Risk intelligence sources, many of which are open access, can provide businesses with valuable insight into risk identification, assessment, and mitigation techniques. By harnessing these learnings and applying them at a local or individual scale, firms can take significant strides to reduce their risk exposures, increase resilience, and secure better policy conditions from insurers.

Sources of risk intelligence

Risk intelligence is the process of gathering information to identify, avoid, and manage the impact of risks. By harnessing risk intelligence, businesses can deploy the learnings to make better decisions, which can ultimately contribute to long-term business success.

The Global Risks Report (opens a new window), published by the World Economic Forum, is one example of a recognised risk intelligence source. The key risks that the 2024 report identifies include: extreme weather scenarios; misinformation and disinformation; inflation and the potential for debt distress; and simmering geopolitical tensions and ideological divergence.

Useful features of these and other risk intelligence sources include:

Detailed analysis of risk issues by geography, risk category and stakeholders

Consideration of the interconnectivity of risk themes and the potential for multiple threats to escalate simultaneously

Contributions from corporate and government organisations, and academia, providing a reliable and independent view on current and emerging threats.

Data presentation, helping to visualise current and emerging risk landscapes

Global thinking, applied locally

Risk intelligence sources typically take a macro-perspective when it comes to emerging threats. For many businesses – especially those operating at a local or regional level – this perspective can seem divorced from the day-to-day realities of business activities.

For instance, a risk manager for a consumer goods producer may not be interested in extreme weather patterns in more remote parts of the world, but perhaps these weather patterns could disrupt the supply of core components of their best-selling product. Further, while corporate entities tend to focus on direct consequences of events, government organisations focus on wider implications such as societal change or the demise of specific industries, a perspective that corporate entities should also include in their risk assessment.

Whilst not always transparent or obvious, many of the key global risk issues highlighted in these studies will have a direct (or indirect) influence on the more localised risks being identified by individual business entities. Sources may also contain insights into government policies and strategies towards specific risk areas, which can be useful to businesses in their strategic planning activities.

Other benefits of risk intelligence for risk managers, chief risk officers and other risk professionals include:

Keeping informed of global risk trends from both a short term (i.e. next two years) and longer term (over a 10-year period)

Supporting horizon scanning and emerging risk activities by boards, risk committees, etc., as part of the risk management process

Insight into ongoing threat response activities at national and international level

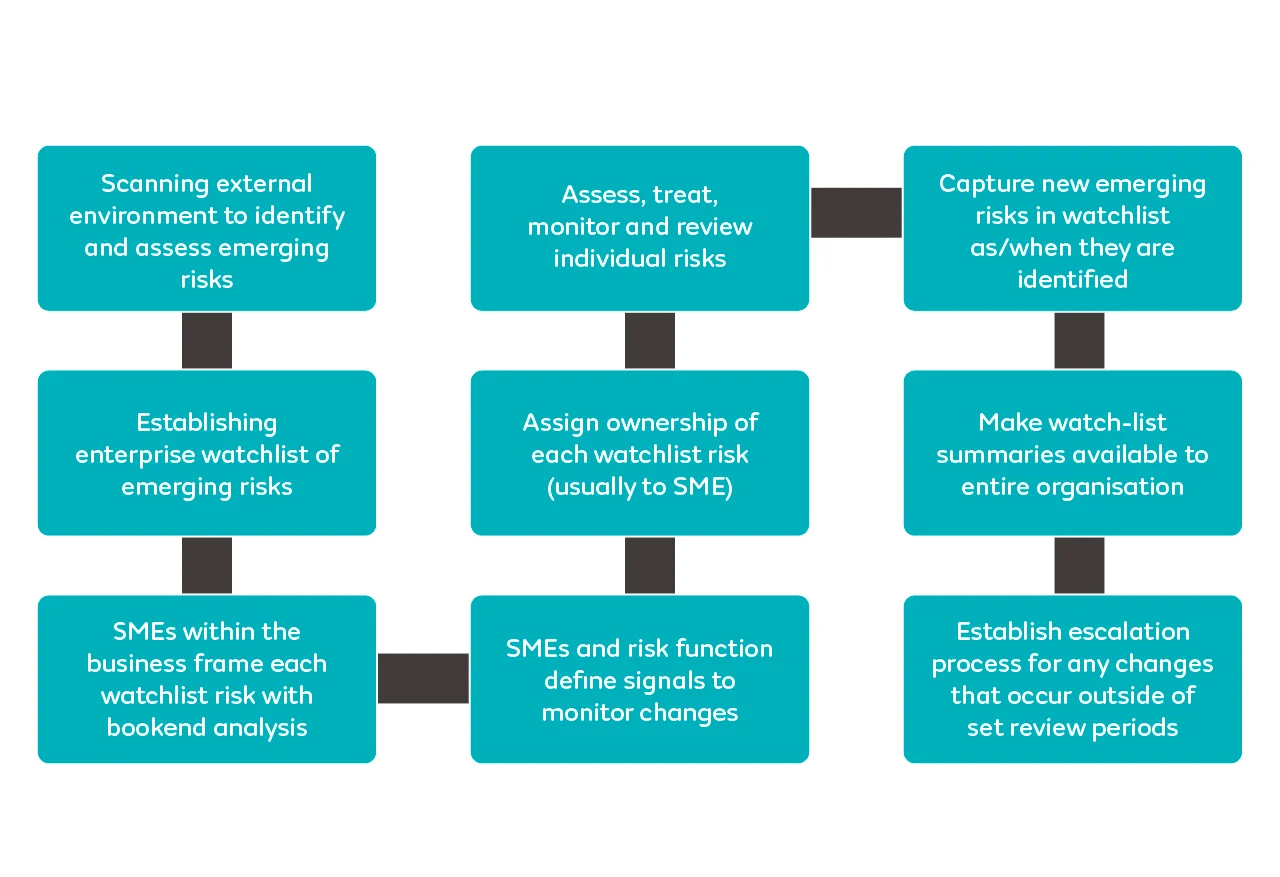

For businesses, it is advisable to have a risk monitoring strategy in place that connects a network of subject matter experts (SMEs) who are responsible for monitoring and sharing insights into specific risk areas and their potential impact on the business.

Source: Risk Leadership Network/Gambit Media (opens a new window)

Risk intelligence and insurance renewals

There are rewards to be had for those who routinely take a step back and consider a wider perspective when it comes to mitigating risk. Organisations that demonstrate a proactive and holistic approach to risk management are likely to present as more attractive to the insurance market.

To reap the benefits of risk intelligence, businesses should be prepared to demonstrate the extent of their risk intelligence activities and evidence how it is shaping their risk management strategy, including demonstrable resulting actions. These actions may include conducting a strengths, weaknesses, opportunities, and threats (SWOT) analysis and incorporating risk intelligence into your risk register. This can help businesses to articulate their risks clearly, while also giving insurers confidence in how those businesses are navigating a continuously evolving risk landscape. Ultimately, this provides the best basis to seek more favourable insurance terms.

For further information, please visit our Risk Control (opens a new window) page.