As the world aims to reduce CO2 emissions and reach climate goals, China is forecast to add the bulk of the global renewable energy capacity to be created by 2026 in the power sector. To be completed, the projects will require significant insurance capacity from international markets.

Global renewable power capacity is expected to increase by more than 60% between 2020 and 2026, adding the equivalent of the current total global power capacity from fossil fuels and nuclear combined, according to the International Energy Agency (IEA) (opens a new window). Solar photovoltaic (PV) alone is set to provide more than half of this capacity creation. Renewables are set to account for almost 95% of the increase in global power capacity through 2026, driven by stronger support from government policies and more ambitious clean energy goals announced before and during the COP26 Climate Change Conference.

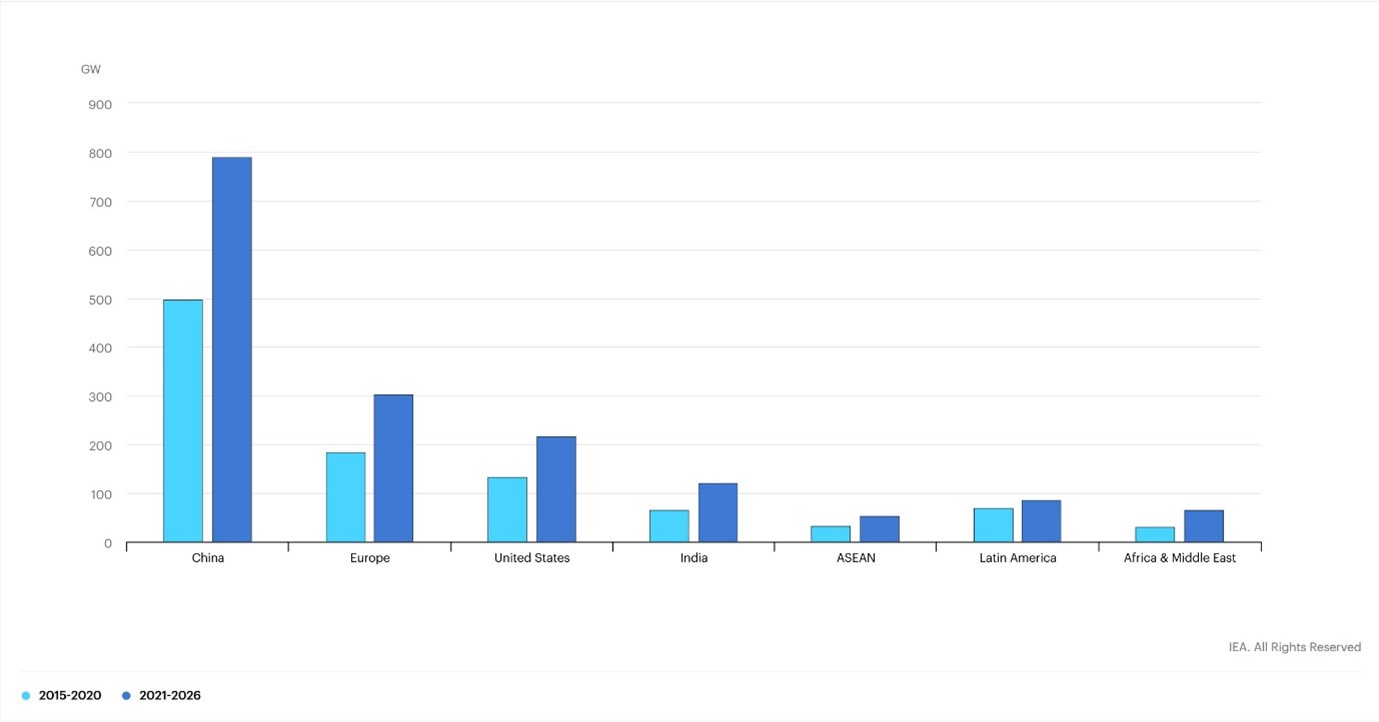

China remains the global leader in the volume of capacity additions. The country is expected to reach 1,200 GW of total wind and solar capacity in 2026.

Renewable electricity capacity growth by region/country, main case 2015-2020 and 2021-2026

Source: IEA Report Renewables 2021 (opens a new window)

Risk considerations

The main focus for the expansion of renewable energy sources is on solar and wind. The location’s exposure to both energy sources is of course essential, but a geographic assessment should also include the risk perspective: The likelihood of nat cats such as windstorms, wildfires, hailstorms, flood events and how this might evolve due to climate change.

Regarding onshore wind risks, turbines can suffer from gearbox failures which sometimes are associated with costly serial losses and fires. Furthermore, lightning strikes can cause blade delamination while windstorms have resulted in turbine collapses. Wildfires can cause solar panels to explode.

The accessibility of the power generating facility is critical for potential maintenance and repair costs and therefore potential insurance claims costs.

Expert risk consultants with close ties to insurance underwriters should be involved in the process from design all the way through to operations performance to facilitate the risk transfer process to the insurance market and ensure reasonable premium cost during construction and operations.

Transferring the risk

Insurers like to have a clear view of the potential claims that may arise from the risks that they are underwriting. This is complicated due to the high pace of innovation in ever shorter cycles in the renewable energy sector. Underwriters need to keep up with international engineering standards as well as certifications for equipment (e.g. type certification) and projects.

Issues that underwriters might query in wind energy projects include prototypical or unproven equipment such as specialized blades and gearboxes. Larger rotor diameters and tower heights can result in higher dynamic loads and complex vibrations which increase rotor blade stress and impact the drive train.

Risks insurers are most concerned about:

Prototypical / untested equipment,

Natural hazards,

Wind (onshore): Turbine gearbox failures and evolution of technology (larger tower heights and larger rotor diameters) meaning the rotor blade stress is greater and the drive train is impacted,

Wind (offshore): Subsea cables (transportation and installation), logistics (e.g. vessel availability for making repairs),

Battery energy storage (BESS): Thermal runway when lithium ion cells overheat causing major fires. Choice of engineering, procurement, and construction (EPC) contractors and site layout (spacing between battery containers is important),

PV panels: natural hazards, transformer fires and theft,

Cost saving methods: Can affect maintenance quality, technology quality and EPC contractors

Cyber Attacks

Business interruption (incl. supply chain disruption),

Changes in legislation and regulation (e.g. trade wars and tariffs, economic sanctions, protectionism, Brexit, Euro-zone disintegration).

Offshore renewable projects are likely to face more scrutiny because of the potentially higher claims costs driven by technological challenges, complicated logistics and battery storage systems. Large offshore projects are underwritten on a case-by-case basis. There have been a few expensive claims in this field caused by natural catastrophes, but offshore projects also arguably offer the greatest potential as space availability enables developments at much larger scale then onshore and therefore significant efficiency gains. Offshore solar energy projects with a variety of flotation concepts are expected to rival offshore wind turbines in the future. Just recently, Huaneng Power Internal has connected to the grid (opens a new window) in what is dubbed the world’s largest floating PV plant in China with a capacity of 320 MW.

Underwriters are particularly interested in the flotation concept used in such projects as well as the anchoring system which need to undergo technical due diligence covering the construction and the first year of operation.

General challenges when placing such risks in the market:

Losses are frequent and can be severe

Risk engineering: Technology is always evolving meaning close monitoring is required engineering standards need to be adhered to

Many of the onshore wind and solar PV installations are small scale meaning they need to be handled efficiently.

Offshore wind, geothermal and concentrated solar are often larger projects and more complex requiring detailed analysis

Gathering the required insurance capacity for large renewable energy projects can be challenging, particularly for offshore projects, not only due to underwriting scrutiny but also because the necessary insurance capacity is often unavailable locally and needs the involvement of international insurance markets. Capacity for offshore insurance is more limited than for onshore projects. Many insurers are currently not willing to cover offshore renewable energy projects as they have not developed the necessary expertise and are unwilling or unable to take such risks on to their balance sheets, driving up premium. At the same time, domestic insurers usually price the risk more attractively than international insurers as they have the local knowledge and perhaps government backing or receive subsidies.

Renewable energy projects are often packaged up into one policy:

Construction All Risks + Delay in Start-up (DSU),

Operating All Risks + Business Interruption (BI) and Marine,

Third Person Liability,

Environmental Liability and Engineering.

The fact that securing the necessary protection for large projects requires the involvement of several insurers domestically and internationally makes the process complex and time consuming. Having the right contacts in the local and international insurance markets is therefore essential to complete the underwriting of renewable energy projects in a timely manner.

Generally required underwriting information includes:

Track record of the employer and its main contractor in similar projects

Detailed layout plan

Program Chart

Breakdown value of the project

Technical Due Diligence Report– consults, geographical reports etc.

Max designed wind speed / Max wind speed recorded (m/s) in the region

Design criteria details

For further information, please contact:

Carol Chan, Head of Power and Energy, Real Estate and Construction Greater China

T +852 6915 8371

E: Carol.Chan@lockton.com