Premiums for private medical insurance are set to rise significantly driven by several different factors. By assessing their potential impact individually, businesses can fine tune their private health insurance programme and ensure that they get the most out of it for their staff.

Medical trend, a term used to describe changes in health care costs, is facing double-digit percentage increases globally in 2023. For the UK, Lockton predicts clients to face a medical trend in the range of 7%-12%. At the mid-range, without accounting for demographic or plan changes, healthcare costs are set to double in just over seven years.

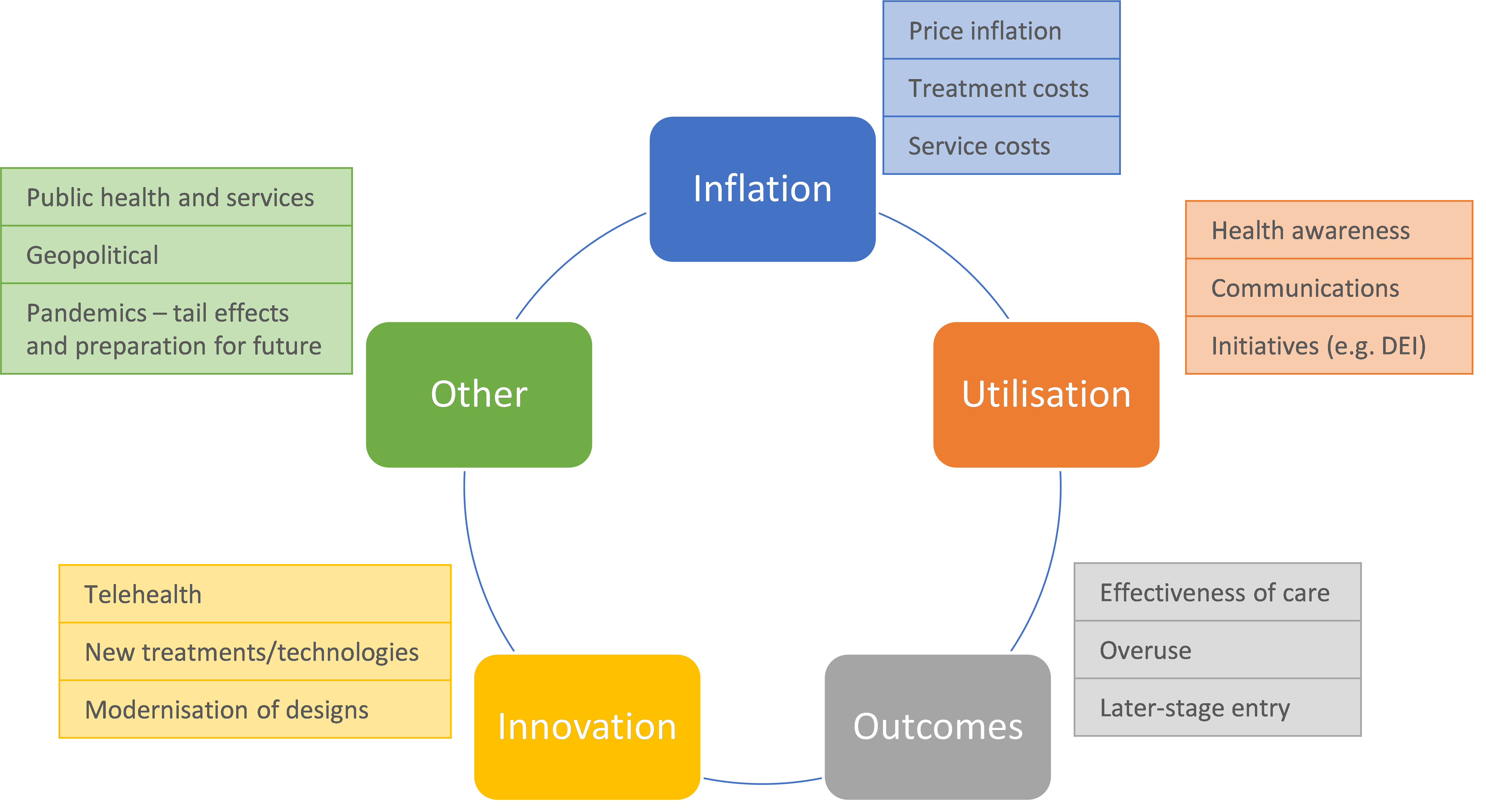

At Lockton, we engage with our clients and providers using a thematic framework to break medical trend down into its component parts. An analysis of these individual components can show where the greatest drivers are and help formulate a plan of action to try to mitigate the risks and/or control the impact it has on future costs.

Medical trend components

Source: IEBA/Lockton

Inflation

Pulling the latest available data on claim types and concentrations creates a snapshot of a population’s claims inflation and show the average claim costs are increasing over time for a given claims type – given price inflation, spiralling cost of treatments, and the associated service cost around the claim.

An assessment can help identify the most prevalent and costly current and/or future health issues, and which claims management plans are required given current and future plan design changes.

Utilisation

Covid-19 has increased the focus on healthy living practices, the need for quality in health-related staff communications from employers and their advisers, and the understanding of benefits plans and access to them. Coupled with a broadening of benefits plan designs and eligibility due to heightened focus on Diversity, Equity and Inclusion (DE&I) matters, the utilisation of healthcare plans has seen a marked increase and this trend is expected to continue in future.

An assessment can clarify whether healthcare plans have the correct balance to allow and promote early-stage detection and screening as well as effective treatment of chronic conditions.

Other

The Covid-19 pandemic and the macro-economic pressures in the public sector have created backlogs in the UK’s National Health Service (NHS). This will continue to drive higher usage of private medical insurance plans unless addressed. Healthcare benefits are dependent on the healthcare networks and the professionals helping with issues employees and their families encounter. As custodians of the current and future affordability of private healthcare, companies need to ensure that the effectiveness, cadence, and outcomes for people entering the plan is satisfactory and improvements are made where necessary.

An assessment of claims frequency and cost by healthcare providers is an option in larger plans and where significant variations are witnessed. This can lead to improvements in claim pathways and ensure more effective care. Similarly, an assessment may be required on the supporting corporate communications strategy to promote pathways and effective use of all benefits plans (from absenteeism through to core benefits).

Innovation

Healthcare systems around the globe have had to evolve to keep pace with demand and new health trends. Covid-19 has accelerated the introduction of planned innovations such as telehealth (virtual GPs etc.) and new treatments and technologies are being incorporated into existing processes. Furthermore, plans are under review to broaden eligibility as well as to provision for previously under-represented areas of human health such as fertility, gender-dysphoria, mental health, to name just a few. From a medical trend perspective, these innovations are conflicting in that some will drive, and some offset the medical trend, if effectively adopted.

An assessment of an employer’s future vision of its role in individual health, and how healthcare reflects corporate philosophy needs to be performed regularly to create a programme that establishes the right balance between cost and ambition. Changes that are decided from an aspirational perspective need to be mapped out in a business case to ensure that they enhance or address key features that will positively impact employees and their families.

Outcomes

Businesses are operating in a constantly changing world where macro events can suddenly affect benefits professionals and require them to act.

It is therefore important to be prepared for other, perhaps more external contributors to the medical trend.

A regular assessment of known and future risks helps to create response plans that account for the practicalities and the financial circumstances. A heightened understanding of plan designs, accessibility, exclusions, and limitations needs to exist to address potential shocks.

The medical trend, while complex and material, can be actively tackled with analysis and management. While this article looks at this area through a UK private healthcare lens, the topic and the associated issues are not UK-specific and are being dealt with by healthcare stakeholders globally.

For more information, please contact:

Lisa Parker

Senior Benefits Consultant, Lockton People Solutions

M: +44 (0) 79 1956 0605