Money may not buy happiness but there is an ever increasing amount of research corroborating the link between financial wellbeing and mental/physical health. While employers are widely offering solutions for their employees’ potential mental or physical health issues in their benefits offering, they are mostly neglecting the need for financial wellbeing. An imbalance that needs to be addressed.

A CIPD factsheet (opens a new window) states that investing in health and wellbeing at work can lead to greater resilience, innovation and productivity. The Healthiest Workplace Study sponsored by Vitality says that the cost of lost productivity due to poor health and wellbeing in the UK currently stands at around £57 billion. While employers are widely offering solutions for their employees’ health issues in their benefits offering, they are often reticent to offer financial wellbeing. This reticence is often born out of the fact that employers do not want to find themselves in a position where they may be held liable or accountable for financial advice that inadvertently makes the employees financial situation worse.

Financial wellbeing can be described as “being and feeling financially healthy and secure, today and for the future,” and is a major contributor to an employee’s performance and productivity.

Financial distress can be immensely damaging and impact a person’s day to day living whether it be professionally, emotionally or through the impact on personal relationships. But there is still a lot of stigma attached to financial health and debt which makes it hard for affected persons to address the issue. Society still widely equates financial worth with self-worth. A meaningful and sustained employee wellbeing strategy should therefore include financial wellbeing tools.

Companies have long ago recognised the importance of employees’ health by ensuring access to healthier lifestyles, for example discounted gym memberships. Prudent employers as a matter of course also offer tangible employee benefits such as Private Medical Insurance (PMI), Group Income Protection (GIP), 24-hour access to GPs and Critical Illness Cover (CIC) to name a few.

More recently companies discovered the importance of addressing mental health and wellbeing in their benefits offering. Corporate culture has come a long way since the 16+ hour working days of the industrial revolution when the concept of employee wellbeing was as alien as a daily shower. The significance of mental wellbeing is now widely recognised and it is now less stigmatised than in the past thanks to campaigns by governments, non-profit organisations and businesses themselves. Furthermore it is now common to see Employee Assistance Programmes (EAP) in place which assists in employees’ personal and work problems that may impact their job performance, health, mental and emotional wellbeing.

Despite all the efforts to address the issue, mental ill health is still the number one reason for long term absence from work, followed by stress, according to the 2018 Health and wellbeing at work survey (opens a new window) from the Chartered Institute of Personnel Development (CIPD).

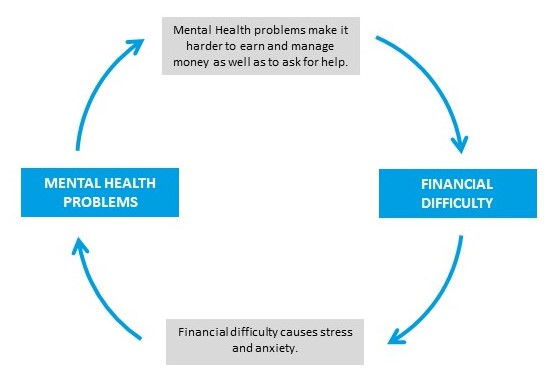

And financial and mental wellbeing are closely interrelated, according to research by the Money and Mental Health Policy Institute (opens a new window), which shows that 46% of respondents with debt problems also have a mental health problem. Furthermore, 86% of respondents who experienced mental health problems said that their financial situation had made their mental health problems worse and 72% of respondents conceded that their mental health problems had made their financial situation worse.

Research has also revealed a direct link between a person’s financial situation and their physical health. Money worries are commonly related to stress and anxiety which may manifest in physical symptoms such as lack of sleep, increased blood pressure and heart problems.

In order to improve their employees’ financial wellbeing, companies can include financial education courses or advice in their benefits package, helping to improve employees’ ability to manage their money. Companies can also offer employees access to affordable loans where repayment is deducted directly from the salary. Furthermore, free debt advice can help reduce the pressure some employees may be facing. Another option could be to offer access to accounts that make investing easy and where payments are directly deducted from the salary. A global Lockton survey demonstrated that employees would benefit most from investment, savings and ISA advice. This was followed by home ownership/mortgage advice.

A meaningful and sustained employee wellbeing strategy is not an extravagance, it’s a business imperative, and should include financial wellbeing tools along with mental and physical wellbeing options. Listening to staff feedback is essential to ensure the employer is providing what is genuinely wanted, this also serves as a good recruitment and retention tool. In addition, all forms of wellbeing should be part of the company’s culture.

Employee wellbeing is good for the employees and good for the organisation. It can prevent stress and create positive working environments where individuals and organisations can thrive. Companies should help assist in a virtuous cycle where physical, mental and financial wellbeing are all in sync. Organisations such as the Chartered Institute of Personnel Development (CIPD) champion wellbeing in the workplace and advocate a holistic approach. Given that the majority of a person’s day is spent in the workplace, ensuring a happy and content workforce is key to promoting the nation’s health and wellbeing.