Skip to main content

ARTICLES / SEPTEMBER 2, 2025

2025 Trend outlook shows little healthcare cost relief in sight

3 MIN READ

Download flyer (opens a new window)

Download flyer (opens a new window)

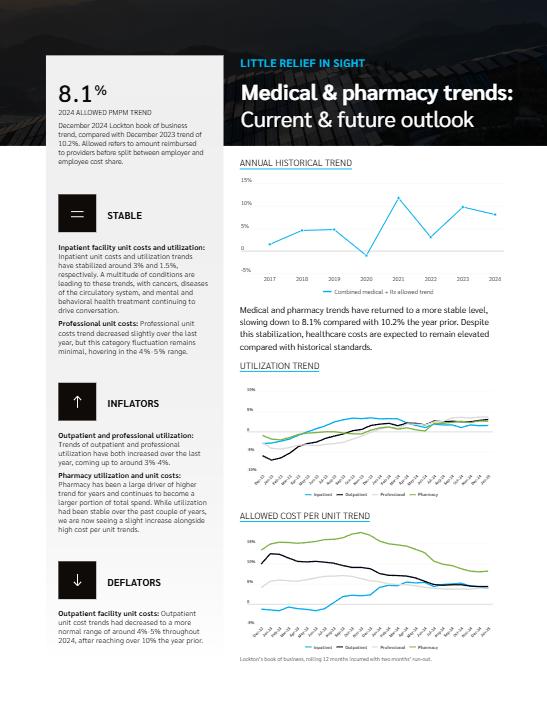

Medical and pharmacy trend reached 8.1% in 2024

Medical and pharmacy trends have returned to a more stable level after previous volatility, slowing down to 8.1% compared to 10.2% the year prior.

Despite this stabilization, healthcare costs are expected to remain elevated compared to historical standards. A mix of factors are contributing to these upward trends:

Stable factors

Inpatient facility unit costs and utilization: Inpatient unit costs and utilization trends have stabilized around 3% and 1.5%, respectively. A multitude of conditions are leading to these trends, with cancers, diseases of the circulatory system, and mental and behavioral health treatment continuing to drive conversation.

Professional unit costs: Professional unit costs trend decreased slightly over the last year, but this category fluctuation remains minimal, hovering in the 4%-5% range.

Inflators

Outpatient and professional utilization: Trends of outpatient and professional utilization have both increased over the last year, coming up to around 3%-4%.

Pharmacy utilization and unit costs: Pharmacy has been a large driver of higher trend for years and continues to become a larger portion of total spend. While utilization had been stable over the past couple of years, we are now seeing a slight increase alongside high cost per unit trends.

Deflators

Outpatient facility unit costs: Outpatient unit cost trends had decreased to a more normal range of around 4%-5% throughout 2024, after reaching over 10% the year prior.

Looking forward to 2026-2027 healthcare costs

The expected trend is for medical pharmacy costs for 2026-2027 is 8%-10%, with 7%-9% for medical and 10%-12% for pharmacy.

Key factors to watch will include:

Inflation and tariffs: Inflation continues to hover around 2.5%-3%, which is higher than the 2% that the government would like to see. With the uncertain environment around tariffs, providers are more uncertain around their future costs.

Contract negotiations with providers: With the uncertainty after the pandemic, many providers pushed for shorter-term contracts to be able to adjust rates as needed sooner. For those that have longer-term contracts, those are likely coming up for negotiations again in the next couple of years. The continued high inflation and fear around the tariff situation could result in tense negotiations with carrier partners

Legislative changes: The new Trump administration’s bill that was signed in July 2025 contained many provisions that will impact the healthcare industry. While initial legislation around price transparency for pharmacy benefit managers was included, it didn’t make the final version. The overall impact to healthcare costs is still being evaluated and will not be known until some parts become effective in 2026 and later.

Advancements in pharmacy: Biosimilars are becoming more available, driving costs of biologics down. Many clients are weighing the options of covering GLP-1s for weight loss and, if they are covering them, implementing pharmacy management programs with their PBMs. More drugs continue to fall off of patents, allowing generic options to become available for highly utilized medications.

by Jason D'Ambrosio, FSA, MAAA

Actuary

by Shelly Lewis

VP, Director of Actuarial Analytics