It was a positive year for firms that renewed their insurance in 2024, with rate reductions that accelerated as the year progressed.

There were three core factors driving these improved conditions:

Renewed appetite for growth among some established insurers.

The continued arrival of new entrants to the market. Coupled with those who entered in 2023, this resulted in new capacity seeking to grow portfolios and build critical mass.

A stable claims environment. Despite larger losses continuing to emerge, the market has avoided a new wave of attritional loss. In years gone by, be it, buyer-funded developments, Right to Buy, cyber-crime, or escalating ground rent, the market has managed to avoid a new wave of loss.

As ever, not all firms experienced rate reductions. For pockets of the profession, insurers remain reluctant to deploy capacity. This is particularly true for: firms with fees below £500,000 and a high proportion of commercial and/or residential property exposure; firms whereby directors/partners are at, or nearing retirement age with no succession plan in place; firms engaged in financial mis-selling work.

Claims data

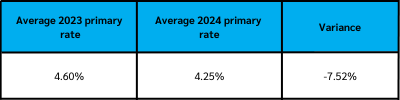

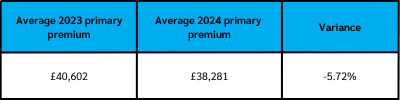

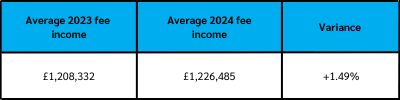

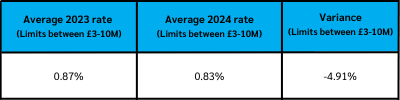

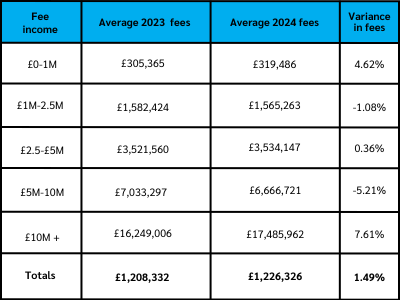

We have analysed four main factors across our portfolio of circa 1,700 SRA regulated practices across 2024. This data is taken from placements across the main SRA participating insurers. The main themes from the data show that across 2024, the average primary rates and premium have diluted once again. While firms’ average revenue continued to grow, it did so at a slower rate than in 2022-23:

Primary layer rate (cost of primary layer insurance as a % of revenue)

Total premium

Fee income

Excess Layer rate (cost of excess layer insurance as a % of revenue)

Further analysis

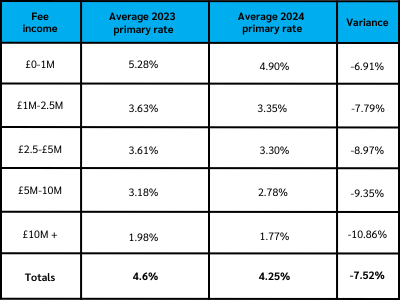

In addition to the above, we have drilled down further to examine the relationship between fee income and primary rate. The data shows that the lowest rates were available to firms with the largest fee income. Predictably, these firms also experienced notably larger reductions in rate in 2024.

As ever, firms with greater exposure to high-risks areas of work and/or significant claims payments will typically experience higher rates than the average, while the opposite is true for those undertaking low-risk areas of work, and/or with fewer claims.

Insurer outlook for 2025

As above, there is reason for continued optimism across 2025, primarily as a result of new entrants, and as the majority of established insurers have an increased appetite and premium targets to meet. We anticipate further new capacity entering the marketplace, and greater competition across the next 12 months. However, there does remain concern among insurers, particularly those who have insured for SRA-regulated practices for a sustained period.

Areas that could result in issues across insurer portfolios include:

The financial health of a practice – the sector continues to see notable collapses of legal practices, which tend to bring with them significant claims.

Fraudulent acts – 2024 brought a series of high-profile thefts of client monies. These are occurring with rising severity, giving insurers cause for concern.

Artificial intelligence (AI) – many insurers are embracing the potential of AI, albeit with reservations. A primary concern is that the lack of clear policy for AI usage within a firm may lead to scenarios in which AI is used by a minority in the business without the knowledge of the company leadership. Firms may also deploy AI without proper protocols for human verification and scrutiny of AI-generated content.

Anti-money laundering and identification checks – this follows an increase seller fraud across 2024.

Financial mis-selling work – perhaps the most significant emerging risk to insurers across 2024. The year saw a number of high-profile collapses of firms engaged in financial mis-selling, with the aftermath of some cases resulting in Parliamentary scrutiny. Insurers are cautious of such work, primarily due to the funding structures that are in place.

Aggregation principle – PII insurers continue to be concerned as to the courts application of the aggregation principle, the most recent such example being Discovery Land Vs Axis. The SRA minimum terms and conditions require insurers to provide any-one-claim coverage. However, this leaves insurers with uncapped liabilities at the total limit, and no protection in worst-case loss scenario. Where the aggregation principle is interpreted as it is currently, claims can be extremely costly and result in a primary insurer paying out tens of millions of pounds.

Overall, there is strong reason for continued optimism in 2025. As ever, insurers remain thorough in their underwriting process, so firms should continue to present themselves as positively as possible. By increasing underwriter confidence in their risk, firms give themselves the best chance to achieve a strong placement outcome. This relies on strong, transparent communication, early engagement, and proactive risk management.