Demand from businesses and a better understanding of a corporation’s risk exposure and appetite are prompting insurers to expand their parametric solutions offering to cover a wider range of risks.

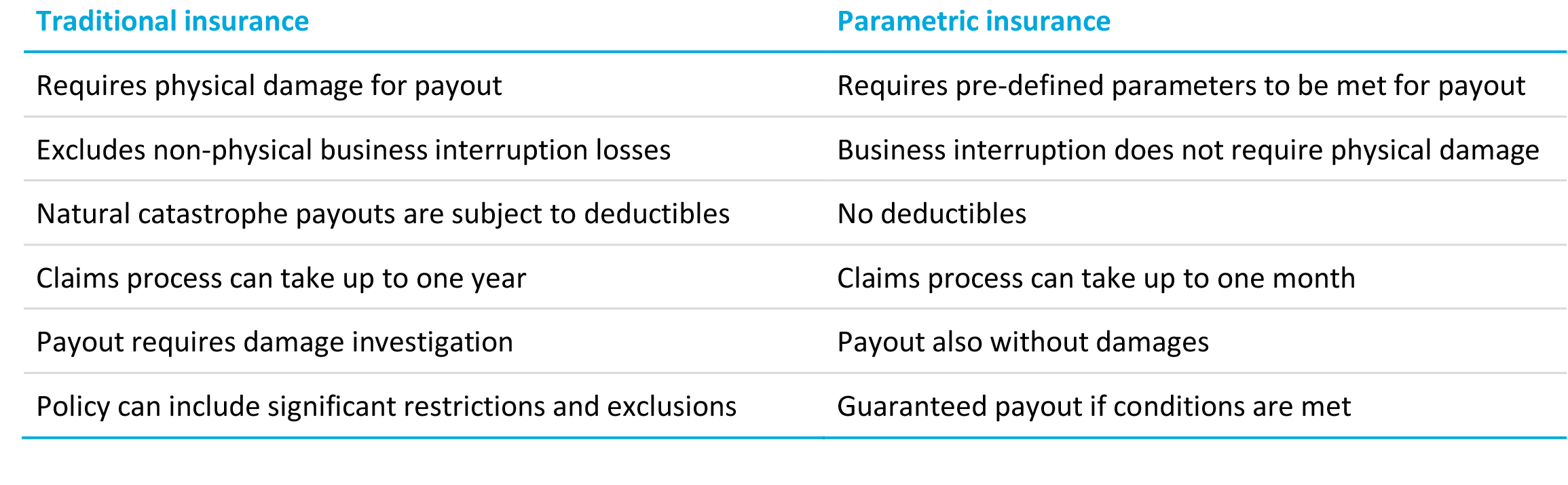

Parametric insurance is mostly known for protecting governments and large corporations against natural catastrophes. Such contracts offer pay-outs that are automatically triggered once the pre-defined threshold of an index is reached or exceeded, for example a certain earthquake strength on the Moment Magnitude (Mw) scale. Advantages of these alternative risk solutions include a quicker claims payment and higher transparency. Since parametric insurance solutions use pre-defined values for payouts insurers can ignore the value of the damage from the underwriting equation, and therefore the requirement for claim adjustment. Traditional policies that pay on actual incurrence of loss can delay the payment following an event and may result in disputes.

Growing in popularity

Although parametric solutions are not suitable for every risk a company faces, they are growing in popularity for several reasons.

Technology is unlocking new and efficient methods to conduct business, and this does affect a company’s risk exposure. Furthermore, COVID-19 has heightened business’ sensitivity to uncertainty and potential threats to operations. Fast cash to support a business in a crisis is what parametric insurance can offer. In addition, population growth and urbanisation are driving up catastrophe costs, and climate change is making loss events less predictable.

But at the same time, advances in sensor technology, data analytics increasing computer power, artificial intelligence (AI) and the proliferation of the Internet of Things (IoT) networks enable a quicker reaction to events and a better analysis of the potential impact. These technological advancements are enabling the creation of broader information indexes on a variety of phenomena, enabling the expansion of parametric insurance cover into new risk areas.

The current hard market is further driving demand and innovation: When insurance rates are perceived as high, buyers are keen to seek alternatives. Insurance buyers appreciate the clarity created by the use of pre-defined values for a claim while insurers value the fact that they are exposed to fewer variables and pass that benefit onto clients in form of lower premiums. If a price still appears unattractive, adjusting the parameters of the cover can align it with the budget.

Demand drives expansion

Fuelled by this growing interest, particularly in respect to economic and social risks once deemed uninsurable, the market is delivering. A recently launched platform (opens a new window) aims to use advanced technology such as machine learning to price and trade business interruption cover while other more established players such as Descartes Underwriting (opens a new window), Parsyl (opens a new window), NPU, Celsius Pro, Arbol (opens a new window), among other managing general agents (MGAs) have announced big equity raises to fund the expansion of the parametric insurance offering.

As a result, parametric cover is emerging for new risk areas. Examples of segments where parametric insurance is being applied include travel, energy, construction, terrorism, agriculture, forestry and supply chain. The perils covered range from climate change to pandemics, cyber, and many other measurable risk areas.

Potential coverages:

Extra expenses

Mitigation expenses

Utilities services

Landscaping

Event cancellations

Booking cancellations

Loss of sales

Loss of revenues

Loan defaults

Lack of sunshine

Excess rain

Low or high river levels

Extreme temperatures

Drought

Strong winds

Frost

The additional capital currently pouring into parametric insurance providers will continue fuelling this expansion. Further innovation is likely since parametric insurance lends itself most naturally to blockchain technology, which allows smart contracts to execute automated payouts once the specified parameter thresholds are triggered.

Instead of replacing traditional insurance cover, parametric insurance products expand the scope of what can be insured; therefore, filling some protection gaps that traditional policies do not respond to. In future, parametric cover may be offered as hybrid products that can be acquired on top of or next to a traditional indemnity-based insurance.

For further information, please contact:

Diego Monsalve, LACIS Head of Risk Consulting & Analytics + ART Solutions

M: +1 561 690 5286

E: dmonsalve@lockton.com