Skip to main content

The Lockton Malta team has extensive experience and understanding of our European domiciled clients' needs. We forge long-term partnerships that count for more than the value of any fee arrangement. We act as strategic partners, contributing to the success of your business beyond the obvious provision of insurance cover.

1 / 5

Welcome to Lockton Malta

The Lockton Malta team are empowered to make decisions quickly and are agile, proactive and driven in approach. We forge long-term partnerships that count for more than the value of any fee arrangement. We act as strategic partners, contributing to the success of your business beyond the obvious provision of insurance cover.

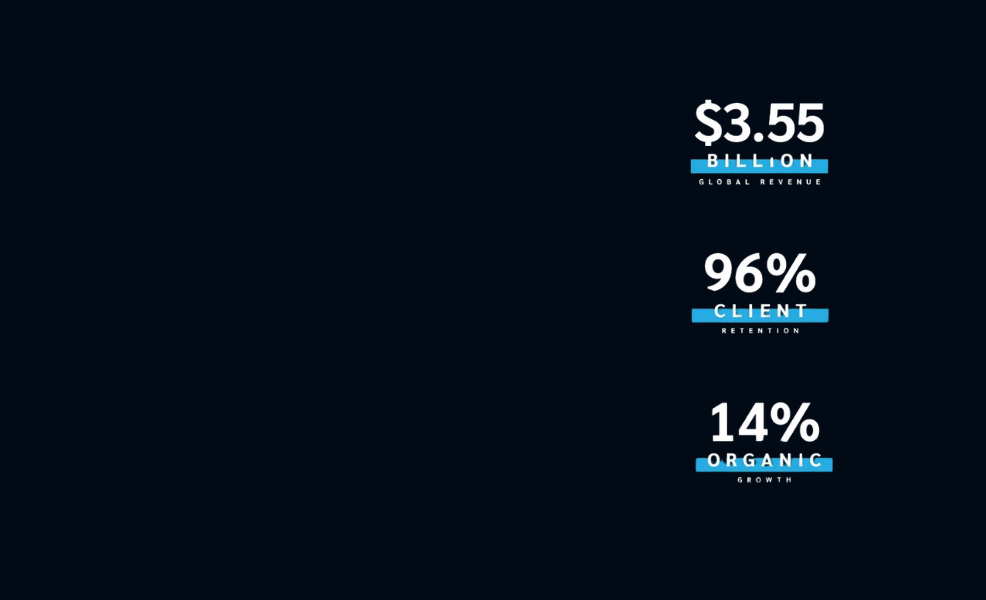

Uncommonly Independent

We bring creative thinking and an entrepreneurial spirit to the insurance business and are uniquely positioned to help you succeed.

See our storySign up to our Europe Insight Newsletter

Stay informed about emerging risks and how to address them with our latest thought leadership content.

Register nowLockton Malta Team

Joanne Alamango

CEO - Lockton Malta

joanne.alamango@lockton.com

+356 2779 5708

Maria Farrugia

Associate

maria.farrugia@lockton.com

Sonia Micallef ACII

Account Executive - Malta

sonia.micallef@lockton.com

General enquiries

Latest news and insights

We're here to help

We bring creative thinking and an entrepreneurial spirit to the insurance business and are uniquely positioned to help you succeed.

Get in touchTake me back to Lockton Europe homepage (opens a new window)