After several years of falling rates in what is typically described as a “soft market,” rates in property & casualty (P&C) are now starting to harden for both US & International risks and are likely to continue going up as carriers reduce their capacity, especially at Lloyd’s of London, in a profitability push following two years of severe losses.

“Rates are generally going slightly up in P&C after about eight years of rate cuts,” says Simon C. Scholfield, Partner and Head of Wholesale P&C at Lockton.

Average premium prices increased by 1.6 percent in the third quarter of 2018 in the US after dropping 1.3 percent in the same period a year ago, according to the latest update (opens a new window)from the Council of Insurance Agents and Brokers.

Some lines are more affected than others. In Marine, Cargo for example has been particularly unprofitable for carriers in the past years and finding cover has become increasingly difficult as carriers look to reduce exposures.

Previously, rates were driven down partially by capital inflows from investors such as pension funds and private equity funds that saw the P&C reinsurance market as an opportunity to generate higher returns in a low interest rate environment, which in turn increased capacity in the market. At the same time, the P&C market had enjoyed a period of relatively low losses from natural catastrophes, giving insurers few arguments to push for higher rates.

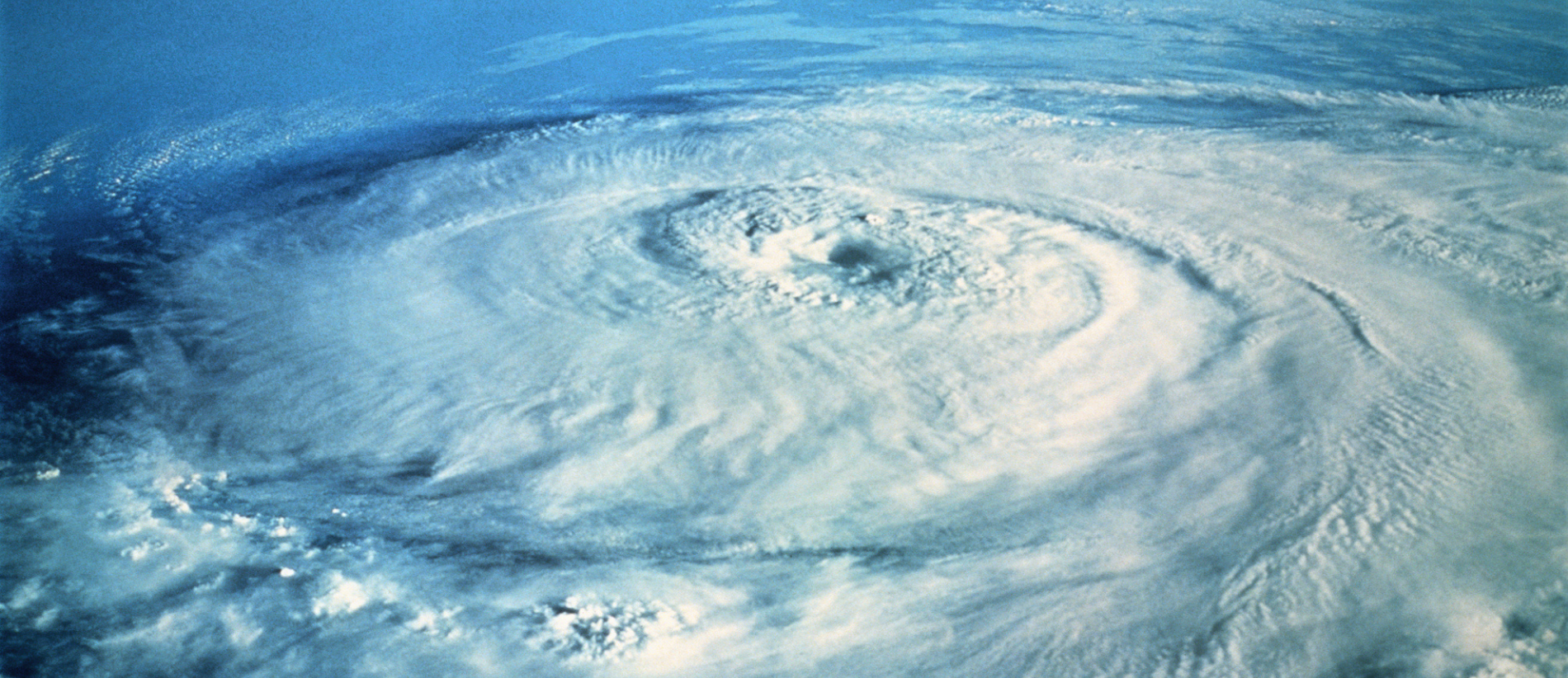

But this situation changed in 2017 with a series of powerful hurricanes in the US (Harvey, Irma and Maria, also known as HIM). Hurricane Maria caused estimated insured losses of $32 billion, and Irma and Harvey added another $30 billion each. The hurricanes contributed to a record total insured loss from natural catastrophes of $144 billion in 2017. Additionally claims creep from HIM continues to haunt the market as costs turn out higher than initially expected.

These events were followed by the most damaging wildfires in Californian history with ‘Camp fire’ in November 2018 in northern California producing estimated insured losses of around $12.5 billion. In addition typhoon Jebi in Japan contributed $9 billion and Hurricane Michael in the US with $10 billion of insured losses. Overall, 2018 insured losses totalled $80 billion, which although lower than the total of 2017 is still significantly higher than the 30-year average of $41 billion, according to data from Munich Re.

“The events of 2017 and 2018 came at the lowest ebb of the longest ‘soft market’ cycle on record which has resulted in a number of challenges for underwriters’ profitability and earnings,” Scholfield explains. “Capacity and pricing competition remained high while investments in assets such as bonds produced low returns”.

Lloyd’s of London, for example, reported a pre-tax loss of £2 billion for 2017 and a combined loss ratio of 114 percent. The market has since introduced a profitability review to reduce loss-making business, which forced syndicates to cut capacity or even exit some lines of business, including international property (direct & facultative).

“The price correction happening right now could be set to continue for some time,” Scholfield says. “Cargo and marine are already in what can be described as a hard market with risks becoming more difficult to place. Property such as multi-family residential real estate, mining risks and US beachfront hotel risks are also becoming more difficult to place,” he adds.

“The price correction happening right now could be set to continue for some time".

Other markets are likely to follow Lloyd’s as carriers seek to adjust their portfolios. Given the greater frequency of unusual loss events and the possible links between them, insurers have been (re)examining their actuarial rating models. A significant increase in hot summers that are linked to climate change, combined with man-made factors such as settlements close to forests may be behind rising wildfire losses and require carriers to realign their risk management and underwriting strategies.

“Chief financial officers and risk managers are unlikely to see rate reductions at upcoming renewals,” Scholfield says.

“Insurance buyers might want to instead look at increasing retentions and aggregate deductibles or self-insure some of the risks via captive structures and have more skin in the game,” he notes.

Buyers that are prepared to share the pain with insurers for example by increasing retentions have an incentive to manage the risk more carefully, making them more attractive for insurers as clients. The advantage for buyers may also be that, if they remain loss-free during the period, they will have saved money.

“We want to put as many options in front of clients as possible with different blocks of capital with balanced portfolios, geographically distributed between several regions,” Scholfield notes.

“In this tightening market we will make sure that we find alternatives for clients, taking advantage of all available premium carriers and capacity in different markets in order to find the best risk cover,” he adds.

While the actions carriers are taking to improve profitability are starting to reflect on rates, any further development of prices will also depend on the occurrence of natural catastrophes this year.

“If hurricane Michael which made landfall in the US in 2018 had hit Miami we would already be in a hard market now. That would have been a game changer,” Scholfield says. “If something of such a size and scope happens this year it could impact the capital of carriers and push investors out of the market. The resulting capacity reduction would then push rates up further,” he explains.

Such a loss event could make private equity firms and other investors behind syndicates as well as investors operating in Bermuda reassess the attractiveness of the re/insurance sector, reducing the available capacity in the market.

“Capital behind existing vehicles could dry up if they don’t achieve the expected returns,” Scholfield explains.

“The situation may get worse if we see a big loss this year but already now the market is in a state of flux.”