Chile recently enacted a major overhaul of its pension system. Key changes include the creation of a new social security fund, new social security retirement benefits, and gradual increases in total mandatory employer contributions to employees’ pension accounts and social security (from 1.5% to 8.5% of employees’ taxable income), among other reforms.

These changes are expected to take effect over several years, from 1 August 2025 to 1 August 2033.

Background

The reform was approved by the Chilean Congress on 29 January 2025 and published in the Official Gazette on 26 March 2025. It aims to establish a more equitable, intergenerational, and gender-inclusive system by addressing long-standing disparities, particularly those affecting women, and strengthening retirement benefits.

The existing pension system comprises three pillars:

Non-contributory/Solidarity: A government-financed pension benefit called the universal guaranteed pension (Pensión Garantizada Universal or “PGU”) provides a monthly income to eligible pensioners based on income and residency requirements, regardless of their contribution history.

Contributory: Employees make mandatory contributions to individual accounts managed by private pension fund administrators (Administradoras de Fondos de Pensiones or “AFPs”). AFPs are private financial institutions that invest pension funds to generate returns over time. Currently, employers do not contribute to employees’ individual pension accounts. However, they do contribute an average of 1.5% of employees’ taxable income to Disability and Survivorship Insurance (Seguro de Invalidez y Sobrevivencia or “SIS”). SIS is a mandatory private insurance benefit that is administered through AFPs.

Voluntary: Individuals can make additional voluntary contributions to further build their retirement savings.

From 1 August 2025, the existing contributory pillar will transition to a new mixed system, consisting of both existing private individual AFP accounts and new social security retirement benefits to be financed by a new social security fund (the Autonomous Pension Protection Fund or “FAPP”). The FAPP will be primarily funded through employer contributions.

The most significant change under the new system is the obligation for employers to begin contributing not only to the FAPP but also to employees’ individual AFP accounts.

Key details

The most relevant details for employers to note include the following:

Creation of FAPP and new social security retirement benefits

The reform creates the FAPP, which will be an autonomous public entity primarily funded by employer contributions (see below) and supported by an annual government contribution.

The FAPP will finance:

A new social security retirement benefit based on years of contributions: This will be available from 1 January 2026 to men aged 65 and above with at least 20 years of contributions and women aged 60 and above with at least 10 years of contributions (gradually increasing to 15 years by 2035). The amount of this benefit, to be paid monthly, will be calculated at 0.1 Unidades de Fomento (UF) per year of contributions, capped at 2.5 UF. The UF is a financial unit of account in Chile that is adjusted daily for inflation (UF as of 1 June 2025: CLP 39.191,97). It is used for calculating health insurance contributions, pension payments, loans, and other long-term contracts.

A new social security retirement benefit for women to provide compensation for women’s longer life expectancy: This will be available from 1 January 2026 to women aged 65 or olderwho are receiving a contributory old-age or disability pension. Women who retire before age 60 will not be eligible, and those who retire before 65 will only receive a partial benefit. The amount of the benefit will range from 0.25 to 18 UF, depending on the individual’s total monthly pension amount and life expectancy at retirement.

SIS: This is currently administered through AFPs but will be integrated into the FAPP as a social security benefit (instead of a private insurance benefit) by 1 August 2026.

Increases in mandatory employer contributions

Employers are currently only required to contribute an average rate of 1.5% of employees’ taxable income to SIS. From 1 August 2025, employers will be required to make contributions to both employees’ individual AFP accounts and the FAPP.

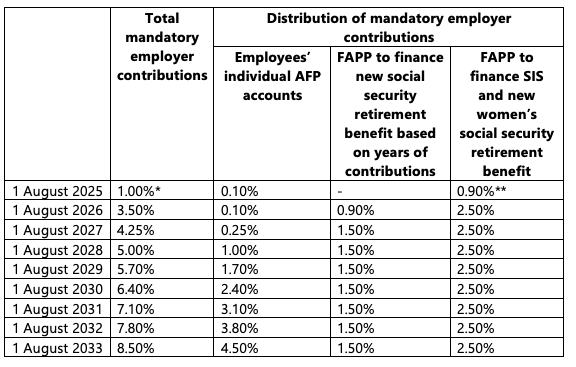

From the current 1.5%, the total rate of mandatory employer contributions will gradually increase to a total of 8.5% of employees’ taxable income by 2033 (i.e., over nine years; this could be extended by two years to 2035 based on recommendations of the Autonomous Fiscal Council, which is responsible for assessing the long-term sustainability of public finances):

* As SIS will only be integrated into the FAPP by 1 August 2026, employers will continue to contribute 1.5% for SIS separately for 1 August 2025 to 31 July 2026.

** Only to the new women’s retirement benefit, as SIS will only be integrated into the FAPP by 1 August 2026

Details of the progressive rate increases and how employers should declare and pay contributions can be found on the government’s website here (opens a new window).

The reform does not make any changes to the rate of mandatory employee contributions, which will remain at 10% of employees’ taxable income.

Increase in PGU

Currently, the PGU is available to individuals aged 65 and older who do not belong to the wealthiest 10% of households, have a monthly base pension lower than a set threshold (CLP 1,210,828 as of 1 February 2025) and meet Chilean residency requirements. Those with a base pension of CLP 762,822 or less receive the maximum PGU of CLP 224,004 per month. Individuals with base pensions between CLP 762,823 to CLP 1,210,828 receive a proportionally reduced amount.

Under the non-contributory pillar, the reform will increase the maximum PGU from CLP 224,004 to CLP 250,000. The increased maximum PGU which will apply to pensioners aged 82 or older from September 2025, pensioners aged 75 or older from September 2026, and pensioners aged 65 and older from September 2027. This change will primarily benefit low-income seniors.

Regulatory changes in the pension fund administration industry

The reform introduces changes to the AFP industry, such as the following:

AFPs currently offer five investment funds for contributors to choose based on risk levels. On 1 April 2027, these will be replaced by 10 default target-date retirement funds, based on the risk level and return on investment suitable for each age range of contributors.

A public bidding process will be held every two years starting on 1 August 2027 for 10% of individual AFP accounts to be randomly reassigned to the AFP that charges the lowest commission (to be fixed for five years).

Employer action: ACT

Employers should review and update their internal policies, practices and systems, employment agreements and collective agreements, where necessary, to reflect the upcoming changes. Particularly, employers should prepare for the phased changes in employer contribution rates starting 1 August 2025 by budgeting for the increased costs, coordinating with payroll providers to gather necessary information, and ensuring payroll systems and timelines are ready for implementation. Regular reviews should be conducted to ensure ongoing compliance with the scheduled increases in contribution rates. Employers may also wish to educate employees on the upcoming changes and how they will affect their retirement benefits.

Please contact your Lockton Consultant if you wish to discuss these changes or the potential impact on the retirement benefits, financial planning, and financial education currently offered to your employees.

Written in collaboration with:

Carola Orellana Santos

Head of People Solutions, Lockton Chile

carola.orellana@lockton.com (opens a new window)

Cesar Lopes

Executive Director Actuarial Benefits

cesar.lopes@lockton.com (opens a new window)

Further Information

Legal Guide on Pension Reform 2025 | Library of the National Congress of Chile (opens a new window)

Law 21735 | Library of the National Congress of Chile (opens a new window)