Data suggests that the path to growth for UK law firms lies outside the UK. Firms planning to engage in international acquisitions should address a few common risk factors.

Despite several economic shocks, the UK legal market has grown substantially over the past two years. According to data compiled by The Lawyer (opens a new window), the top 200 firms based in the UK have grown 20% since 2020, with increased demand for their services during tumultuous times producing high revenues. Much of this growth has happened in foreign markets.

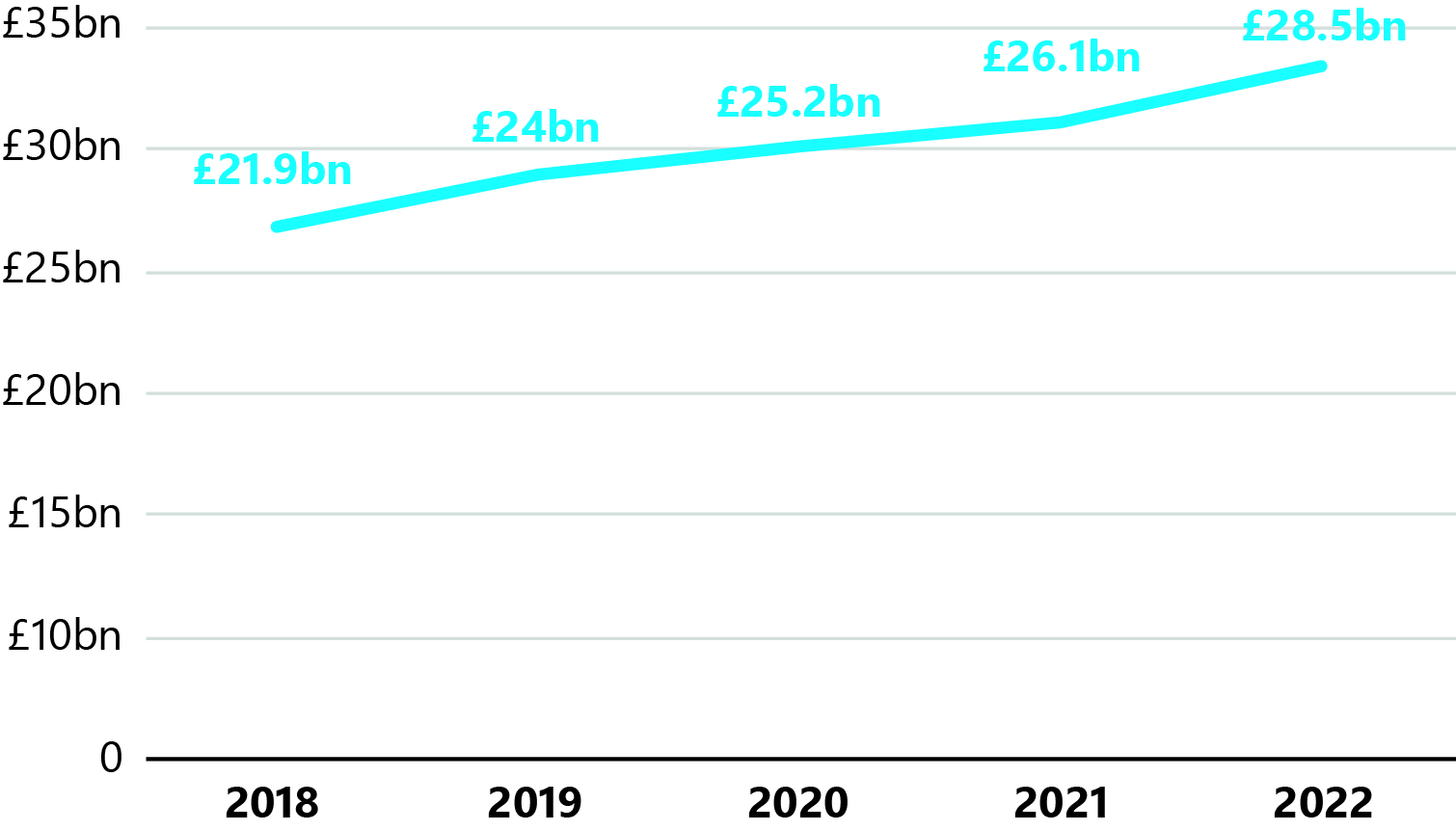

Five-year revenue growth at the top 50 UK law firms

Source: The Lawyer

The looming global economic recession hasn’t cooled ambitions either. According to the latest HSBC/Briefing law firm strategy survey 2022 (opens a new window), non-UK growth remains a top priority for firms with an international office with 58% saying that their strategy for 2022/2023 is to continue expanding internationally – an increase on 52% reporting this in 2021

It appears international expansion through mergers and acquisitions (M&A) will be a key strategic element of this predicted growth. Some 70% of respondents to HSBC’s report predicted a rise in M&A activities in the year ahead.

Businesses will want to move swiftly after identifying opportunities to grow via M&A abroad, but there are a number of risks these firms should consider.

Risks for law firms expanding through international M&A

Litigation in foreign jurisdictions

Local courts’ attitudes toward foreign investments vary and this can present litigation risks to buyers falling out from unsuccessful transactions. This risk alone can be a key contributor to expansion plans being placed on hold. This risk is particularly high in countries that have less friendly or restrictive foreign investment policies which are highlighted in the latest OECD FDI Regulatory Restrictiveness Index (opens a new window).

Compliance with local laws

For successful integration into new jurisdictions, buyers will have to acclimate to local laws, regulations and customs. This is particularly important for matters related to taxes, employees and operational elements of the target. Partners, shareholders, investors, and lenders alike will be looking for comfort that these matters have been diligenced appropriately and are covered.

Limitations on financing

Firms may struggle to raise funds on the local market of the target firm where they have no established operations of their own. Regulatory hurdles and unfriendly foreign investment policies typically create challenges. Raising funds on markets in the UK can also present challenges if the investment jurisdictions is deemed higher risk.

Recommendations

The recommended first step for all law firms looking to expand cross border is to consider taking out a strategic warranty & indemnity policy (W&I). Insurers will stand behind the warranties given by the seller to the buyer in the transaction documents should a breach arise. Where sellers do not provide suitable warranties to the buyer, Lockton has negotiated a synthetic set of warranties with select insurers that sits wholly outside the transaction documents.

In most transactions, the buyer will pursue a broader set of warranties, whereas the seller will look to limit the warranties, often leading to an impasse or protracted negotiations. W&I can help bridge the gap between sellers and buyers, with insurers often able to offer a broader coverage position where adequate due diligence of the target is undertaken by the buyer.

To help unlock deal value, W&I can present an alternative for the need to defer part of the consideration by way of escrow or other form guarantee to be delivered post signing. Where matters can be wrapped up in the W&I workstream, this facilitates a cleaner exit for the seller and avoids the overrun of post signature commitments. This is often seen as a deal enabler where there is management roll over, allowing the consolidated management team to focus on the running of the business.

Some lenders may require a buyer to have W&I in place as part of the lending conditions. W&I can provide a hedge against other risks for lenders and can ultimately be assigned to the lender should the need arise.

In conclusion and where there is a breach of the warranties, possible reputational damage flowing from the litigation process or adverse publications (or both) is a risk law firms will be conscious of. The anonymity afforded to both buyer and seller by proceeding under the W&I is a key motivator for clients adopting W&I, avoiding costly and protracted litigation.

For further information, please contact:

Steve Holland – Senior Vice President, Global Professional & Financial Risks

M: +44 (0)7901 514001

E: steve.holland@lockton.com

Jarrod Morgan-Evens – Vice President & Solicitor, Global Professional & Financial Risks

M: + 44 (0)7883371573

E: Jarrod.MorganEvens@lockton.com