The UK’s Ministry of Justice has released a pre-action protocol for the forthcoming Whiplash reforms setting out some of the initial detail as to how the new procedures will be applied by insurers and practitioners.

The Civil Liability Act 2018 (CLA 2018) (opens a new window) was enacted in December 2018 to great fanfare. The legislation included, amongst a host of other changes, headline grabbing reforms to the civil justice system including the imposition of tariffs for compensation in whiplash claims and an increase to the small claims track limit. The fundamental idea of these reforms is to decrease the cost of motor claims for all and finally bring an end to decades of what has been described as a ‘whiplash epidemic’.

The pre-action protocol for personal injury claims below the small claims limit in road traffic accidents (the Protocol) will now come into effect for road traffic accidents that occur on or after 31st May 2021. Here we set out the key aspects of the procedural changes that commercial fleet policyholders should be aware of.

Key Headline Details & Implications

All personal injury claims pursued in England and Wales, where the injury is valued at less than £5,000 with the total claim (generally excluding vehicle related damages, unless the Claimant has paid for them themselves e.g. excess) being valued at less than £10,000, should be submitted to the Official Injury Claims (OIC) portal.

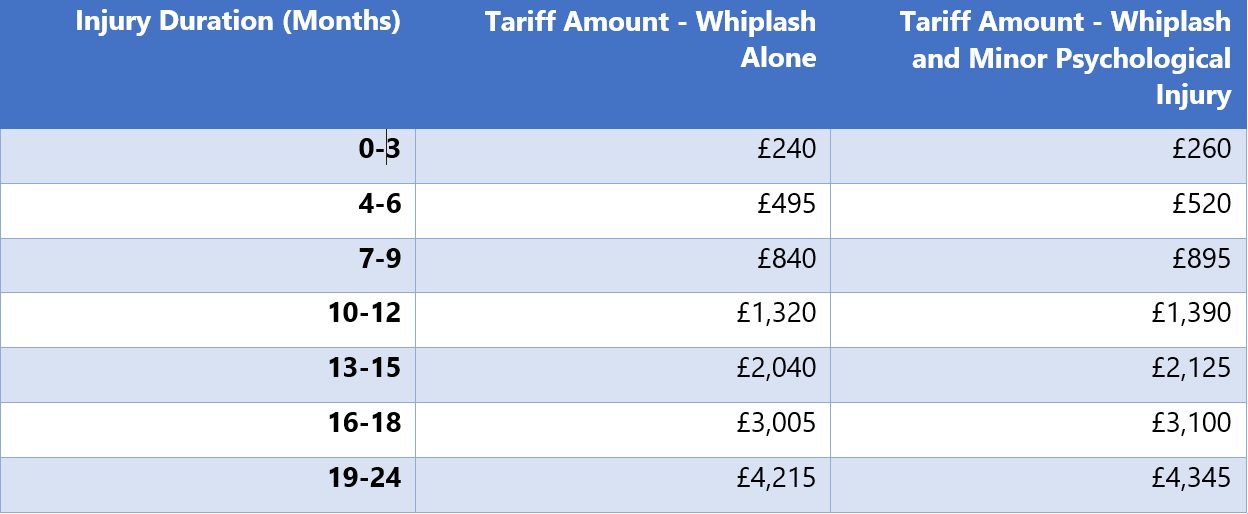

All claims pursued within the OIC portal will be subject to reduced value whiplash tariffs which will cover RTA whiplash injuries, including where there is an element of minor psychological injury. These new tariffs have been confirmed as follows:

Any offer for personal injury in the absence of a medical report (pre-med offers) are banned.

Claimants will generally not be able to recover their legal costs from the at fault party. Child claims will be subject to the tariff but Claimant solicitors will be able to claim their fixed costs in accordance with the current procedure (as these will still require approval by the Court).

As previously reported, claims from vulnerable road users (cyclists, pedestrians, motorcyclists etc.) will be exempt from the process and the associated whiplash tariffs. These Claimants will continue to use the current claims process. Claims relating to breaches of duty by other non-road users (e.g. caused by potholes) or where there is a breach relating to the Health and Safety at Work Act also do not fall into the process.

An Insurer/TPA under the OIC Portal now has 30 working days (not the 15 working days under the current protocol) to make a liability decision. However, if no liability decision is made by the 30 day limit there is a presumption that liability has been admitted.

Where liability is being denied (in full or in part) then the Defendant Driver’s version of events needs to be uploaded to the Portal within 30 days supported by a Statement of Truth (which has contempt of Court implications). Thus, it will be vitally important that policyholders engage fully with Insurers to provide full accident details and evidence given tight timescales to put together a defence statement on disputed cases. This again highlights the importance of early, high quality FNOL (First Notification Of Loss) documentation.

Where liability is disputed the OIC claim will essentially go on hold and the Claimant will be free to issue proceedings for determination of liability to the Small Claims Court. Once that process is concluded, should the Defendant be found to be at fault the matter will return to the OIC portal for the gathering of medical evidence and settlement.

All medical evidence will be obtained via the MedCo system ensuring that the experts nominated are independent and impartial. Guidance will be provided to litigants in person as to how this process operates.

The Motor Insurers’ Bureau (MIB) will be publicising the OIC portal in the coming months given that it will be used by unrepresented claimants and the public generally. Lawyers and claims handling organisations can still carry out the process for Claimants but the intention is that most will use it without legal support. This is likely to lead to significant queries and potential inconvenience to corporate customer care teams who should expect questions from third parties. Policyholders are advised to engage with their fleet insurers to obtain guidance as to managing litigants in person and advising them appropriately as to how they are able to pursue a claim.

It is anticipated that there will also be claims handling challenges for Insurers and TPAs who will have to put procedures in place for handling OIC portal claims, existing MOJ RTA personal injury protocol claims and non-protocol vehicle damage related claims concurrently. Insurers/TPAs will be putting in place training programmes to prepare for the new procedures.

If you have any questions on the Whiplash reforms please contact:

Samuel Ellerton, Regional Claims Leader

T +44 (0)121 232 4563 | E sam.ellerton@uk.lockton.com (opens a new window)

Tom Maughan, Claims Executive

T +44 (0)121 232 4589 | E tom.maughan@uk.lockton.com (opens a new window)