Skip to main content

ALERT / AUGUST 20, 2025

Amidst continuous change, upcoming ERISA compliance webcasts keep employers in the know

4 MIN READ

This year has been an eventful one so far for health and welfare compliance, with a new presidential administration, the sweeping One Big Beautiful Bill Act, and several Supreme Court decisions, to name a few.

For plan sponsors, it can be a lot to unpack. That’s why Lockton offers a regular cadence of free webcasts, in which our compliance experts weigh in on a range of pressing issues and changes under the Employee Retirement Income Security Act (ERISA).

Whether you’re a Lockton client or not, we encourage you to attend the upcoming fall/winter webcasts for our Client Advisory Seminar Series, hosted by Lockton's Compliance Consulting team. This series of one-hour webcasts provides practical advice on a variety of issues that include direct primary care, interactions of HSAs and HRAs, Affordable Care Act reporting, and a wrap-up of the biggest developments in compliance for 2025.

Read on to learn more and feel free to register for one or all four webcasts:

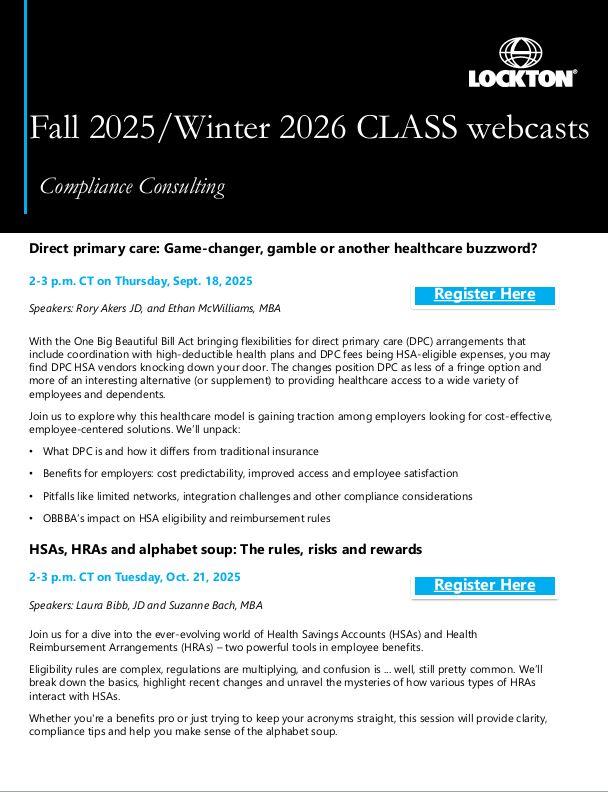

Direct primary care: Game-changer, gamble or another healthcare buzzword?

2-3 p.m. CT on Thursday, Sept. 18, 2025

Speakers: Rory Akers, JD, Ethan McWilliams, MBA, and Sarah Shaw

With the One Big Beautiful Bill Act bringing flexibilities for direct primary care (DPC) arrangements that include coordination with high-deductible health plans and DPC fees being HSA-eligible expenses, you may find DPC vendors knocking down your door. The changes position DPC as less of a fringe option and more of an interesting alternative (or supplement) to providing healthcare access to a wide variety of employees and dependents.

Join us to explore why this healthcare model is gaining traction among employers looking for cost-effective, employee-centered solutions. We’ll unpack:

What DPC is and how it differs from traditional insurance

Benefits for employers: cost predictability, improved access and employee satisfaction

Pitfalls like limited networks, integration challenges and other compliance considerations

OBBBA’s impact on HSA eligibility and reimbursement rules

REGISTER HERE (opens a new window)

HSAs, HRAs and alphabet soup: The rules, risks and rewards

2-3 p.m. CT on Tuesday, Oct. 21, 2025

Speakers: Laura Bibb, JD and Suzanne Bach, JD

Join us for a dive into the ever-evolving world of Health Savings Accounts (HSAs) and Health Reimbursement Arrangements (HRAs) – two powerful tools in employee benefits.

Eligibility rules are complex, regulations are multiplying, and confusion is ... well, still pretty common. We’ll break down the basics, highlight recent changes and unravel the mysteries of how various types of HRAs interact with HSAs.

Whether you're a benefits pro or just trying to keep your acronyms straight, this session will provide clarity, compliance tips and help you make sense of the alphabet soup.

REGISTER HERE (opens a new window)

2025 in review: The big, the beautiful and what it all means for benefits

2-3 p.m. CT on Thursday, Dec. 4, 2025

Speakers: Rory Akers, JD, and Mark Holloway, JD

To borrow a phrase from Ferris Bueller, “A year moves pretty fast, so you better stop and consider the benefit impacts going forward.”

Join us as we rehash and refresh some of the biggest benefit compliance happenings of 2025 that employers will want to consider as they roll into the new year. Jump-start your planning and strategy with our robust discussion of topics that will dominate health and welfare benefits in 2026, including:

The impact of the One Big Beautiful Bill on benefit plans in 2026 and the potential for any additional legislative changes before the end of the year

The latest on prescription drug issues, including the expanding realm of GLP-1 indications

The current state of mental health parity rules and enforcement efforts

Litigation impacting employer benefit plans, including a review of fiduciary cases, the Supreme Court ruling on state laws directed at gender-affirming care, and HIPAA

REGISTER HERE (opens a new window)

ACA reporting review: The old, the new and the downright confusing

2-3 p.m. CT on Thursday, Jan 15, 2026

Speakers: Ruhe Wadud, JD, and Michael Baker, JD

ACA employer mandate-related filings (as well as several state individual mandate filings) for the 2025 calendar year will be due in early 2026, and there are several important items and reminders to consider. Join us for our annual ACA reporting webcast, in which we’ll discuss:

What’s new on and how to complete the 2025 Forms 1094-C and 1095-C

Frequently asked about and particularly challenging coding scenarios, including COBRA and M&A-related examples

Rules requiring all employers subject to the ACA employer mandate to file electronically

Relaxed rules for furnishing 1095-Cs to individuals with proper notice

An update on enforcement efforts we’ve seen

And more

REGISTER HERE (opens a new window)

For more compliance insights and additional information, click here (opens a new window) to visit Lockton's ERISA Compliance Consulting page.

Download article (opens a new window)

Download article (opens a new window)

by Beth Latchana

Senior Vice President; Director, Compliance Consulting