The past several years have been difficult for most property insurance buyers, punctuated by one bad headline after another. Midway through summer 2022, insurers were already under pressure from accumulating natural catastrophe losses. By the end of the year, damage from Hurricane Ian served as a tipping point for the reinsurance marketplace.

In the fourth quarter of 2022, property insurance rate increases accelerated (opens a new window), according to the March 2023 Lockton Market Update. Conditions are expected to remain challenging for most buyers in 2023.

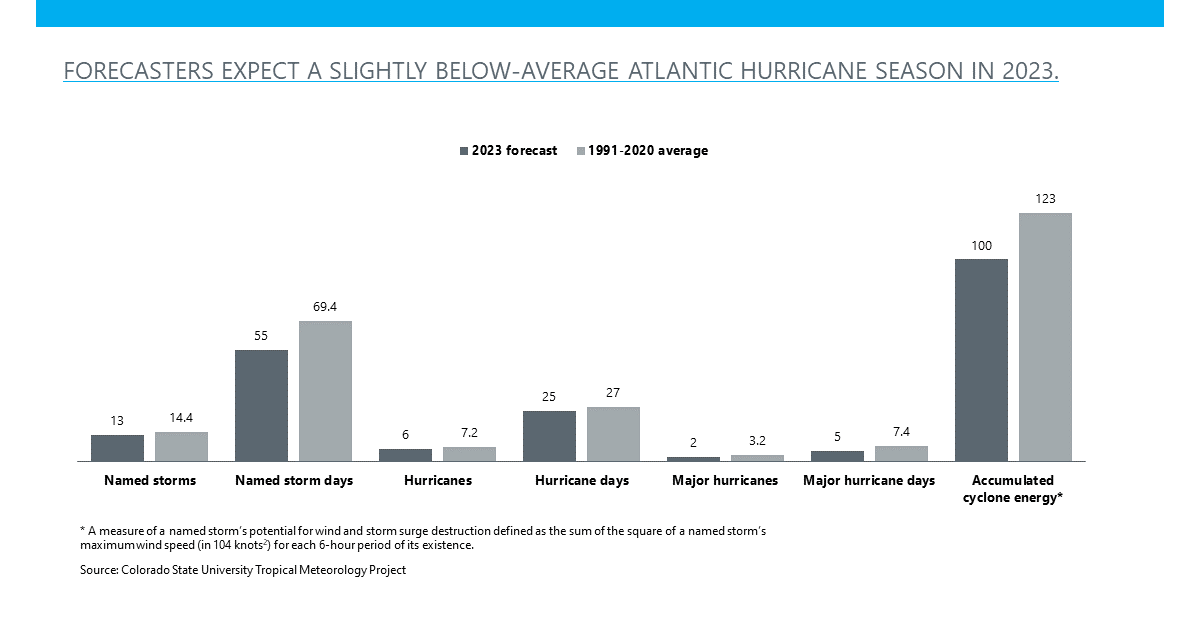

Amid this doom and gloom, Colorado State University’s forecast of a slightly below-average 2023 Atlantic hurricane season (opens a new window) might appear to be some welcome good news. CSU researchers today announced their forecast of 13 named storms this year, including six hurricanes, two of which they expect will be major storms — category 3 or above on the Saffir/Simpson scale. All of these figures are slightly below the recorded averages from 1991 through 2020.

Despite this, there are reasons for worry. CSU researchers said the probability of at least one major hurricane making landfall along the U.S. coastline is 44% — slightly above the 43% average from 1880 through 2020. Researchers also noted that a busy Atlantic hurricane is still possible, given uncertainty about El Niño strength in 2023.

Property owners must also keep in mind that hurricanes are not the only natural catastrophe concern they face. In 2022, hurricanes accounted for just three of the 18 separate natural catastrophes that resulted in $1 billion or more in economic losses in the U.S. (opens a new window), according the National Oceanic and Atmospheric Administration. And total insured natural catastrophe losses globally have topped $100 billion in three calendar years since 2017. As climate change persists, the frequency and severity of all natural catastrophes will be a long-term worry for insurance buyers.

And, of course, just one catastrophic event can spell disaster for a company and its bottom line. CSU researchers predict that 2023 hurricane activity will be about 80% of the average season from 1991 through 2020. 2022, in comparison was about 75% of an average season — and yet had destructive impacts on many businesses.

So what’s the takeaway from all of this for companies with catastrophe-exposed properties across the U.S.? Simple: Don’t be complacent.

It’s imperative that property owners — in conjunction with their risk advisors — use analytics to better understand their catastrophe risk and take steps to manage that risk sensibly given current market conditions.

Your Lockton team can work with you to ensure you are:

Reporting accurate property valuations to underwriters. This has become a significant point of contention in renewal discussions since the start of 2022.

Making insurance buying decisions with the most complete picture of your risk. Lockton uses the industry's two leading model vendors along with our proprietary Dynamic Capital Modeling process to help you better understand the full scope of the risk/reward tradeoff.

Considering alternative risk solutions that may help you better manage a range of catastrophic property exposures. Parametric insurance policies, for example, have garnered much interest in recent years because they allow for payouts based not on sustained property damage but on weather conditions — for example, recorded wind speed within a defined geographic area.

Contact your Lockton representative today to learn more about how our property analytics can help you manage risks from hurricanes, tropical storms and other natural catastrophes.