Government intervention in the housing market, a shortage of solicitors and ‘pen and paper’ practices could create a rise of professional indemnity claims for conveyancing solicitors.

The stressful nature of the work is leading much of the little qualified talent in the UK market to look elsewhere. According to research conducted by the trade publication (opens a new window), almost half (49%) of currently employed solicitors have seen a colleague step away for mental health reasons.

Law firms are reporting real and tangible effects on their bottom line. Speaking at a Law Society event (opens a new window) in September 2022, a representative from one firm said they were turning away work, as they couldn’t find the necessary talent to keep up with demand.

Demand has always been high, but the UK government’s intervention during the Covid-19 pandemic has compounded the problem.

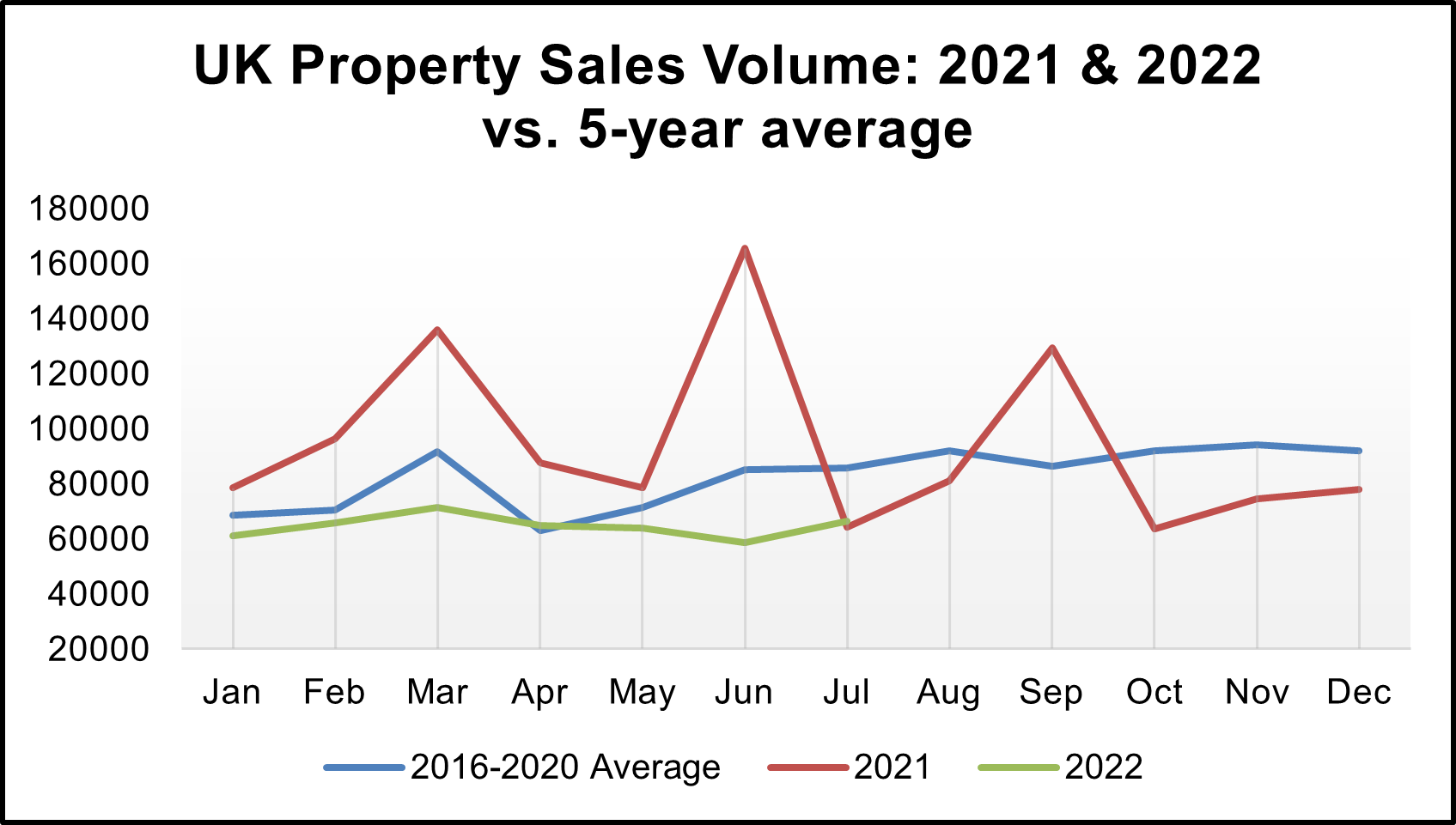

Looking at data from Land Registry going back to January 2015, purchases of property remained relatively steady month-on-month. Demand typically increases during the spring and summer months, before tailing off towards the turn, and start of the year.

But in the summer of 2021, there was a drastic increase in property buying, as buyers looked to take advantage of the Stamp Duty freeze.

Huge demand and insufficient resources created an environment where mistakes can be made. And while there is currently no indication in the data to suggest that claims against conveyancing firms are increasing in the here and now, these issues can often go unnoticed for years. For instance, residential conveyancing claims take a mean average of 4 years, and a median average of 2.3 years, to be discovered (opens a new window).

Source: Land Registry Data

Additional challenges

Other ongoing results of the Covid-19 pandemic could also leave firms open to more problems. During the peak of market activity, the majority of solicitors were working from home. Hybrid working is likely to be a common work practice as these businesses try to retain their existing staff.

Junior solicitors may not be developing skills as quickly, or as thoroughly, as they would have if they were in proximity to their senior colleagues.

While there will have been adoption of digital technology to facilitate this new working paradigm, there is reticence to adopt it in certain key processes. This is particularly pertinent when it comes to signing deeds and other important documents. While HM Land Registry now allows for digital signatures, some conveyancers still prefer pen and paper.

In-person identification can slow down processes, creating further backlogs, in turn increasing workloads and the likelihood of errors.

Also pushing against these longer waiting times, are the expectations of buyers and sellers themselves. Speakers at The Law Society roundtable said these parties are often frustrated with slow turnaround times during the conveyancing process. External pressures can again lead to errors in the process and might actually be a factor in experienced practitioners moving away from the industry.

Minimising claims and reducing premiums

The expectation of potential future claims is being reflected in insurance premiums. Regardless of claims history, all firms have experienced increased spend on their solicitor’s professional indemnity insurance costs (PII).

Conveyancing has always produced circa 50% of all losses with little change in the underlying causes including:

Not properly checking title deeds, or official copies of titles

Failure to recognise the existence of a restrictive covenant

Failure to advise that you do not have a right of way to access your property, or that someone else has a right of way over your land

Missing any physical or latent defects

Failure to do the proper checks, such as for planning permission, building regulations, listed building or conservation area consent

Failure to carry out and/or advise upon pre-contract searches and enquiries

Drafting incorrect provisions in the sale deed or contract

Failure to protect vulnerable clients

Failure to pay the sale proceeds to all the owners of a property upon sale

The Law Society roundtable recently flagged another area of contention: fraud.

Advances in know-your-customer technology mean that even when face-to-face interactions with buyers are limited, as was the case during Covid-19, there are more tools available to reduce the firm from exposure to malicious actors.

Using digital tools to ascertain the identity, and the financial credentials, of buyers are valuable means of combating ever-more sophisticated fraudsters.

While conveyancing firms are under immense pressure, there are tools, and advisors available, to minimise risk, and fulfil this vital process in the property market safely.

Firms should not only be alert to the increase in external fraudsters, but also the internal threat from partners and staff who maybe struggling in the current cost of living crises and be tempted dip into client funds.

For more information, please contact:

Steve Holland, Solicitors Practice Group Manager

T: 0207 933 2444

E: steve.holland@lockton.com