As the hospitality sector recovers from the pandemic and inflation levels rise, businesses are urged to closely evaluate building reinstatement values to avoid being inadvertently underinsured.

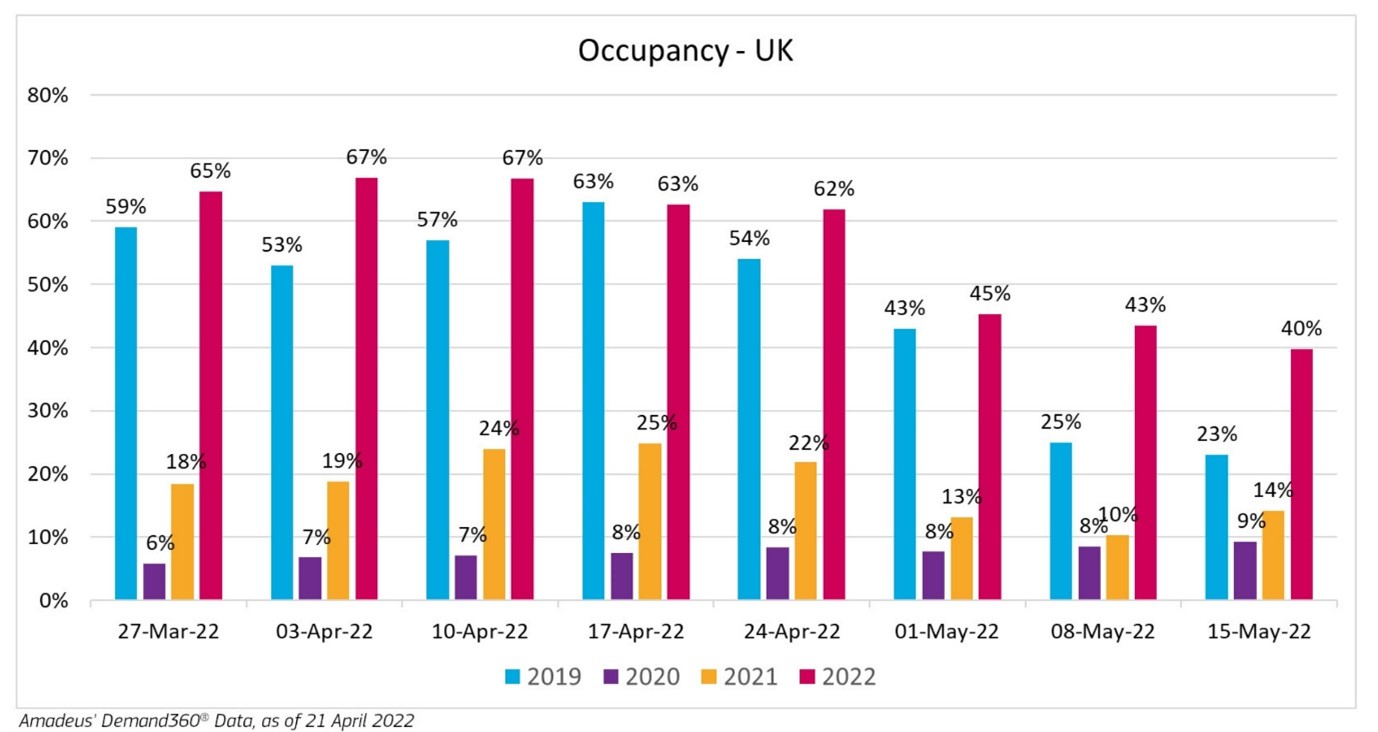

The hospitality sector is enjoying a remarkable come-back following the pandemic. Hotel occupancy rates in the UK are consistently higher in 2022 compared to pre-pandemic 2019, according to Amadeus Hospitality data.

Elsewhere in the world hotel occupancy is also on the rise, having increased from 31 percent in January 2021 to 46 percent in April, according to Amadeus data.

Traveller confidence is generally growing with the global hotel industry reporting a 60 percent increase in net reservations since the beginning of the year.

While the financial prospects for the industry have improved significantly due to rising demand, businesses are at risk of faltering following a claim due to a sharp rise in inflation if the values insured are not adjusted appropriately.

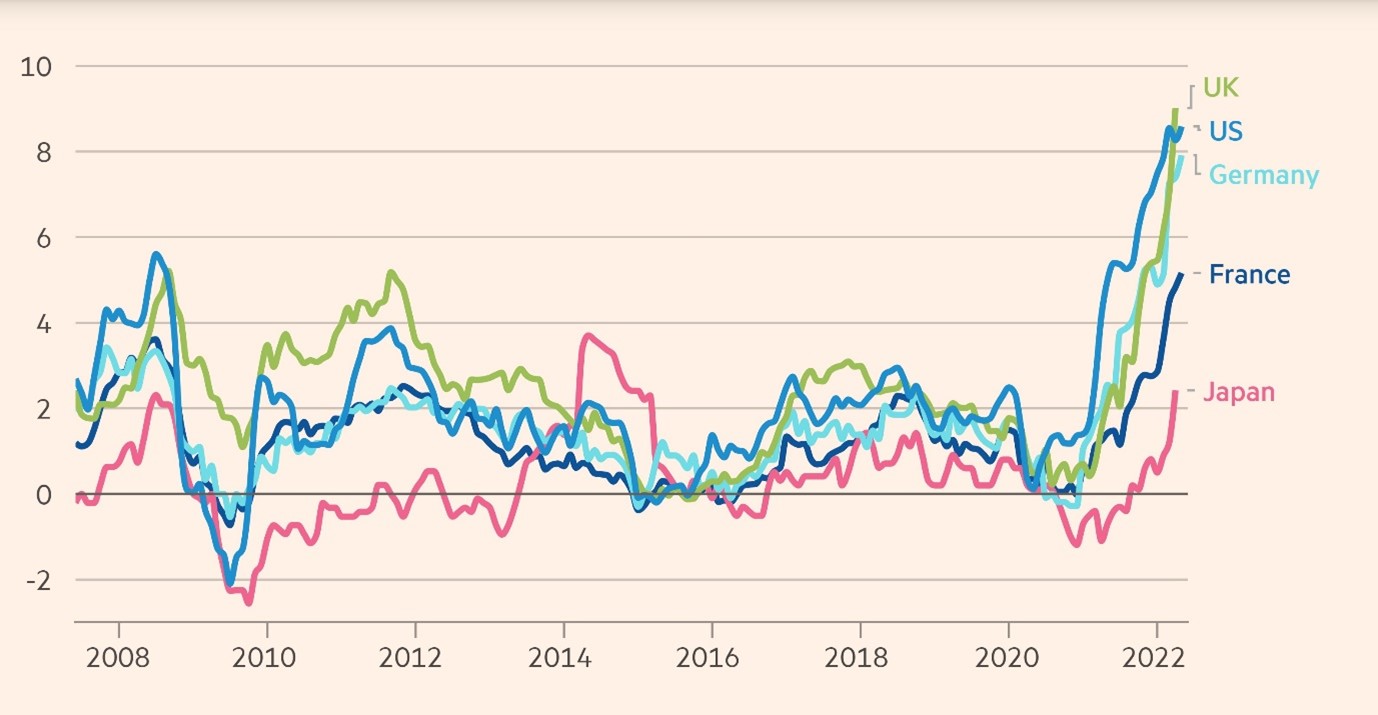

The UK’s Consumer Prices Index rose by 9.1% (opens a new window) in the 12 months to May 2022, up from 9.0% in April, but this is not a UK phenomenon. Inflation is on the rise globally, driven by sharply rising demand following the pandemic coupled with disrupted supply chains and labour shortages. The war in Ukraine and the sanctions implemented by the Western World has further squeezed the supply of fossil fuels.

Inflation in selected countries

Source: Financial Times, Refinitiv, national statistics offices

Property damage/business interruption

Property damage claims are being hit particularly hard because of international shortages in timber, steel, cement, metals, and plastics.

In addition, reinstatement delays driven by extended delivery timescales are leading to further costs with lead times significantly longer than in 2020 due to delays at ports. This, combined with a global shortage of shipping containers, is leading to the ‘perfect storm’ of significant delay and exorbitant international freight costs.

An increase in housebuilding and infrastructure projects is driving the cost of labour higher with many contractors now submitting multiple price variations mid-contract to account for increasing costs. There is also a general increase in contractors refusing to tender leading to lower competition and a decrease in associated deflationary pressure.

The matters described above are resulting in many reinstatement projects running overtime at a much higher cost than originally anticipated. This is leading to business interruption issues, particularly where policyholders are subject to inadequate indemnity periods.

Any significant increase in property reinstatement costs creates the potential for underinsurance. Insurers can and do reduce property claims settlements proportionately if it turns out that the sum insured is less than the actual cost of reinstatement (most notably where a policy wording does not adequately cater for the inflationary pressures noted above, e.g. “Day One Reinstatement” wordings and the presence of “Average” conditions).

Best practice would be to consider undertaking periodic professional valuations now known as Reinstatement Cost Assessments (RCA) which are adopted by the Royal Institution of Chartered Surveyors (RICS). RICS recommends that full RCAs are carried out every 3 years.

The valuation process

The starting point is understanding the insuring obligations. Establishing whether the hotel is owned and operated by the client, occupier under a lease or franchise agreement, will determine which assets need to be assessed and insured. If the hotel is owner-occupier, then buildings and general contents would usually be valued together. If the hotel is managed and operated under a lease agreement or operating franchise, then it is important to determine responsibility for insuring the fit-out and general contents, or the entire structure i.e. in this example the landlord might insure the shell and core, but this would be subject to the agreement in place.

Before attending site, the valuer will request some initial information such as floor plans; area schedules; room types and number of keys etc. The valuer will attend site to verify the information provided, review the building structure and construction form, together with the contents items and complete the valuation. Building items are generally valued by way of a cost per sqm calculation. The general contents items are valued using a replacement value per asset or by way of contract analysis/review of asset registers. Client provided data is important for the outcome of the valuation and reduces time required when at the hotel. On average, to complete a valuation of a hotel of 100 rooms takes around four days in total subject to availability of the information and the nature of the hotel. However, Listed/historic, resort style or boutique hotels take longer, compared to budget or roadside hotels. Generally, the site visit itself will take around a day but would be unobtrusive to the business.

The final point worth noting is that the valuation has a lifetime of around three to five years if kept up to date correctly. The values (buildings value and general contents value) can be updated by different indices prior to each yearly insurance renewal. The total insured figure can be updated using one index. However, with building cost increases outstripping typical general contents increases in the UK over the last 12 months it would be better to index both asset categories separately as part of the yearly renewal process. As inflationary pressures ease, equal consideration should be given to the updated/increased insured values.

Mitigating the impact of inflationary pressures

In advance of insurance renewal, conduct more robust reviews of reinstatement values than in recent years and consider appointing a third party valuer to undertake an RCA.

Ask your broker to review current policy conditions to ensure they provide appropriate protection to help mitigate the potential for underinsurance and that they are fit for purpose.

Review adequacy of your business interruption indemnity period to ensure it reflects the short/medium term supply chain disruptions and potential extended lead times for key items of building materials and plant (e.g. automated platforms within fulfilment centres).

Aim to establish a robust business continuity plan (BCP) or challenge the assumptions of an existing BCP.

Consider insuring the risk based on loss limits as opposed to declared values plus XX% as the latter figure might not adequately reflect price changes.

For further information on how we can help you, please contact your Lockton representative or:

Andrew Nicholson, Partner, Head of Hospitality Practice

T +44 (0)207 933 2336

E andrew.nicholson@lockton.com (opens a new window)

Rupert McLean, Client Advocate Risk Solutions

T +44 (0) 7725 651 142

E rupert.mclean@lockton.com

Darren Cook, Risk Management Executive

T +447770133953

E darren.cook@uk.lockton.com