The economic implications of rampant inflation are innumerable — and they extend to the commercial insurance marketplace.

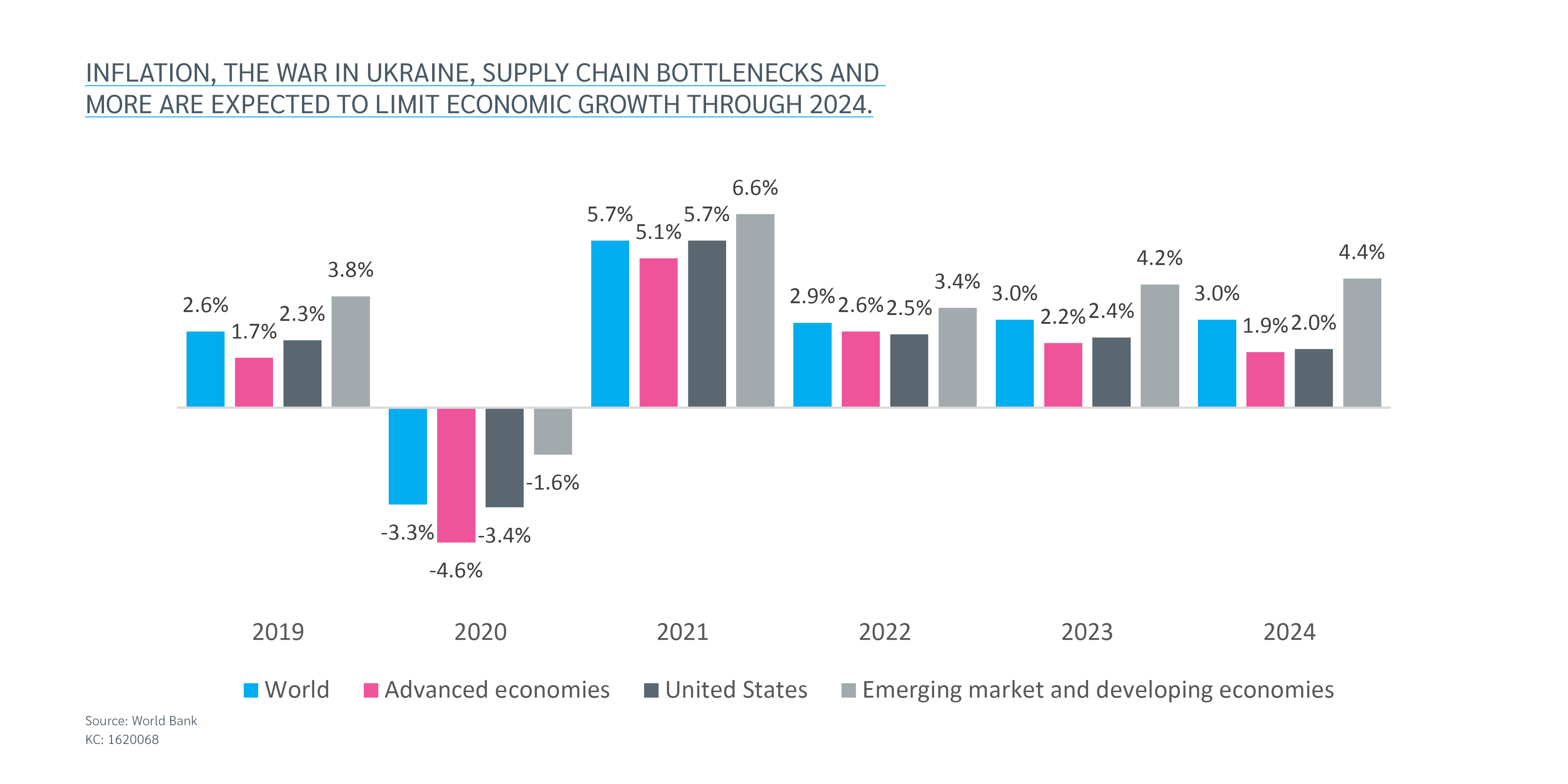

Last week, the World Bank updated its economic forecast for 2022 and beyond (opens a new window). And the outlook is bleak: Economic growth is projected to slow to 2.9% globally and 2.5% in the United States in 2022. U.S. economic growth is expected to slow even more over the next two years, to 2.4% in 2023 and just 2.0% in 2024.

This projected economic slowdown can be attributed to several factors, but the clear headliner is inflation. In 2022, inflation has risen to levels that have not been seen in four decades. (opens a new window) This is the first direct experience with severe price hikes that many people have had, including a number of underwriters and risk professionals.

Inflation is not a new phenomenon, but the current rate of inflation has several adverse implications for the insurance industry. And for insurance buyers — who must always carefully consider what insurance coverage to purchase, how much to purchase, how to structure programs, and at what point risk should be retained versus insured — it raises new concerns that existing retentions and limits may no longer be sufficient.

The good news is that analytical tools can help to address these potential concerns. Lockton’s Dynamic Capital Modeling (DCM) was designed to help organizations make smarter decisions about their insurance coverage. Ahead of your next renewal, our DCM offerings can help you optimize your overall cost of risk, make the most out of potentially limited capital resources and determine:

Whether your limits are adequate.

Whether to retain or transfer a risk layer.

Which retention enables the best use of capital.

The estimated cost for a unique program structure.

The potential for catastrophic loss even when a company has no catastrophic historical experience.

Download our brochure on Lockton’s Dynamic Capital Modeling (opens a new window), read our new report on the insurance implications of inflation (opens a new window) and contact your Lockton representative today to learn more about how we can help.