Overall capacity in the environmental insurance market is robust, and pricing is generally stable for most buyers. In the face of emerging hazards and a challenging and uncertain regulatory landscape, however, insurers continue to deploy capital judiciously.

PLL, CPL markets stable

The environmental insurance market is mainly comprised of two products: pollution legal liability (PLL), which is aimed at covering fixed facilities, such as owned or leased locations, and contractor’s pollution liability (CPL), which is designed for contractors working at job sites.

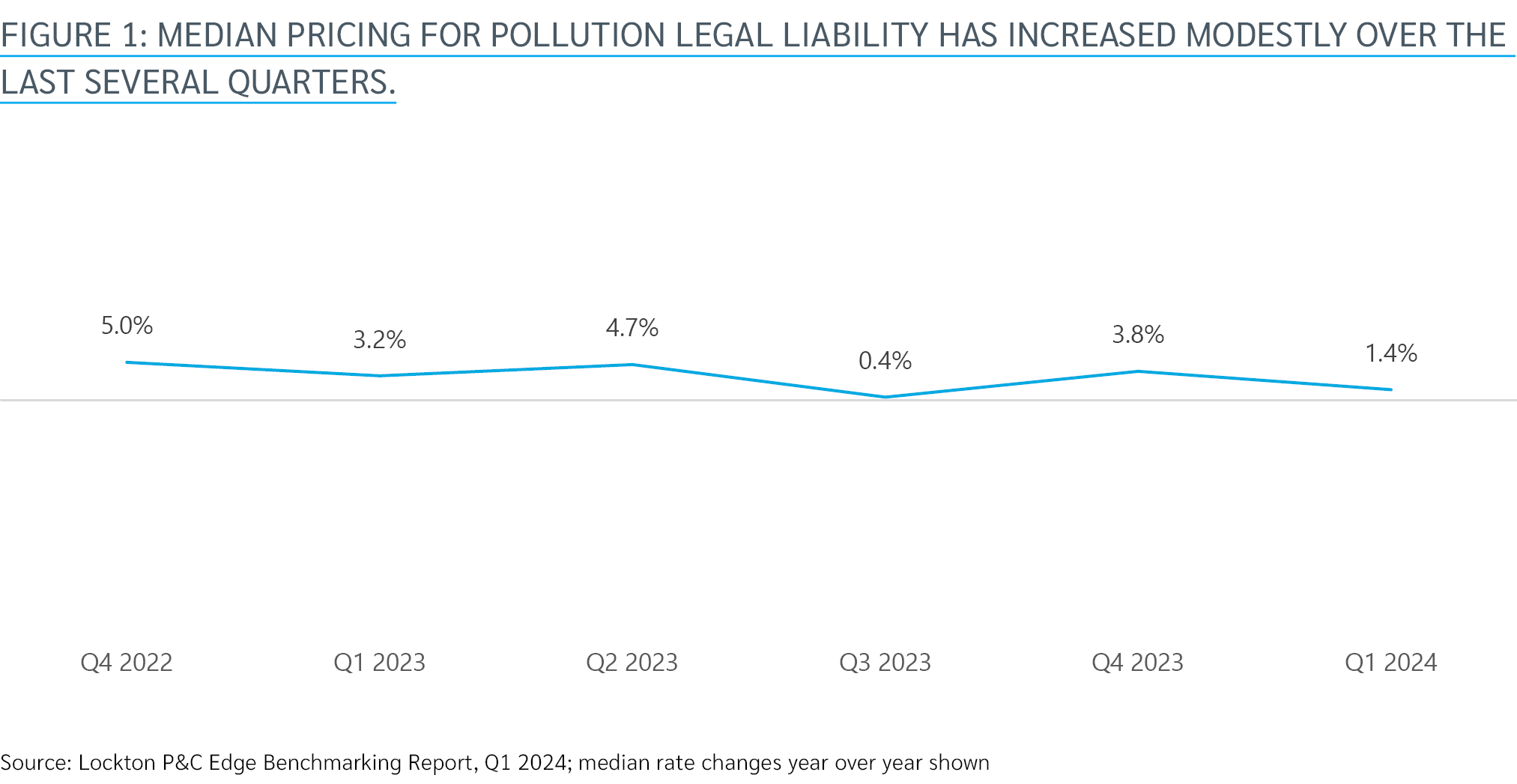

Median pricing for PLL increased 1.4% in the first quarter of 2024, according to Lockton data (see Figure 1). PLL rate fluctuations recorded over the last several quarters have been modest, ranging from flat to +5%. While insurers have sought to keep pace with growing loss costs, competitive pressures have generally prevented large rate increases from materializing.

Multiyear policies remain available for PLL. While rates remain stable, the negotiation of terms and conditions is where experienced environmental brokers can demonstrate their value. Underwriters are asking for more robust underwriting information and are making better use of publicly available data, so it’s vital that insureds and their brokers understand the critical pieces of information they must provide and how to showcase risks to the best-suited markets.

Pricing for CPL remains stable and predictable, with most buyers renewing their programs with rate changes of between -2% and +3%. Backed by ample capacity, insurers are also aggressively competing for new business and demonstrating flexibility around terms and conditions.

Outliers, however, exist. Environmental liability coverage and market conditions are highly individualized and driven by insured’s specific characteristics. Buyers in more favorable or challenging industries or with stronger or adverse loss histories often experience results outside the norm. Other variables, such as the traits of surrounding properties or proximity to water bodies, protected habitats, and other sensitive areas, can also dictate renewal results.

Litigation threats expanding

Although significant pricing changes have not yet materialized, insurers remain wary of a number of potential threats. These exposures impact coverages not only under environmental insurance programs; significant judgments have also been levied due to products pollution, a coverage available within combined general liability/pollution programs or on a stand-alone basis.

An increasingly aggressive — and creative — plaintiffs’ bar is focused on several contaminants of concern, including per- and polyfluoroalkyl substances (PFAS, also known as “forever chemicals”). PFAS are used in a variety of consumer and industrial products, and can contaminate food supplies and water sources.

Although litigation is still developing — as is regulation — nearly 10,000 PFAS suits filed against companies in 140 industries through late 2023 had resulted in settlements totaling $16.7 billion (opens a new window), according to a November 2023 report from consulting firm Milliman, a figure that is expected to grow significantly in the coming years. The same report referenced an estimate from risk analytics firm Praedicat that the cost of remediating PFAS contamination in drinking water across the U.S. could ultimately cost as much as $370 billion.

Insurers are also monitoring litigation related to ethylene oxide, which is used in the production of antifreeze, as a medical sterilizing agent, and as a pesticide. Exposure to ethylene oxide has been linked to lymphoma, leukemia, and other forms of cancer. A 2023 settlement to resolve nearly 900 ethylene oxide claims against a medical sterilization company — which followed a 2022 jury verdict of $363 million against the same company — is indicative of the potential financial ramifications for businesses with ethylene oxide exposures.

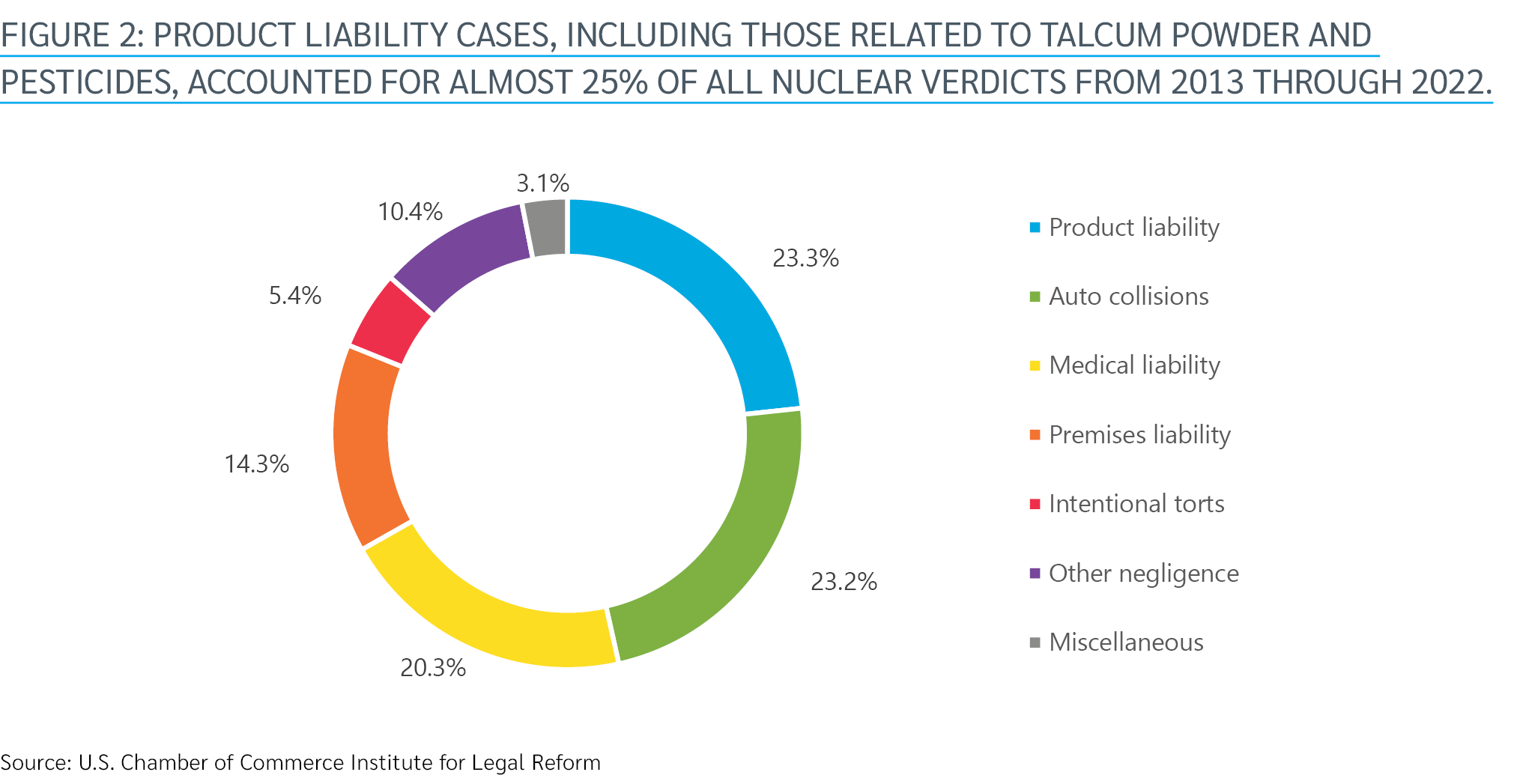

PFAS, ethylene oxide, and other contaminants have been a driving force behind many so-called nuclear verdicts — defined as those of $10 million or more — that have been recorded over the last several years. Product liability cases — including those alleging health risks associated with emerging contaminants — accounted for nearly one-quarter of all nuclear verdicts between 2013 and 2022 (opens a new window), according to the U.S. Chamber of Commerce Institute for Legal Reform (see Figure 2). In 2022, the median nuclear verdict in product liability cases was $36 million, up from $24 million in 2013.

While product liability is typically insured under general liability policies, the increasing frequency and severity of verdicts is leading to growth in the application and breadth of pollution exclusions under those programs. The gaps created may be closed using environmental policies with enhancements for product liability or through a blended product that combines general, product and environmental liability.

In any case, whether they are reviewing risk related to insureds’ products, facilities, or operations, underwriters are more wary about the exposures that they can insure and how they price that risk. For example, those insurers that historically have strategically deployed capacity to companies with PFAS exposures are now limiting coverage for these companies or seeking to exclude coverage for PFAS-related risks altogether.

This underwriting scrutiny is being driven in part by pressure from reinsurers to manage the profitability of their books. Uncertainty around future regulations and remediation technologies along with the ubiquity of some contaminants are also prompting greater attention by insurers.

Public awareness, societal pressures prompting greater consideration of insurance

Despite growing loss activity and intense public focus on sustainability, only about 20% of companies purchase environmental insurance coverage today, roughly the same amount as in 2018. As market conditions have hardened across other lines, companies have largely hesitated to add more coverage, viewing it as yet another expense. Brokers with limited environmental insurance expertise can sometimes compound the problem by failing to properly explain the environmental risks companies can face and the potential value of transferring (or capping) those risks.

This may be changing, however, in part to growing awareness and media coverage of environmental risks. Advances in sciences regularly identify potentially dangerous chemicals and contaminants and the adverse health effects that can arise from substances previously considered safe. Companies are increasingly recognizing that they cannot turn a blind eye to these exposures, and must instead evaluate how best to manage the use, handling, processing, and disposal of these pollutants.

At the same time, pressure from investors, employees, customers, and communities have prompted many companies to increasingly focus on environmental, social, and governance (ESG) strategies. The general public’s views toward climate change and other environmental impacts may be partially responsible for the growth in the size and frequency of nuclear verdicts over the last decade. Federal and state regulatory agencies have also become more proactive, with fines and penalties continuing to increase.

These developments have prompted many buyers to revisit environmental coverage options, while simultaneously strengthening their controls and response plans. Environmental liability has also become a key element of M&A due diligence, with insurance often facilitating successful deal closings.

Working with the right broker

As companies increasingly weigh their potential environmental risks and consider purchasing environmental insurance products, it is vital that they seek advice and support from an experienced insurance broker that specializes in environmental risk and works exclusively with the environmental market.

Environmental insurance products are highly customizable, able to be catered to a company’s specific risk. It is important that companies work with brokers that understand their unique needs, can look beyond topline premium expenses to assess the true value of coverage, and can negotiate relevant and favorable terms and conditions on their behalf.

An effective broker can also:

Offer insights and expertise from professionals with backgrounds in environmental science, consulting, broking, and underwriting, which can inform choices about insurance program terms and conditions, limits, and other features.

Coordinate coverage across all lines to ensure environmental policies close gaps and work seamlessly in a claim scenario.

Help insureds secure favorable outcomes from complex and potentially costly claims.

As their peers increasingly recognize the value in environmental insurance products, those companies that have been reluctant to purchase coverage should reconsider their choice, especially as environmental insurance is increasingly required by lenders and landlords and valued by potential merger and acquisition partners. Purchasing insurance now — before a potentially significant environmental exposure is discovered — could help a company proactively address an issue before it becomes uninsurable.