Should We Worry About Inflation or Not?

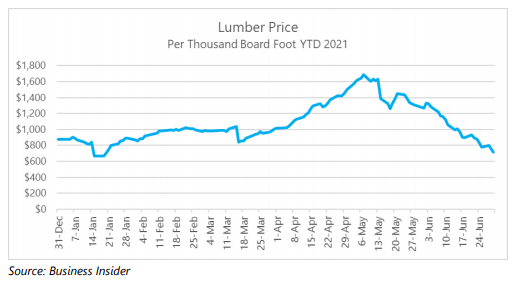

Albert Einstein once opined that as the bees go, so will go mankind. Today, we see this interconnective analogy again, but instead of physics and bees, it’s financials and buildings. Specifically, the price of lumber’s wild ride effectively sums up the key risk currently facing markets: Inflation. Lumber prices rose more than 260% over the past year as the pandemic reshaped America’s spending habits and disrupted supply channels. An urban exodus and renovation projects turned our houses not just into homes but also into offices, playgrounds, halls of learning, and so much more that was inconceivable to a pre-pandemic world. Increased, unanticipated demand perfectly aligned with the massive supply disruption created when lumber production halted. But, since early May, those prices have plunged by over half. Lumber’s wild price gyrations show how shortterm re-opening kinks like shipping delays can create inflation that is not indicative of a lasting higher price shift.

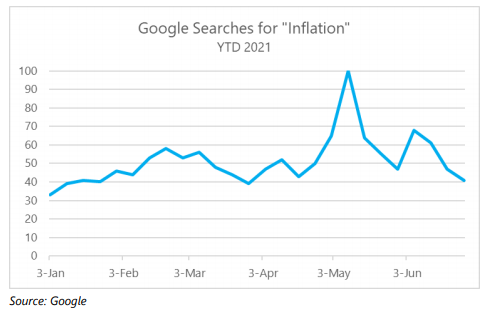

Recent interest rate movements and internet search activity further reinforce belief that inflation concerns will subside. Interest rates spiked through the end of March 2021, making the first quarter of 2021 the worst quarter for the treasury market in 40 years. Rates have since trended lower by approximately 15%. This downward move signals the bond market’s lack of concern with longer-term inflation risks. Bond markets typically function under different dynamics than stocks and provide a more sober and accurate assessment of future market conditions. Google search trends also provide strong insight into prevailing thought. As graphed, after spiking in May, searches for “inflation” collapsed by more than 55%.

Too many economic structural issues exist to allow inflation to take hold and create perennial problems. Global demographic shifts, for instance, continue to place downward pressure on inflation. To illustrate, China’s recent policy shift allowing married couples to have as many as three children is indicative of a demographic challenge faced by much of the world. From an economic perspective, prices go up when more people want to purchase a good or service. Projecting forward, it takes 2.1 children per woman to replace the population, but birthrates in developed countries—those like the U.S. and China with strong consumption capabilities—have fallen drastically below that. In fact, the U.S. birthrate in 2019 fell to 1.7 kids per woman. The current Chinese birthrate is estimated at 1.3. The lack of new consumers helps hold inflation down.

In addition, we remain in the early stages of the greatest technological leap forward since the industrial revolution. The resulting downward price pressure of the resulting efficiencies seems likely to continue for some time, despite temporary upticks. For example, Uber rides are more expensive momentarily due to a lack of drivers. This problem will eventually fix itself as more drivers return to the job, at which point the downward pricing pressure created by ridesharing technology will likely continue. As other consumer behaviors also normalize and pent-up demand is exhausted, a return to low overall inflation levels appears likely. Long-term demographic and technological longterm trends will win out over momentary supply vs. demand aberrations.

Normally, recessions leave households poorer but there was nothing normal about the COVID-induced recession of 2020. Globally, households added over $13 trillion in wealth last year. Multiple rounds of fiscal stimulus and low interest rates boosted the value of stocks and real estate, buffering household net worth. Domestically the personal household savings rate, which nearly doubled from where it stood pre-pandemic, has started to drift lower. Broad based economic re-opening has encouraged consumers to venture out which in turn has seen a shift in spending habits. This pivot moved consumption away from the purchase of goods, like lumber, towards greater spending on services which encompasses the dominant share of total consumer spending. Since personal consumption represents two-thirds of the economy, a strong summer of spending should continue to bolster economic growth. Pent-up demand is being unleashed on the economy in a way unseen since the guns fell silent after World War II.

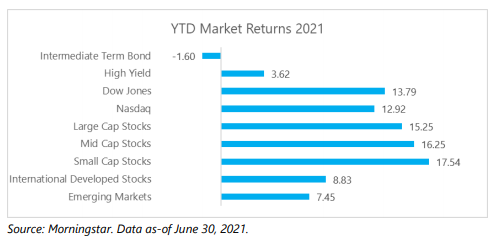

More broadly, markets also powered through inflation concerns. Stocks continue to hover near all-time highs with the S&P 500 ending 2021’s half-way point up 15.25% for the year. International markets trended positively as well with the MSCI EAFE up 8.83%. Domestic investments continued to lead as more effective vaccine and economic reopening campaigns bolstered relative U.S. strength compared to most of the world.

After a difficult first quarter, bond returns stabilized generating a 1.83% return in the second quarter. The Barclays Aggregate Bond index still has a -1.60% year-to-date. While we continue to encourage an overweight to stocks, bonds still serve an invaluable place in any well-diversified portfolio working as a “shock-absorber” during periods of extreme market stress. High quality bonds, despite prevailing interest rates’ drag on long-term return potential, provide shock-absorption most appropriately. More volatile bond categories, like high-yield or emerging market debt, can swing wildly like stocks but do not carry the same long-term growth potential.

The future, as always, remains unwritten. Inflation could take hold or new pandemic developments could disrupt consumers eager to spend, but that is not the most likely path forward. Moving ahead, the road will inevitably be bumpy with even a few bee stings along the way. But, aren’t those bee stings a good thing according to Einstein?

As always, we thank you for your continued trust, confidence, and support in our investment process, long-term strategy, and constant vigilance.

Download alert (opens a new window)

Download alert (opens a new window)

FOR INSTITUTIONAL USE ONLY.

Investment advisory services offered through Lockton Investment Advisors, LLC, a SEC registered investment advisor.

For educational purposes only. Nothing in this alert should be construed as legal or financial advice. Nothing in this message should be construed as legal or financial advice. Lockton may not be considered your legal counsel and communications with Lockton's compliance services group are not privileged under the attorney-client privilege.

Circular 230 Disclosure: To comply with regulations issued by the IRS concerning the provision of written advice regarding issues concerning or related to federal tax liability, we are required to provide to you the following disclosure: Unless otherwise expressly reflected herein, any advice contained in this document (or any attachment to this document) that concerns federal tax issues is not written, offered or intended to be used, and cannot be used, by anyone for the purpose of avoiding federal tax penalties that may be imposed by the IRS or promoting, marketing or recommending to another party any matters addressed in this document or any attachment.