Skip to main content

The need to analyse, negotiate and facilitate decision making on all components of your insurance and risk management program is now more vital than ever before.

— RISK SOLUTIONS

Data Analysis Services

Transforming data into meaningful information and quality decisions

Understanding data is vital

The need to analyse, negotiate and facilitate decision making on all components of your insurance and risk management program is now more vital than ever before. The prevalence and availability of data is not the issue, it is how to disseminate the data into meaningful information to make quality decisions that can transform business operations and financial returns.

We provide clear and concise analytics to help you make informed decisions. Coupled with market intelligence and sound judgment, we assist you with creating a clear oversight of the current environment and strategic road maps to help meet business objectives.

Lockton’s approach to analytics is a key differentiator

Analytics are viewed as an ongoing, collaborative process to support our client’s businesses, not a static report. We challenge our clients to find answers to questions like:

Do I have the right retentions?

Do I have enough limits?

What is driving the change in my projected loss rate?

Do I have an exit strategy?

How is my risk changing as I acquire, divest and grow?

Are my losses tracking as expected?

How will my Total Cost of Risk change if I change my program structure?

How will my cash flow change if I change program structure?

How will multi-year structures change my Total Cost of Risk?

Is my claims management plan effectively reducing the cost of claims?

How can I implement preventative and cost mitigation plans?

Our Products and Services

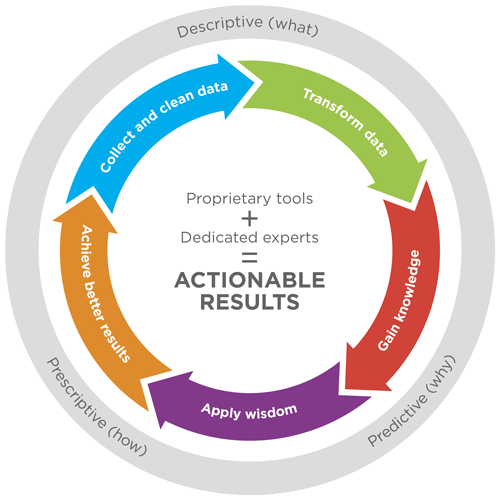

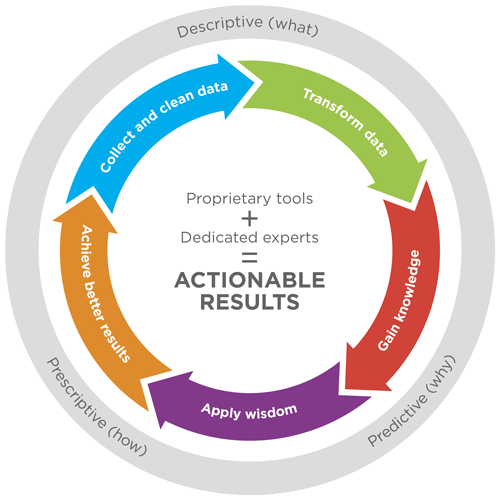

Effective analytics services are based on supplementing quantitative data (collect, clean data and transform data) with qualitative understanding of your businesses (gain knowledge, apply wisdom, and achieve better results) as in the diagram to the right.

This process is universal to most classes of insurance where high volume claims or high values can be generated from the following risks:

Property and catastrophic events like major property exposure to weather, flood, fire, wind etc.

Workers’ compensation - all states, government and privately underwritten

Motor vehicle fleet

Liability

Presenting our client’s risk profile to insurers through a more informed lens will educate the underwriter to understand the risk and provide new opportunities to enhance cover, reduce price and reduce claim costs.

Questions? We'll guide you in the right direction.

Ask us about our products, services or anything else on your mind. Our insurance and risk specialists are here to help.

Contact usKey Contact

Craig Simpson

National Manager - Premium Strategy & Analytics

craig.simpson@lockton.com

+61 414 637 205

Get in touch

Latest from Lockton

Commercial Property Risk Checklist: A Practical Guide for Property Developers, Owners & Investors

articleWould your asset withstand real insurer scrutiny? Commercial property risk continues to evolve, and insurers are paying closer attention to how assets are presented and maintained. The difference between expectations and what’s documented can influence how a ...

With a global footprint of 150+ offices and partner offices, find one near you.

Find an office