Like it or not, benefits packages play a key role in hiring and retaining the right staff. You can be the most successful company in the world, but if your benefits aren’t attractive to the best talent, they are unlikely to bring that talent to work for your company. And with an increasingly multi-generational workforce, employers need to consider a wider spectrum of ideas when crafting benefits packages.

“People are having to rethink the concept of retirement because of changes to the state pension age,” says Jon Green, Lockton's UK Benefits practice leader. “Some are being forced to work longer because they can’t afford to retire. Others may want to remain longer in the job as they don’t want to live as a pensioner for 30 or 40 years.”

At the same time, companies need to accommodate the needs of millennials and Generation Z employees who often have different priorities, such as strong inclusion policies, flexible working and a more open/progressive approach to mental health.

Emerging benefits trends

Wellbeing initiatives are now common across the board, from discounted gym memberships to employee assistance helplines, bike purchase schemes, sports challenges, yoga classes and sleep apps.

More recently, the Lockton Benefits team are working with an increasing number of companies to help them strengthen their focus around mental health. This may include initiatives designed to raise awareness or tap into the rapid development of mental health first aider schemes to ensure better support for colleagues that are experiencing difficulties. Diversity and inclusivity are also climbing the corporate agenda.

“There is a lot more focus on inclusivity programmes and it has really reached a tipping point in the last year,” says Green. “In medical insurance, we are seeing employers seeking to cover things like gender reassignment surgery and infertility treatment because of a surge of interest in these issues from entry-level candidates.”

Telemedicine – providing access to virtual general practitioner services – is also growing rapidly in popularity.

The plethora of new services, providers and technologies has created an additional challenge for employers. The huge amount of choice means that distinguishing the good from the bad and assessing the effectiveness of the various offerings is difficult.

What progressive companies are doing

Holiday ‘gifting’ schemes’ – building on the idea of being able to buy or sell some of your holiday each year, some firms are offering employees the chance to ‘gift’ holiday to a colleague.

Wellbeing funds – rather than offering prescriptive wellbeing perks, such as discounted gym membership or bike purchase schemes, some companies are offering employees a lump sum (such as £500) that they can claim back each year for wellbeing-related purchases and activities.

Inclusive benefits – some companies are offering inclusive benefits such as cover for gender dysphoria and fertility treatment.

Asking employees what they want

All too often, employers offer benefits schemes that are complicated and/or undervalued. To develop more attractive schemes, Lockton regularly carries out qualitative and quantitative research across multiple employers and jurisdictions to find out what employees really want.

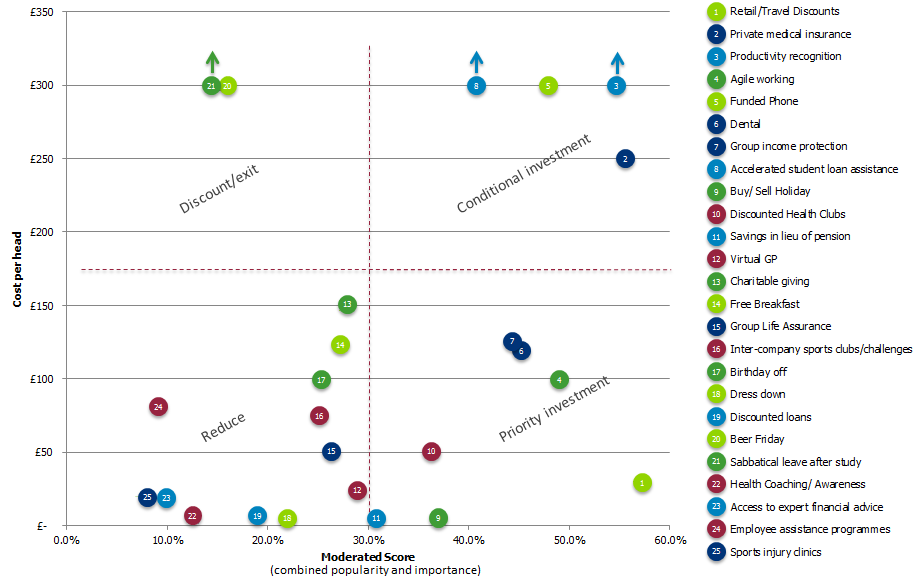

Results show that often relatively low-cost lifestyle benefits are highly valued. “For example, a very popular perk is having your birthday off,” says Green. “It is relatively cheap for the company as it is only one day of extra holiday, but it is really appreciated.” Discounts through online service providers such as Reward Gateway and Perkbox are also highly appreciated.

In the chart below, the bottom right corner shows some examples of highly valued but relatively low-cost benefits, including retail and leisure discounts, dental insurance, buying/selling holiday and savings in lieu of pensions. These insights form part of a study that Lockton carried out for a technology company.

Cost benefit analysis:

What employers think

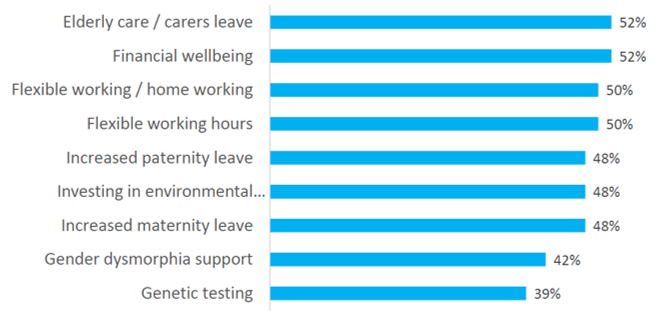

Lockton has recently conducted a survey of employers about the benefits that they think will become more available in their organisations in the next decade.

Leave for people caring for unwell or elderly relatives and services to improve financial wellbeing (such as expert advice about pensions and mortgages) both scored highly. Flexible working schemes also did well.

As the benefits offering is increasingly tailored specifically to the needs of the workforce, it may need to be reviewed and adapted more frequently than in the past to keep it attractive.

For further information, please contact:

Jon Green, Lockton Regional Head of Benefits UK & Europe

E-mail: jon.green@uk.lockton.com (opens a new window); Direct Tel: +44 20 7933 2877