Extreme weather events such as floods and droughts, and natural catastrophes like tropical cyclones are major causes of disruption in the mining sector. As such events are expected to increase in frequency and severity, insurers are becoming more cautious in their underwriting approaches, particularly for tailings dams. Parametric insurance can offer an attractive alternative solution, filling the gaps in the traditional insurance programs .

Extreme weather events

Scientists are warning that a warming climate is making extreme weather events more frequent and severe. Warmer temperatures increase the amount of moisture the atmosphere can hold, making heavier rainfall in a shorter space of time and in smaller areas more likely. Further, average temperatures in the Arctic have risen faster than the global average. This is causing the jet stream to slow, increasing the likelihood of heat domes. Such heatwaves can worsen droughts by drying out the soil.

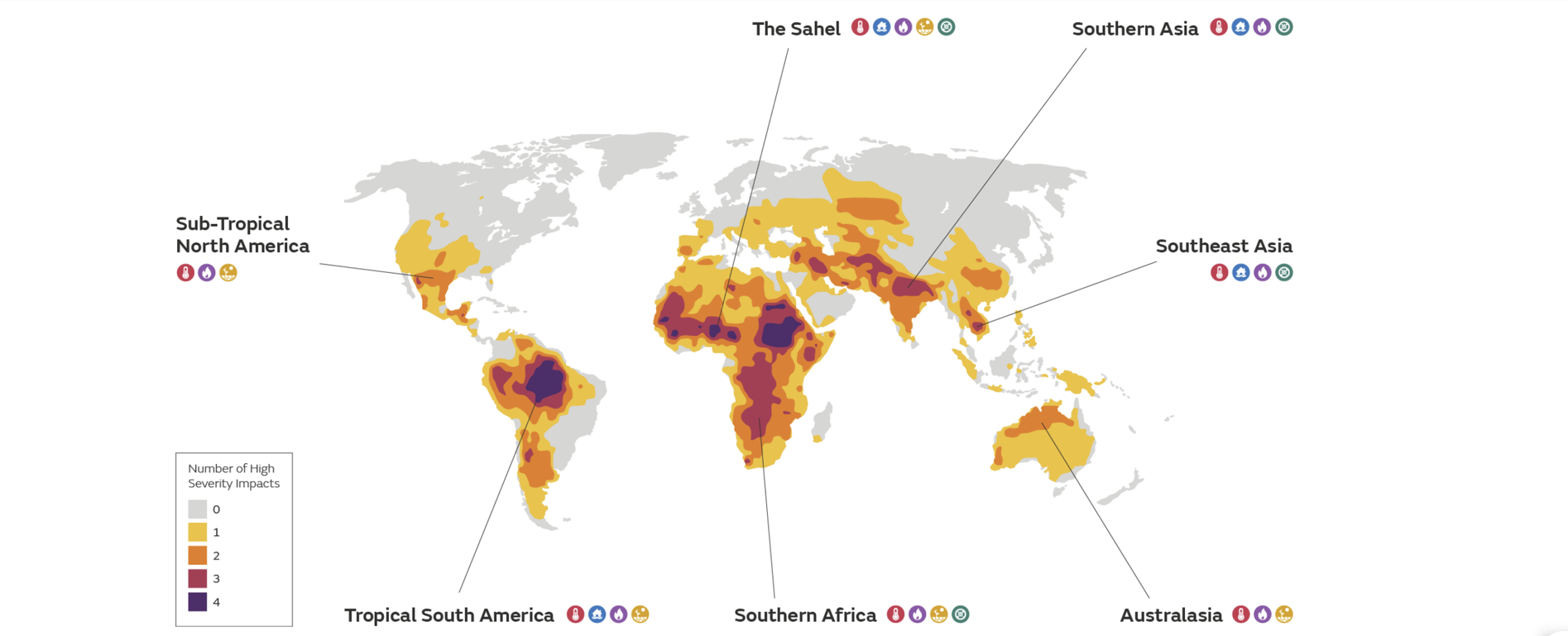

The map below shows regions where multiple severe impacts may occur at similar times at 4°C of global warming above pre-industrial levels. These impacts include extreme heat stress risk, river flooding, drought, and wildfire risk. Many of the regions expected to be affected are also traditional mining locations.

Source: Met Office (opens a new window)

The impact on mining operations

The environmental impact of such weather events can disrupt supply chains across different raw materials, mining sites and climatic zones. For example, flooding, following heavy rain or surges, can cause hazardous or toxic waste storage to spill and disrupt operations.

Insurers are particularly concerned about tailings dams. They can fail for many reasons, including floods caused by heavy rain, tropical cyclones, snow melt or storm surges. Tailings dams can represent a big risk for insurers as a failure can not only result in extensive environmental damage, but it can often also destroy livelihoods, damage infrastructure, and even cause fatalities.

However, having too little water also poses risks to mining. Droughts can lead to water shortages, affecting both environmental aspects (e.g. less water available for dust suppression) and supply aspects (e.g. water-intensive production processes need to be slowed down). In addition, increased water stress might intensify water competition between mining and other water users (e.g. communities or agriculture). This is of particular concern to governments and local authorities. A combination or sequence of extreme events can amplify the impact: a wet weather event during a period of prolonged drought can worsen the impact on mining and processing operations.

Alternative protection

Parametric solutions can help protect mining businesses against weather-related losses and the consequent non-damage business interruption. Parametric policies respond when pre-defined parameters (triggers) are met or exceeded. The client must suffer a financial loss due to a triggering event taking place but unlike traditional insurance, there is no need for loss adjusters to determine the loss and there are no exclusions for any assets or business interruption losses.

For floods and droughts, the obvious trigger for a parametric insurance policy would be rainfall. There are various data sources available to insurers to measure and trigger policies. It is key that the data source is independent of both the client and the insurer to ensure complete transparency in the contract. Lockton works with several data providers to structure and price a solution that suits the mining company’s needs.

Benefits of parametric insurance

Traditional insurance policies include a number of conditions and limitations, exclusions and self-insured retentions that are assumed by the insured. Where insureds or captives want to reduce their exposure beyond what the traditional insurance market will offer, parametric insurance can supplement that cover and fill gaps left in the risk transfer program.

Advantages:

Business interruption doesn’t require a physical damage trigger

There are no deductibles

Contracts are transparent and simple

Claims are usually recovered within one month as there are no lengthy loss adjuster requirements

Example of a mining company in Peru

Main purposes of the coverage:

Cover deductible

Cover self-insured retention (SIR)

Cover sublimit of the tailings dams

Cover physical damage/business interruption in their location

Cover any contingency that could happen in supply chains

While there is no need for loss adjusters for parametric insurance claims, clients need to present proof of loss declaration signed and notarized. Depending on the insurance company, some of them require presenting financial statements and invoices as part of the claims process.

Parametric insurance will keep growing in the mining industry because it can fill the gaps in traditional insurance programmes. At Lockton we can create tailor-made structures that leverage data-driven triggers that can stabilize your business’ cash flow and reduce downtime.

For further information, please contact the author or your Lockton representative.