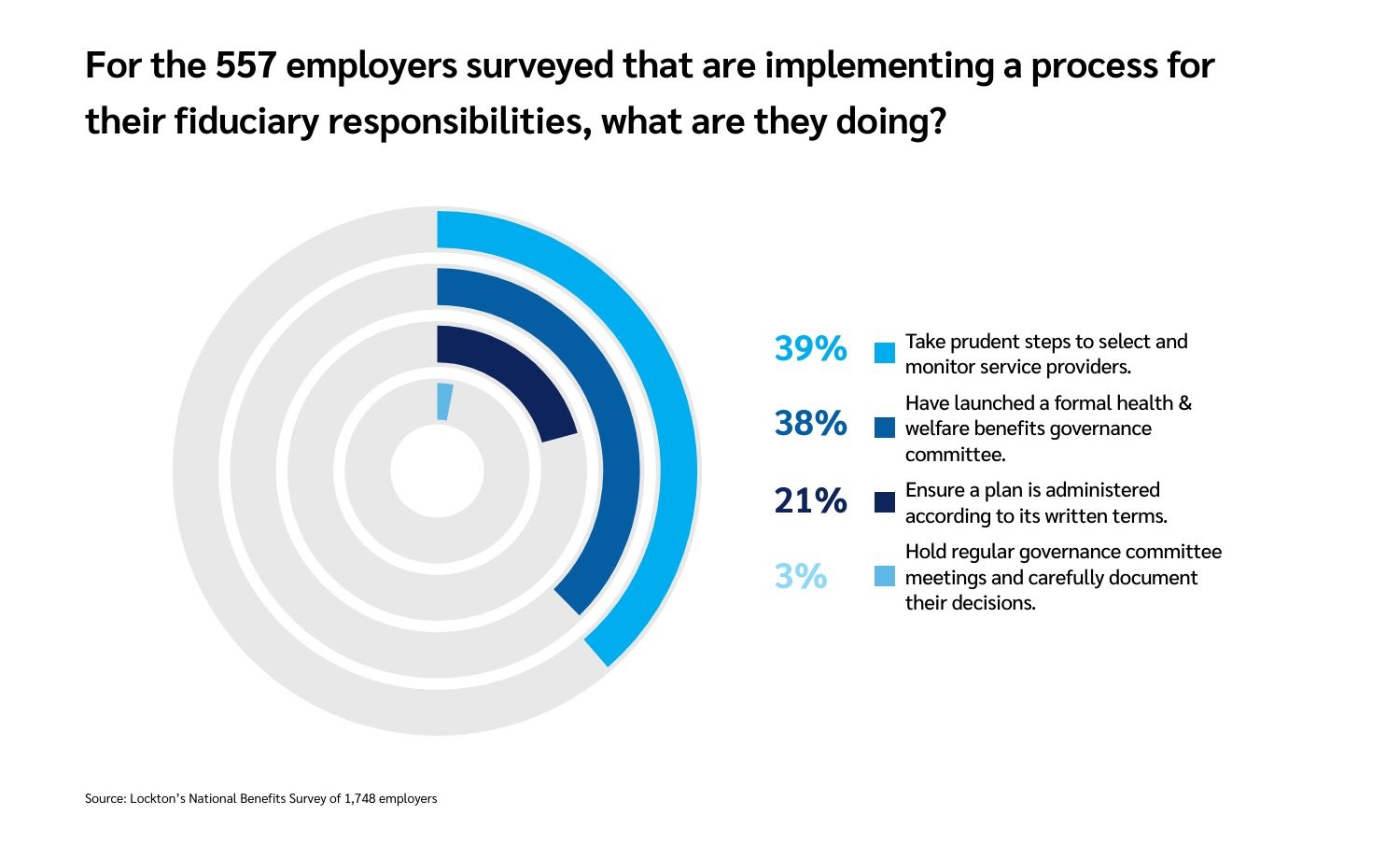

Despite the risks, fiduciary duties remain on the backburner for many employers. In Lockton’s recent National Benefits Survey, 557 employer respondents said they had “implemented a process” to evaluate their fiduciary responsibility for their benefit plan. However, of those who reported implementing a process, only 3% said they held regular committee meetings and documented decisions about fiduciary governance.

Cost accountability with pharmacy benefit managers

A key concern raised in recent litigation over fiduciary governance is the need for effective evaluation and oversight of PBMs to ensure fiduciary compliance. With pharmacy benefits accounting for 30% of total health plan costs, addressing high costs with responsible PBM oversight is a legal obligation for plan sponsors. However, managing the complexities of the PBM industry is challenging due to its concentration and vertical integration. The top three PBMs control over 80% of the market, creating obstacles for plan sponsors seeking transparency and value.

Because of this market dominance, securing cost efficiency aligned with fiduciary responsibilities requires employers to make thorough assessments and competitive evaluations of service providers to ensure effectiveness and value. Employers can accomplish this by partnering with independent experts who aren’t tied to PBMs, helping to ensure unbiased evaluations. They can assess PBMs for cost and value with requests for proposals and market checks. Finally, plan sponsors should have a full understanding of PBM contracts and monitor costs, including administrative fees, dispensing fees, and utilization of rebates.

What else can employers do?

Transparency really means clarity. It’s an insight into what things cost and how they work.

When it comes to transparency in health and welfare benefits, there’s a lot of talk about… allowing patients access to information, the cost of a covered item or service, and the quality of care ahead of time. For the employer, as plan sponsor, having this information is essential to protecting plan participants and beneficiaries. It can help ensure that benefits are paid for the exclusive benefit of these individuals, the “prudent expert standard” is utilized, only reasonable fees to service providers are paid, plan documents are followed, and more. These are all part of ERISA’s required fiduciary duties.

So, what can employers do to be certain they’re doing everything possible to be a good fiduciary? The five main duties first established by ERISA more than 50 years ago continue to exist:

To act only for the benefit of participants/beneficiaries (which is known as “duty of undivided loyalty”)

To act for the exclusive purpose of providing plan benefits or defraying reasonable expenses of plan administration (which is the exclusive benefit rule)

To perform duties with the care, skill, prudence and diligence of a subject matter expert (that’s the prudent expert rule)

To diversify plan assets to minimize the risk of large losses

And, finally, to follow the terms of the plan.

Of course, the Affordable Care Act and CAA have expanded on obligations to lead to better transparency of costs and quality of care, and to ensure that plan sponsors and participants/beneficiaries have access to this information. Advances in technology over the years have enabled plan sponsors to have more information at their fingertips, which in turn has raised expectations for higher levels of transparency and monitoring of costs.

An obligation and an opportunity

Taking a more active role in safeguarding and controlling costs in their health and welfare plans can be a lot to unpack for employers. But it can create some opportunities as well. If executed with care and consistency, fiduciary governance can:

Help an organization manage plan cost, and eventually lead to cost savings.

Help to improve benefits and care for employees.

Apply pressure through oversight on players like PBMs that are contributing to the rising health care costs.

This flips the switch from the risk of lawsuit or regulatory action towards the opportunity of providing plan participants with a more cost-efficient, trusting and transparent environment –and a more rewarding experience overall.

Most importantly, plan sponsors do not have to go it alone in this journey. There are resources available to help employers understand how to implement a rigorous and reliable fiduciary governance process.

To learn more about how the legal experts on Lockton’s ERISA Compliance Consulting team can help, visit our practice’s webpage on Lockton.com (opens a new window).