A mining boom is underway in Latin America. Ample resources, rising commodity prices, and foreign investment in critical minerals are fuelling sector growth. But as profits increase, so companies are coming under increasing pressure from illegal operations in search of their own share.

Mining companies cannot resolve this situation alone: ultimately, a resolution requires political will. But help is available. By taking advantage of solutions to mitigate and transfer risk, companies can insulate their operations against potential threats.

Drivers of illegal mining

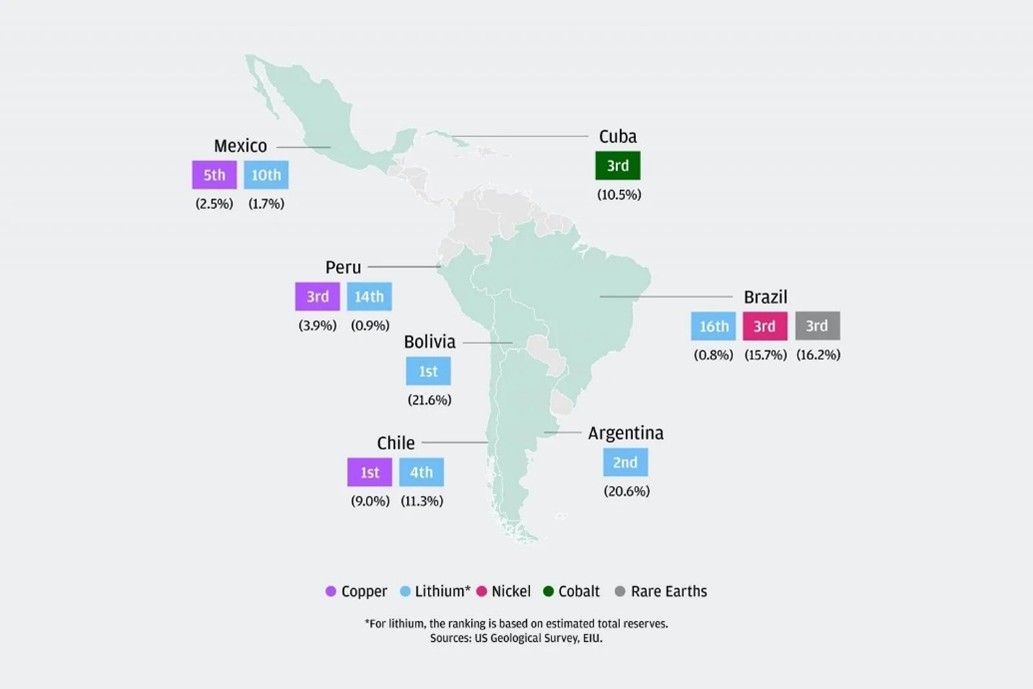

When it comes to mineral deposits, Latin America is rich. According to 2023 reports from the Economist Intelligence Unit (opens a new window), Chile tops the list of global copper reserves, followed by Peru. Mexico is fifth. In the case of lithium, Bolivia’s reserves take top spot; Argentina and Chile are also in the top four – in 2025, these two alone accounted for (opens a new window) 97% of US lithium imports. Brazil has the third largest global reserves in nickel and rare earth elements.

Latin America’s global critical minerals reserves ranking

Source: EIU, 2022

Yet, despite the bounty of deposits across Latin America, the region has historically struggled to translate this into real-world mineral production. It is well-documented that the sector has faced production challenges, driven by poor infrastructure, unstable regulatory environments, labour unrest, and corruption. But these issues have been compounded in recent years by a growing threat from illegal mining operations.

According to the Financial Accountability and Corporate Transparency (FACT) coalition, illegal gold mining in Colombia and Peru now generates more money for organised crime (opens a new window) than the drug trade, despite these countries being the largest coca-producing countries in the world. In the former, the National Liberal Army (ELN) and other guerrilla groups have expanded their illegal gold mining (opens a new window) operations amid a deteriorating political landscape. In neighbouring Venezuela, government forces acting under the pretence of environmental protection have raided gold mines in the country’s south (opens a new window) for their own enrichment – or have allowed armed groups to do so in exchange for profit. In Ecuador, illegal gold proceeds may reach $1 billion a year (opens a new window), according to government officials.

This growth is a response to opportunity. The price of key commodities has grown exponentially in recent years, as demand from renewable energy technologies and the impact of escalating trade tariffs have disrupted supply chains and driven costs higher. In December 2025, the price of gold hit its record high (opens a new window), exceeding $4,500 per ounce. Silver also reached a new high of $83.62 per ounce in late December, before a slight fall.

Latin America has also profited from the escalation of tension between the US and China, becoming a key alternative supplier of critical minerals. China dominates critical minerals and rare earths supply chains, both due to ample reserves of its own, and a highly developed refining industry that represents around 91% of global production (opens a new window). In response, Latin American economies are accelerating investment in extraction capacity to meet rising demand.

The impact on legitimate mining operations

The expansion of illegal mining operations brings significant consequences for legitimate local and multinational mining companies operating within the region. In May 2025, mining activity was suspended for 30 days (opens a new window) in Peru’s northern district of Pataz, after 13 gold mine workers were kidnapped and killed. According to mining company Poderosa, there have been 39 workers killed in Pataz in the past three years. Mine workers and security officers are frequent bribery targets for illegal miners seeking to facilitate resource flows into their operations, with violence – including murder – an increasingly likely outcome for those who resist.

Alongside the substantial human cost, mining companies also face significant financial losses due to illegal mining. When companies are forced to close or suspend mining activity due to illegal operations, it harms profits – due to decreased production and potential mineral decay. For smaller local and regional miners in particular, criminals may demand ‘protection’ or ‘rent’ to continue operations. Those who resist payments often become targets for further attacks. To repel such attacks, many companies have taken steps to enhance their security presence on-site. However, this is not without cost.

Theft of goods is also a critical factor. In April 2023, Patagonia Gold Corp, a Vancouver-based multinational mining organisation, saw US$1m of gold stolen from a mining project (opens a new window) in southern Argentina. In Colombia, meanwhile, Chinese-based Zijin Mining put its total losses (opens a new window) at the Buritica mine at $200 million across 2023, equal to 38% of the mine’s total production. Thefts can occur throughout the supply chain, from the initial extraction of minerals to transportation. Criminals may also infiltrate legitimate supply chains to launder illegally extracted minerals, complicating efforts to distinguish between legitimate and illegitimate goods.

Crucially, not all mining operations feel the effects of illegal mining equally. As insurance markets reflect, nuance remains; underwriters are willing to differentiate between areas where illegal mining is at its most prevalent and consequential for business, areas where those consequences are less severe, and those where there is an absence of illegal mining activity. As ever, pricing is on a case-by-case basis, with options tailored to the exposure level of individual companies.

Why you should consider an insurance broker

Mining companies in Latin America face rising commodity prices, exposure to illegal operations, and mounting financial and human costs. While these challenges cannot be solved by firms alone, insurance brokers provide essential support by helping companies transfer risk and strengthen resilience. Their role spans several key areas:

Secure fair pricing – Educate underwriters on your specific risk profile, highlighting mitigation steps and preparedness measures to ensure premiums reflect actual exposure.

Streamline risk surveys – Coordinate mandatory security risk surveys, and negotiate potential insurer contributions toward costs.

Arrange Political Risk cover – Protect against property damage losses caused by terrorism, sabotage, riots, strikes, civil commotion, insurrection, rebellion, mutiny, coup d’état, and war or civil war.

Provide additional protection – Extend cover to losses from employee injury or death, extortion, kidnap and ransom, or business interruption when operations cease.

By partnering with experienced brokers, mining companies can move beyond reactive measures and build long-term resilience. Tailored cover not only protects against immediate threats like theft or extortion, but also supports continuity in the face of wider political and criminal pressures.

Talk to us

Illegal mining is more than a security issue: it threatens to undermine operational continuity, workforce safety, and the long-term value of legitimate mining projects. Having a robust risk transfer strategy is essential to ensure your resilience.

Lockton’s Mining Practice (opens a new window) works with operators across Latin America and beyond to help them navigate complex risks. Our brokers understand how underwriters assess illegal mining exposure, how to secure fair terms, and build programmes that respond when incidents escalate.

To strengthen your risk posture, benchmark your current cover, or explore further options to protect your operations, reach out to a member of our team.