Recent well-intentioned legislative changes could materially increase cost pressures on employers, particularly affecting SMEs.

In early April the mandatory contributions for defined contribution pension schemes increased for both employers and employees. Days earlier the minimum wage increased by 4.4% (opens a new window).

These changes could put pressure on employers to reduce operating costs or cut back on recruitment plans.

Together, these changes could produce the unintended consequence of increasing the opt-out rate from auto enrolment pensions by employees, and also put pressure on employers to reduce operating costs or cut back on recruitment plans.

Effect on employers

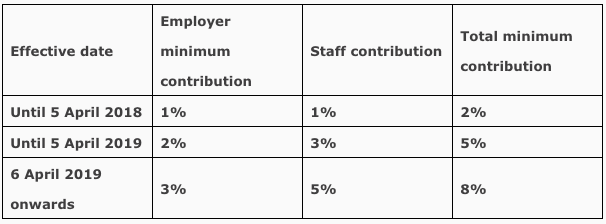

On 6 April 2018 the minimum employer pension contribution increased from 1% to 2% (opens a new window), with a total minimum workplace contribution of 5%.

Where an employer chooses to limit their contribution to the minimum amount, employees are required to make up the shortfall, which in many cases will amount to a 3% contribution (see chart below):

As a result of these changes, employers will face an unavoidable increase to payroll costs. It will particularly affect employers who are following the statutory minimum requirements, and who also have a significant number of employees who are subject to the minimum wage, as shown by the two examples below:

Employer AE contribution before 6 April 2018

£7.50 per hour @35 hours per week = £13,650

Old qualifying earnings band lower limit: £13,650 - £5,876 = £7,774

£7,774 x 1% = £6.47 per month

Much of the 4.4% increase in employees' minimum wage is likely to be eroded by the higher pension contributions.

Employer AE contribution after 6 April 2018

£7.83 per hour @35 hours per week = £14,250

Qualifying earnings band lower limit: £14,250 - £6,032 = £8,218

£8,218 x 2% = £13.70 per month

The combined effect of these pension increases and the minimum wage increase will be approximately 5% of employers’ payroll for lower-paid employees.

From an employees’ perspective, much of the 4.4% increase in the minimum wage is likely to be eroded by the higher pension contributions. And with inflation recently reported at 2.7% through February, their real earnings may well be going backwards (opens a new window). As a result, some employees may feel incentivised to opt out of the plan – a scenario contrary to the Government’s original intentions.

The strain on some employees’ disposable income will be tested further in 2019, when the second increase to pension contributions takes effect.

These legislative changes, and their implications, cannot be avoided. Employers should ensure that they have adopted the new requirements, and considered the longer-term impact on their payroll budget.