Download here (opens a new window)

Download here (opens a new window)

This article discusses how we continue to facilitate the protection, financing, and valuation of innovation. Part 1 (“intellectual property and IP collateral protection insurance”) describes the nature of intellectual property (IP), historical difficulties in financing innovation, and how the insurance industry devised a novel solution to fill that gap. Part 2 (“How can insurance companies get comfortable with the value of intellectual property?”) examines a variety of approaches to identifying and understanding the value of intellectual property.

Part 1: Intellectual property (IP) and IP collateral protection insurance (IP CPI)

Introduction

Innovation is uniquely capable of driving positive global advancement. Without it, half of us might not be alive. In 1968, Nobel Prize-winning biologist Paul Ehrlich forecasted that the human population would grow until we could no longer feed the planet and mass starvation would ensue. Half a century later, a report assessing how humankind escaped Ehrlich’s dire prophesy estimated that without the invention of synthetic fertilizer, 3.5 billion of the global population alive in 2015 would otherwise have perished or could never have been born. (1)

Fortunately, the Founding Fathers of the United States recognized the importance of incentivizing innovation. The United States Constitution, in its very first article, includes an “intellectual property clause,” enabling protections for multiple forms of creation, invention, and discovery. Our very first president even personally signed our nation’s first patent.

Section 1: Intellectual property

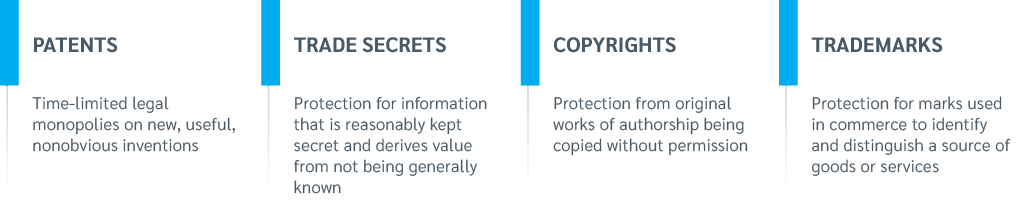

The four IP asset classes — patents, trade secrets, copyrights, & trademarks

PATENTS grant their owners time-limited legal monopolies on new, useful, nonobvious inventions. Such invention patents, called utility patents, can protect products, processes, machines, or devices. (Other, less common types of patents protect ornamental designs of articles of manufacture and new plant varieties). Patented inventions have repeatedly reshaped the world. If not for the force multiplier of chemical fertilizer discussed above, most of us who managed to survive might be full-time farmers rather than varied professionals in other spheres. Fittingly, that very first U.S. patent that George Washington himself signed into force in 1790 protected a method for making chemical fertilizer. (2)

TRADE SECRETS afford companies legal protections for information that is subject to reasonable efforts to maintain its secrecy and that derives economic value from not being generally known (or available through proper means) to others. To be eligible for trade secret protection, trade secrets cannot be able to be easily reverse engineered, must derive value from being kept secret, and must be protected from disclosure with a consummate level of rigor. Unlike patents, trade secrets do not need to be novel or original and trade secret protection can hypothetically last indefinitely. Trade secrets can be non-inventive confidential business information, such as customer lists, or inventions such as formulas or algorithms. The algorithm that The New York Times uses to build its lists of bestselling books is an example of an inventive trade secret.

COPYRIGHTS protect works of authorship from being copied, reproduced, distributed, performed, or publicly displayed without permission — everything from music, sculpture, literature, and poetry to standardized tests, surveys, and published customer intake forms. A hotel may not simply reproduce a photographer’s work without license and hang it around the lobby.

TRADEMARKS provide protection for any word, name, symbol or design (or combination thereof) used in commerce to identify and distinguish a source of goods or services. This category of IP includes not only names and logos, but also trade dress—the visual appearance of a product or its packaging. Trademarks prevent companies from passing their goods or services off as a competitors’ and signal to consumers that goods or services come from a single source, which incentivizes brands to invest in and maintain quality. A trademark registration can last for as long as the brand uses the mark in commerce and invests in and protects such consumer recognition. Bloomberg may not refer to its news agency as The New York Times.

Section 2: IP collateral protection insurance

How do we finance innovation?

The Founding Fathers not only understood that IP rights could protect successful investments, but also that an efficient financial system would be needed to fuel such growth. U.S. inventors, entrepreneurs, innovators, and other business leaders have long benefited from interest from, and access to, investors and investment dollars from around the world — as well as world-leading domestic public and private financial markets with superlative stability, liquidity, long-term resiliency, stamina, tenacity, and depth. It may be hard to imagine improving a financial system that has facilitated an astounding 157,172.5% increase in real GDP per capita over the last 230 years (from $49.10 in 1790 to $77,171.70 in 2022, in each case in 2017 U.S. dollars). (3) Yet despite our impressive track record of funding investment and fueling growth, we are long overdue for some innovation in the way innovation itself is financed.

The problem

All young companies need money, and most want to progress from raising equity capital (by selling part of the company) to obtaining debt capital (through loans) as soon as possible. Accessing debt instead of equity allows founders to keep more monetary and control rights for themselves — i.e., the rights to make money from the company and to exert voting power over it, which are granted to equity investors but not lenders. The issue for young companies that lack a strong credit history and may or may not realize their projected cash flows is that lenders generally will not lend to them without significant tangible assets (such as machinery) or financial assets (such as receivables) that can be pledged as collateral against the loan. (Venture debt has historically been available to some companies, but generally only if the borrower is already venture-backed and often on terms founders frequently see as undesirable.)

This puts growth-stage knowledge-economy companies at a disadvantage. As the economy has shifted from a focus on tangible to intangible assets and value creation, growth-stage companies find themselves in an in-between situation. While they usually lack sufficient tangible assets to obtain the debt they seek, they often own significant intangible assets, including intellectual property, valuable customer contracts, data, and other valuable intangibles such as government licenses. Unfortunately, most banks remain comfortable only with tangible assets and are generally unwilling to accept intangible assets as collateral against loans. However, many lenders are willing to accept policies from highly rated insurance carriers as collateral.

The solution

While many lenders remain unwilling to recognize the value of a prospective borrower’s intangible assets, specialized insurance underwriters have developed the capability to do so. The insurance policies they issue, known as intellectual property collateral protection insurance (IP CPI) or IP residual value insurance, help fill the financing gap between equity investments for startups and traditional debt fundraising for mature companies. If an insurer issues such a policy, they are agreeing to pay a lender in the event of a borrower default. Thus, an IP CPI policy transforms the lender’s risk from the credit risk of a growth-stage borrower to the minuscule default risk of a large, robust, stable insurance company. This allows innovative companies to transition from equity-only fundraising to accessing debt financing sooner than would otherwise be possible.

For this system to function, insurance underwriters must determine which borrowers are suitable for this novel coverage. Insurance underwriters assess the creditworthiness of growth-stage companies based not only on the financial strength of a business and its operations, but also on the strength of its intangible assets. The former assessment — the financial underwriting component — looks at the financial health of a business, including such factors as how much cash the business has historically taken in and how fast they are burning through it; the degree of concentration risk in the business’s consumer base; the business’s customer retention rate over time; and whether the quotient of their customer lifetime value divided by their customer acquisition cost is greater than one.

The second component of underwriting is the evaluation of the company’s intangible assets. In addition to ascribing a range of value anticipated to be reclaimable from an effort to monetize a prospective borrower’s IP, specialists can also evaluate the viability and durability of the company’s business plan through the lens of its salient intellectual property rights. For example, the IP analyst can determine if the firm is well positioned to seize a competitive advantage from differentiating desirable features protected by their patents.

There are several methods of valuing intangible assets that underwriters can use as inputs to evaluate the overall strength and likelihood of success of a prospective borrower. Part two of this article describes various intellectual property valuation methods in the context of intellectual property collateral protection insurance.

A combined approach of the debt finance and insurance markets can offer more advantageous access to capital for growth-stage borrowers with valuable intangible assets. Because an IP CPI lender benefits from the insurance company’s credit rating, such policies can unlock debt capital for borrowers that offers favorably low rates but requires a particular rating (such as NAIC-1), which ratings agencies can sometimes attach to such deals based on the strength of the insurer and their policy. The result of this combined effort of various forces is a new and improved way to finance innovation.

Part two: How can insurance companies get comfortable with the value of intellectual property?

Introduction

This second half of our IP CPI overview series discusses how insurers can derive useful information and meaning

from the multitude of lenses through which intellectual property can be assessed and appraised. An evaluation

of a prospective borrower’s intangible assets should provide several key data points. First, it should provide an

indication of roughly how much money could be reclaimed from an effort to monetize the assets in question.

Second, it should generate a preliminary plan for executing such a monetization. Third, it should provide a critical

input into the underwriters’ assessment of the viability of the company’s strategy, its comparative positioning to

carry out that strategy, and the likelihood that it will succeed in doing so.

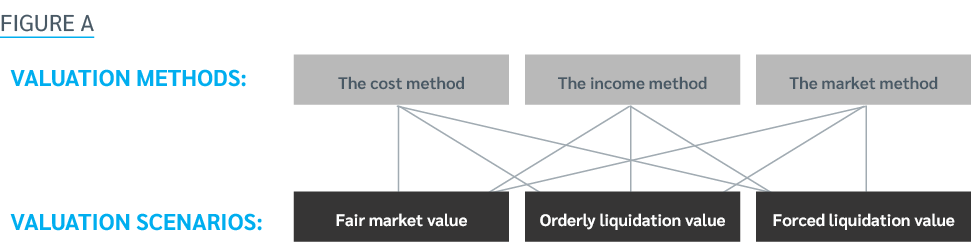

Intangible assets may be notoriously more difficult to value than their tangible brethren, but experts have multiple tools to appraise their worth. There are three main, commonly accepted intellectual property valuation methods. They go by a variety of names — and various manners of conducting them each have a variety of additional names — but we will call them the cost method, the income method, and the market method. We will also address the various scenarios under which IP can be valued, of which there are also three: fair market value, orderly liquidation value, and forced liquidation value. Thus, the same bundle of IP assets can give rise to at least nine different valuation results. (See Figure A.)

Section 1: Three leading valuation methods

The cost method

The cost method is focused on determining how much money the business that developed the intellectual property in question spent during the development process. This method also asks the question of how much money a separate business would have to spend to recreate a similar IP asset (or portfolio of assets) if that second company were to produce an equivalent feature, product, or service (or set thereof).

The cost method captures a variety of input costs that go into developing any type of asset, such as labor costs, material costs (e.g., purchasing chemical ingredients to develop and test potential new formulas), other testing costs (e.g., third-party laboratory service fees), general and administrative operational expenses, and other research and development fees (e.g., acquiring laboratory equipment). It also attempts to capture another important, but elusive, factor. The cost method endeavors to include the expense of developing invaluable “negative know-how” — the understanding of all the things that do not work so a business can home in on what does work. The significance of negative know-how is extensive but often overlooked and under appreciated. The best encapsulation of the value of negative know- how is a quote often, though perhaps apocryphally, attributed to Thomas Edison: “I did not fail a thousand times. I discovered a thousand ways not to make a lightbulb.”

However, the cost method’s salient deficiency is its disconnection from the IP’s market value. The foregoing process fails to incorporate the commercial value of the invention in question — i.e., how much sales or licensing revenue the patented features, goods, or services can generate. Hypothetically, Thomas Edison could have gotten lucky and discovered the most efficient filament on his third try, which would have greatly reduced the cost of developing the lightbulb without at all diminishing its massive market value as a product. Or he could have failed the first 100,000 times, adding to cost but not value.

The income method

There is, of course, an alternative IP valuation method that does focus on the revenue generated by an asset: the income method (also known as the economic benefit method). Unlike the cost method, the income method takes into account the remaining lifespan of an IP asset and attempts to determine the value of all future revenue streams that can be generated by that asset — through both sales and licensing operations.

An iteration of the income method known as the “relief from royalty” approach asks the question of if the owner of the IP assets being valued did not own the assets and instead a hypothetical third party owned them, what is the total sum of royalties they would have to pay the hypothetical third party to obtain a license to those intangible assets? This method looks at market-comparable or industry-standard licensing rates multiplied by the quantum of revenue generated by products or services practicing the features, inventions, or technology protected by the relevant intellectual property.

For example, suppose the Edison Electric Light Company produced a red lightbulb. Now imagine that Edison asked an expert to value a new patent on a heat-resistant translucent red pigment that the company developed to coat the bulbs. The expert might determine the value of the red pigment patent by assessing, if, hypothetically, the red pigment patent were owned by Acme Corporation instead of Edison, how much Edison would have to pay Acme Corporation in reasonable royalties for each red lightbulb sold (assuming Edison held all necessary rights to all other relevant lightbulb patents).

The market method

Lastly, the market method of IP valuation attempts to value IP assets by analogizing them to comparable assets found within accessible information about relevant transactions. For example, an expert working to value one IP asset might first identify a basket of similar IP assets and then search for market data showing prices at which those IP assets were previously traded in commercial transactions. Experts performing such exercises scour transaction data from mergers and acquisitions (M&A), insolvency, litigation, or other public or proprietary reports and databases. The expert in question would then make adjustments to take into account the scenario in which the identified comparables were transacted. For example, an asset sold as part of an M&A transaction and an asset developed by an insolvent business and sold during a bankruptcy auction present vastly different valuation contexts. The valuation expert will sensitize the relevant inputs (e.g., recorded historical sale prices) to adjust for any discrepancies between the circumstance in which the comparable asset was sold and the valuation scenario desired for the relevant exercise. Three valuation scenarios are commonly contemplated, as discussed below.

Section 2: Three common valuation scenarios

This last point brings us to our next discussion: valuation scenarios. The aforementioned valuation methods can, for the most part, be applied to any of the IP asset classes: patents, trademarks, copyrights, and trade secrets — though each has its idiosyncrasies (e.g., several copyright licensing regimes have their own particular laws that impact the application of the income method, and it is extremely difficult to find comparables for trade secrets for use in the market method).

Regardless of which type of IP asset is being assessed, the business scenario in which the asset’s value is being determined can drastically alter the result of any of the foregoing methods. It is important to determine whether the asset should be valued in the context of a going concern — i.e., fair market value; a planned sale — i.e., orderly liquidation value; or an urgent sale — i.e., forced liquidation value. This hypothetical ownership context can lead to significant differences in asset valuation outputs.

Fair market value

A fair market value determination assumes that the seller — the company that owns the IP — and a hypothetical buyer are both solvent businesses without exigent cash flow concerns coloring their behavior. Fair market value scenarios further assume that the entities have a mutual interest to transact regarding the asset in question for the purpose of obtaining the asset (in the case of the buyer) and converting that asset into currency (in the case of the seller), with no extraordinary external pressure to do so. The Internal Revenue Code describes this premise succinctly: “The fair market value is the price at which the property would change hands between a willing buyer and a willing seller, neither being under any compulsion to buy or to sell and both having reasonable knowledge of relevant facts.” (4)

Orderly liquidation value

Orderly liquidation value is the estimated value at which the asset or assets in question could be sold in an organized non-time-pressured sale that is well advertised and professionally planned and executed. This scenario assumes that the seller of the asset is obligated to make the sale but has a reasonably long period of time to do so — generally six months to a year.

Orderly liquidation value assessments take into account the number and breadth of potential buyers who would have interest in the asset in question — for example, a patent to make Wi Fi work faster would have many interested bidders, while a copyright for an obscure yodeling recording might garner more selective interest. Orderly liquidation value is generally intended to match the context of a seller needing to raise capital by selling the asset, but who is not insolvent or in imminent danger of insolvency.

Forced liquidation value

Forced liquidation value is similar to orderly liquidation value but assumes a shorter sale time frame. Forced liquidation value estimates the value for which the asset or assets in question could be sold in an organized but time-pressured sale. This scenario maintains the construct that the prospective sale is well advertised and professionally planned and executed, but presumes that it must take place within about three months or less. Forced liquidation value is generally intended to match the context of a seller that is in financial distress, but is solvent at the time of the sale, meaning that the assets are being sold by a troubled but operational company and not by way of a bankruptcy auction. This scenario also assumes that there are no material information asymmetries between the seller and the buyer and similarly takes into account the broad or narrow market appeal of the specific asset or assets being valued.

Section 3: What is the value of valuation?

It is simultaneously true that the dollar figure determined by an IP valuation exercise is both helpful and often incorrect. The valuation provides an estimate of how much capital might be reclaimed from an effort to monetize the assets in question. However, in most circumstances, it is impossible to accurately predict a precise figure. (One potential exception occurs if the potential seller purchases a put option to offload the assets in question at a fixed price.)

However, in the context of an IP collateral protection insurance policy, IP valuation assessments provide underwriters with numerous crucial data. For example, even though global market context, field-specific technological developments, and countless other factors can greatly impact the ultimate result of a forced liquidation, the exercise undertaken to determine the forced liquidation value of the assets in question nonetheless provides significant benefits. A well-conducted forced liquidation value exercise produces not only an indicative benchmark for the proceeds that can be reclaimed if a growth-stage company is forced to sell its IP, but also the foundation of a plan for conducting such a sale.

A robust forced liquidation assessment jumpstarts the monetization process by identifying in advance potential buyers, licensees, or litigation targets for the assets. The prospective borrower might have valuable intangible assets that can be sold in whole or in part, licensed to one or more entities, or asserted against competitors or other operating companies. Underwriters (or the experts with whom they work) will want to identify in advance both the strategy and the potential counterparties or targets for such actions or transactions. That plan can then be retrieved and updated in an accelerated fashion should the need arise to put it into action.

It may seem counterintuitive that a fair market value assessment of the intangible collateral in question is equally important in the context of insurance underwriting, because insurers would generally only need a borrower’s IP to be sold if the borrower were in distress. After all, it is not expected that the assets of a distressed company can be offloaded for their fair market value.

However, underwriters gain key insight into the strength, viability, and future performance prospects of the prospective borrower by assessing the business advantage granted to the borrower by its intangible assets — i.e., the specific proprietary market advantage imbued by the defined legal monopoly those intangible assets grant to their owner. Strong consumer brand recognition (e.g., Rolex); breakthrough inventions or technological capabilities (e.g., Velcro textile fasteners); or addictive algorithms (e.g., TikTok’s highly personalized video recommendation algorithm) all can be protected by trademarks and copyrights, patents, and trade secrets, respectively. These intangible assets grant their owners a material market advantage over competitors who lack access to, and must attempt to compete against, such differentiating assets. Thus, a fair market value analysis performed on a growth-stage company can help underwriters identify and assess the collective value of the competitive advantages granted by the intangible assets owned by that company — a crucial component of that company’s competitive strength, resilience, forecasted earning potential, and likelihood of success.

The fair market value scenario is also the appropriate lens to look through when mapping a company’s sales to its intellectual property protections. One of the most relevant exercises for insurance underwriters assessing IP collateral protection risks is mapping the combination of features protected by a prospective borrower’s IP (e.g., a granted patent’s specific claimed inventions) to elements of products or services sold in the market that are particularly desired by users or purchasers (as identified by customer insight capture methods — e.g., consumer surveys, focus groups, and A/B testing). Underwriters want to draw clear lines from intangible asset protections to product or service features to customer appetite to revenue. They want to see that sales are driven by customer demand stemming from desirable product features that are protected by the borrower’s IP. This is a key derisking feature of the type of target borrowers that are suitable for this insurance solution. IP CPI underwriters requiring prospective borrowers to be revenue-producing can map the borrower’s products or services that are generating sales in the marketplace to the features or inventions that are protected by the borrower’s intellectual property assets. It is generally appropriate to assume the company is in a healthy state while conducting such an analysis.

In summary, when performing IP analysis in the context of IP CPI, multiple valuation methodologies should be employed and their outputs should be considered in conjunction with one another, to provide a useful overall picture grounded in the type of real-world due diligence information that lenders and insurers require to be comfortable participating in this emerging capital marketplace.

Conclusion

There are multiple types of intellectual property, each of which has a different purpose, but all are intended to support, incentivize, and protect the advancement of applied creativity, inventiveness, and technology — or, as the United States Constitution puts it: “To promote the progress of science and useful arts.” (5) There is no single way to value intellectual property, but a number of useful frameworks exist, each of which can be employed in different contexts to produce a multitude of useful data points for various assessments. Intellectual property collateral protection insurance stands strong as a formidable new element in the business investment ecosystem, bridging the current gap between financing, funding, risk, and growth. Like the asphalt that built our transportation arteries (made possible by John Deere’s revolutionary steam-powered asphalt laying machine, patented in 1903), (6) IP CPI paves a smoother path upon which inventors and investors alike may accelerate toward a better future for all.

Footnotes

1 Hannah Ritchie (2017). “How many people does synthetic fertilizer feed?” Published online at OurWorldInData.org.

Retrieved from: “https://ourworldindata.org/how-many-people-does-synthetic-fertilizer-feed”.

2 “Milestones in U.S. Patenting.” United States Patent and Trademark Office - An Agency of the Department of Commerce, 26 Sept. 2023, www.uspto.gov/

patents/milestones.

3 Louis Johnston and Samuel H. Williamson, “What Was the U.S. GDP Then?” MeasuringWorth, 2023.

4 United States Internal Revenue Code § 20.2031-1(b).

5 United States Const. Article I, Section VIII, Clause VIII.

6 “When Was Asphalt Paving Invented.” JR Paving & Construction Co., Inc., 29 Aug. 2022, jrpavingandconstruction.com/when-was-asphalt-paving-invented/.