Skip to main content

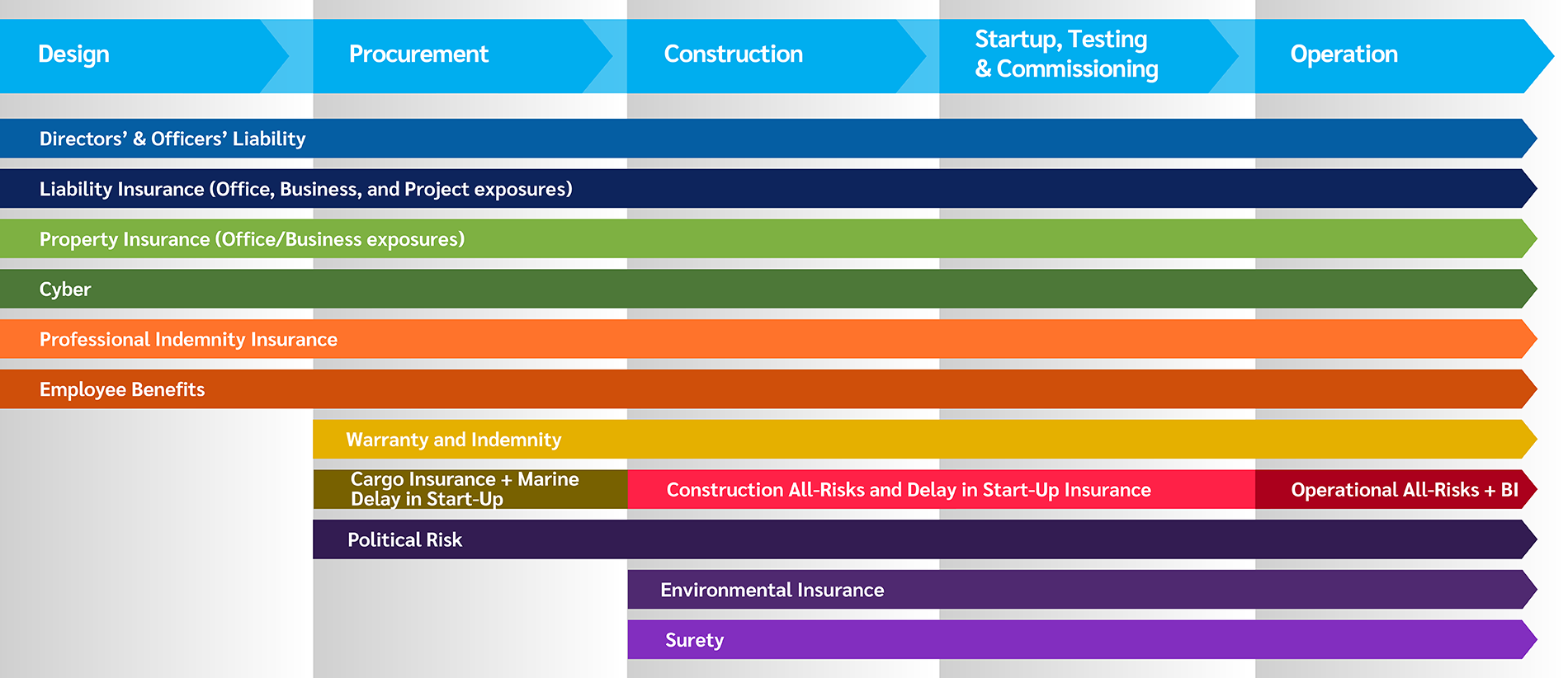

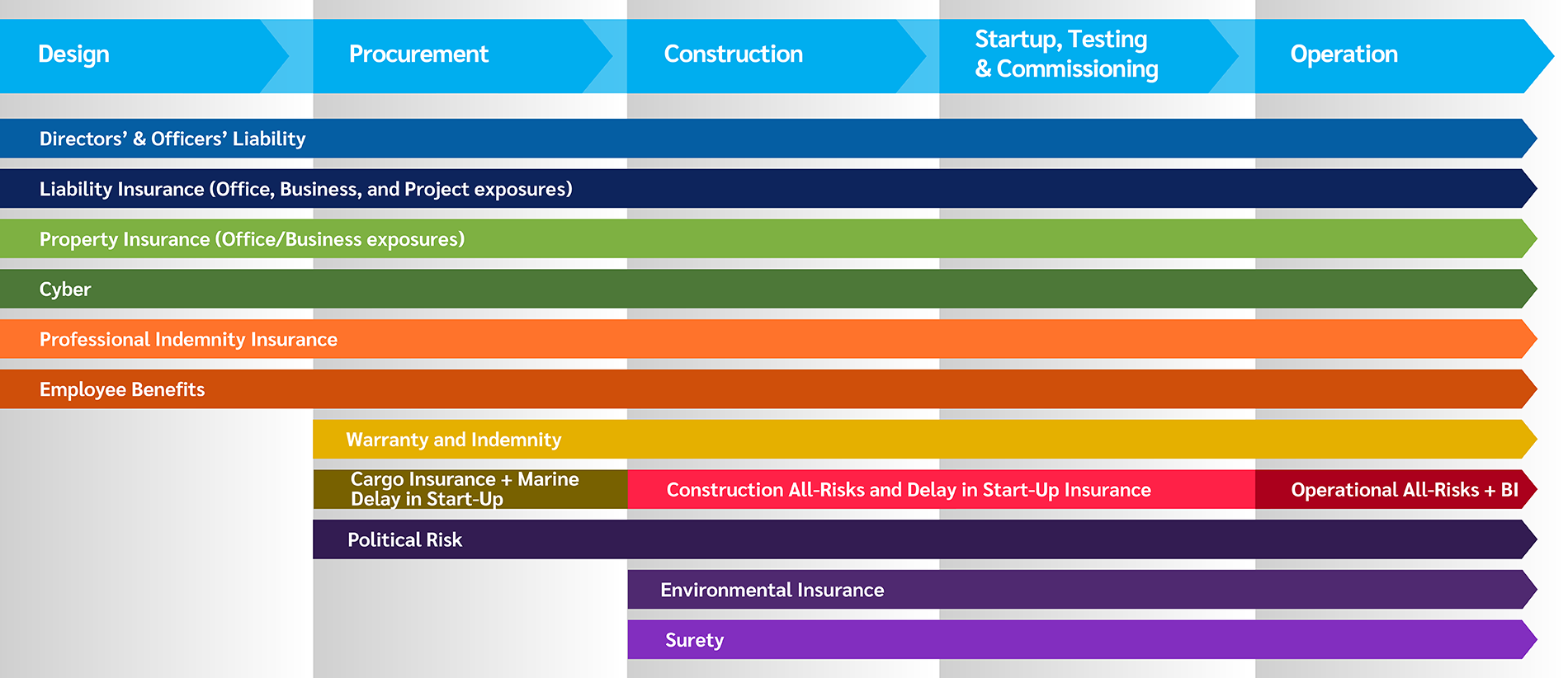

Energy Transition Risk Lifecycle and Insurance Lines Descriptions

Project Lifecycle - Risk Advisory and Placement Services (RAPS)

Liability Insurance

Protects energy companies from claims for legal liability, including costs and expenses, if a third party’s property is damaged and/or polluted (sudden and accidental basis), or if a member of the general public is injured by the company, one of its employees, or a product it suppliers or services.

Your Lockton Contact: Oliver Brooking (opens a new window)

Cyber Insurance

Provides coverage for financial losses resulting from cyber-attacks or data breaches. Includes expenses related to ransom payment, data recovery, legal fees, notification costs, business interruption and potential liability claims. As energy companies increasingly rely on digital technologies for operation and monitoring, the threat of cyber-attacks increase.

Your Lockton Contact: Jack Matthews (opens a new window)

Professional Indemnity

Cover is provided for claims made by third parties of negligence, errors, or omissions in the performance of professional services provided by energy companies (or any person including independent contractors or consultants the energy company is legally responsible for), including legal defence costs and damages awarded. Protects against design, engineering, and consulting errors in energy projects, including those involving relatively new and complex technologies.

Your Lockton Contact: Mike Golzey (opens a new window)

Construction All Risks (CAR) and Delay in Start-Up (DSU)

CAR insurance covers property damage and third-party liability for energy projects under construction. DSU insurance provides coverage for financial losses due to project delays. These insurances ensure project timelines and financial expectations are maintained despite unforeseen events.

Your Lockton Contact: Robert Wilson (opens a new window)

Environmental Insurance

Provides coverage for the cost of cleaning up pollution-related incidents, if required by a third party or government/ state body. It covers both sudden and accidental and gradual pollution events. Critical for energy companies regarding new environmental regulations and potential pollution from operations.

Your Lockton Contact: Jamie Robinson (opens a new window)

Surety

A Surety Bond helps ensure that contractual obligations will be met, providing financial assurance to multiple parties including project owners/developers, stakeholders, and off-takers of energy produced by an asset. For project owners/developers specifically this includes Decommissioning Bonds, Power Purchase Agreements (PPAs), and Grid Connection Bonds. Project owners/developers can also request bonds from their ECP contractors including Performance, Advance Payment, Retention and Warranty Bonds.

Your Lockton Contact: Ben Milan (opens a new window)

Directors' and Officers' Liability (D&O)

Provides financial protection for directors and officers of energy companies against personal losses if sued for alleged wrongful acts while managing the company. This can include lawsuits related to decisions about new energy assets, regulatory compliance issues and environmental, social and governance considerations.

Your Lockton Contact: Lizzie Harris (opens a new window)

Property Insurance

Protects energy infrastructure and covers damage to or loss of physical assets such as buildings, machinery, and inventory due to risks like fire, theft, natural disasters, and vandalism.

Your Lockton Contact: Harry Sans (opens a new window)

Warranty and Indemnity (W&I)

Covers fundamental, tax and business warranties given from the seller to the buyer in a transaction. Energy specific items include condition of assets for large-scale projects, material contract validity (e.g. PPAs), and use of tax assets.

Your Lockton Contact: Ross Lima (opens a new window)

Cargo Insurance

Covers physical loss or damage to goods during transportation by land, sea, or air. It includes coverage for various risks such as theft, accidents, and natural disasters relating to any equipment and materials needed during construction or operation of energy assets. In addition, coverage can also be extended to include inventory risks of such goods, whether in the ordinary course of transit, or (semi)permanently stored

Your Lockton Contact: Maxim De Prins (opens a new window)

Marine Insurance

Provides coverage for loss or damage to ships, cargo, terminals, and other transport or cargo storage facilities. Includes liability (P&I) coverage for the shipowner and marine terminal, which is vital for offshore energy operations.

Your Lockton Contact: Michael Reynolds (opens a new window)

Political Risk Insurance

For energy investments in politically unstable regions, this insurance protects against government actions or political instability that could disrupt operations or lead to asset losses, ensuring financial stability despite geopolitical risks.

Your Lockton Contact: David Coupland (opens a new window)

Employee Benefits

Employee benefits are any forms of compensation or perks that are provided in addition to an employee’s base salary and wage. A complete employee benefits package may include health insurance, life insurance, retirement/pension benefits, wellbeing programmes and more. These benefits are key in attracting and retaining skilled workers by offering competitive benefits.

Your Lockton Contact: Chris Rofe (opens a new window)

Operational All Risks (OAR) and Business Interruption (BI)

OAR insurance covers physical loss or damage to operational energy assets. BI insurance compensates for loss of revenue and additional expenses incurred due to disruptions in production.

Your Lockton Contact: Michael Bogdan (opens a new window)

We're here to help

We bring creative thinking and an entrepreneurial spirit to the insurance business and are uniquely positioned to help you succeed.

Talk to our team