Reinsurers encountered a tough retrocession market at 1/1 renewals, driven by a series of natural catastrophe losses in 2021, and indicating the need for adjustments in the insurance value chain.

When looking to diversify the portfolio risk by sharing it with other players through retrocession, reinsurers faced risk adjusted rate increases in most instances, driven by a combination of price and terms and conditions.

A tricky retrocession market

Non-loss impacted layers and well performing accounts met single digit risk adjusted rate increases. Loss-impacted layers paid a broader range of increases depending on client, historical performance, strength of counterparty relationships and coverage/scope required.

Capacity supply remained flat year over year (YoY) for occurrence structures, driven by:

no new participants (atypical over the last few renewal seasons),

very few carriers increasing their capacity YoY,

deployable insurance linked securities (ILS) capital reduced YoY, and

certain markets looking to reduce cat exposures.

Meanwhile aggregate structures incurred significant capacity reduction due to recent historical losses, inflationary pressures and the expectation that natural catastrophes may increase in frequency and severity due to climate change. In addition:

Many insurance-linked securities (ILS) funds were unable to raise expiring levels of capacity given recent industry loss experience and investor fatigue,

A shrinking capital base markets led to an emphasis on established relationships where portfolios have performed in line with expectations,

Negotiations over trapped collateral were ongoing,

There was a shortage in capacity for riskier layers towards the end of the renewal season as markets were signed more than anticipated.

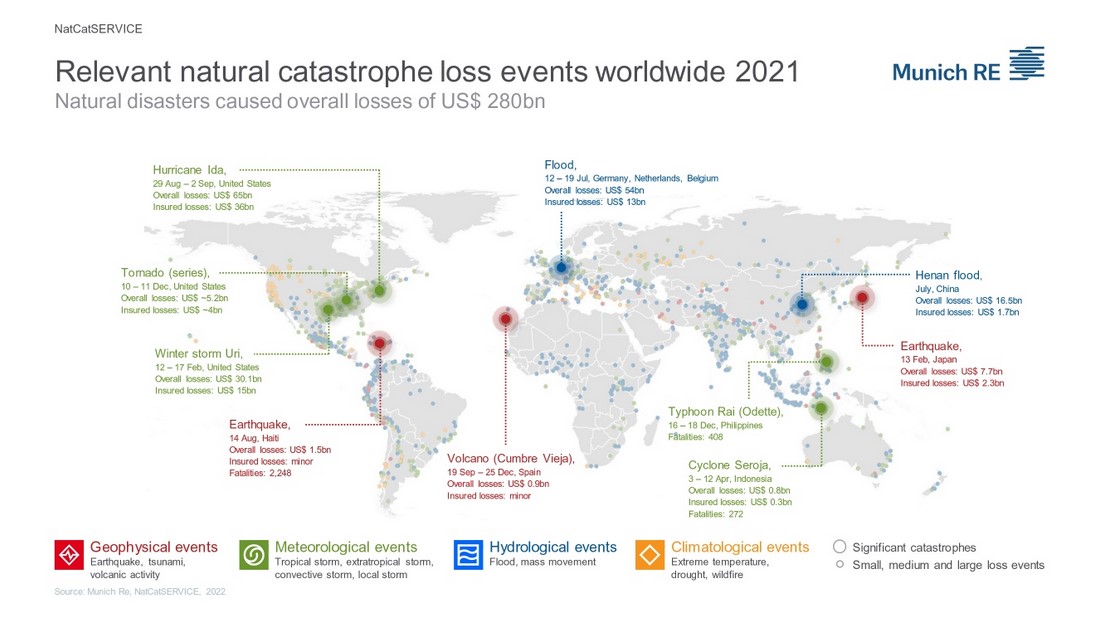

Retrocession pricing went up despite flat demand, suggesting the need for underwriting adjustments across the insurance value chain to better account for property catastrophe risks. The mid-July flooding in Western Europe for example generated a total industry loss (opens a new window) of US$12.0 billion, according to Zurich-based insurance industry organization CRESTA (opens a new window).

This risk adjusted view only encapsulates some of the minutiae as there was a tightening of terms and restriction in coverage offerings (non-modelled and non-property covers) which will not be reflected by standard YoY rate change comparisons.

Uncertainty related to the potential impact of climate change, secondary perils, inflation and interest rates further contributed to the underwriters’ cautious approach.

To create a more favourable retrocession environment, reinsurers may need to adjust their underwriting approach to reflect the increasing property risk from natural catastrophes. This could result in higher premium for insurers or reduced reinsurance coverage. Consequently, insurers would likely need to pass on these costs to their own clients.

Rising catastrophe risk

The declining risk appetite in the retrocession market suggests that reinsurers may be inadequately pricing non-man-made property risks. In 2021, the total insured catastrophe losses increased by 17% to USD 105bn (total economic loss increased by 24% to USD 250bn), according to Swiss Re estimates. Natural catastrophe losses may well continue rising. The 2021 year of account was 44% above the 10-year average of USD 73bn and 59% above the 20-year moving average of USD 66bn.

The growth of urban populations and climate change are likely to contribute to the increase of catastrophe claims cost. Re/insurers may need to re-evaluate the climate related risk carried in their portfolios. To continue servicing the market, underwriters may need to take a fresh approach to those risks, demonstrating flexibility and innovation.

Source: Munich Re

Keeping retrocession costs at bay

To navigate the challenging conditions in the retrocession market, some reinsurers opted for:

retaining more risk

shifting from aggregate to occurrence covers as the former contracted

simplifying structures (i.e. reduction in split deductibles, split EELDs and multi-sections),

raising attachment points

narrowing coverage

accessing the catastrophe bond market

For further information, please contact:

Robert Bisset, Chairman, Global Retrocession & Property Specialty, Bermuda and Market Capital

T: +44 (0)20 7933 1310

E: robert.bisset@lockton.com

Matthew Foreman, Head of Non-Marine Retrocession and Property Specialty

M: +44 (0)7423815540

E: matthew.foreman@lockton.com