Temperatures on Earth have risen and will continue to do so even with rapid greenhouse gas emissions cut, according to the latest research. Since this is likely to increase the frequency and magnitude of extreme weather events, real estate owners need to gather and analyse data related to their portfolios and (re-) assess their risk exposure and identify appropriate measures to offset any negative impact.

The climate change threat

The world is likely to reach 1.5C of warming above pre-industrial levels within 20 years, even in a best-case scenario and temperatures will continue to rise until “at least” 2050, according to the latest report from the UN’s Intergovernmental Panel on Climate Change (IPCC) (opens a new window).

Higher temperatures will lead to further extreme weather events. For instance, a warming of the atmosphere and oceans makes severe rainfall more likely (opens a new window) because higher temperatures let air hold more water vapour (opens a new window) and for every degree Celsius of warming, the atmosphere can absorb 7% more moisture. Wetter air leads to stronger bursts of rainfall.

Further, arctic temperatures are rising twice as fast as the global average, and research shows (opens a new window) that a shrinking temperature difference between the equator and the poles weakens the jet stream. The weakening of the jet stream is making it “wobblier” (opens a new window), pinning large high and low pressure systems in place above North America, Europe, and Asia. Under the highs, temperatures often soar, while persistent heavy rain falls where the lows are entrenched.

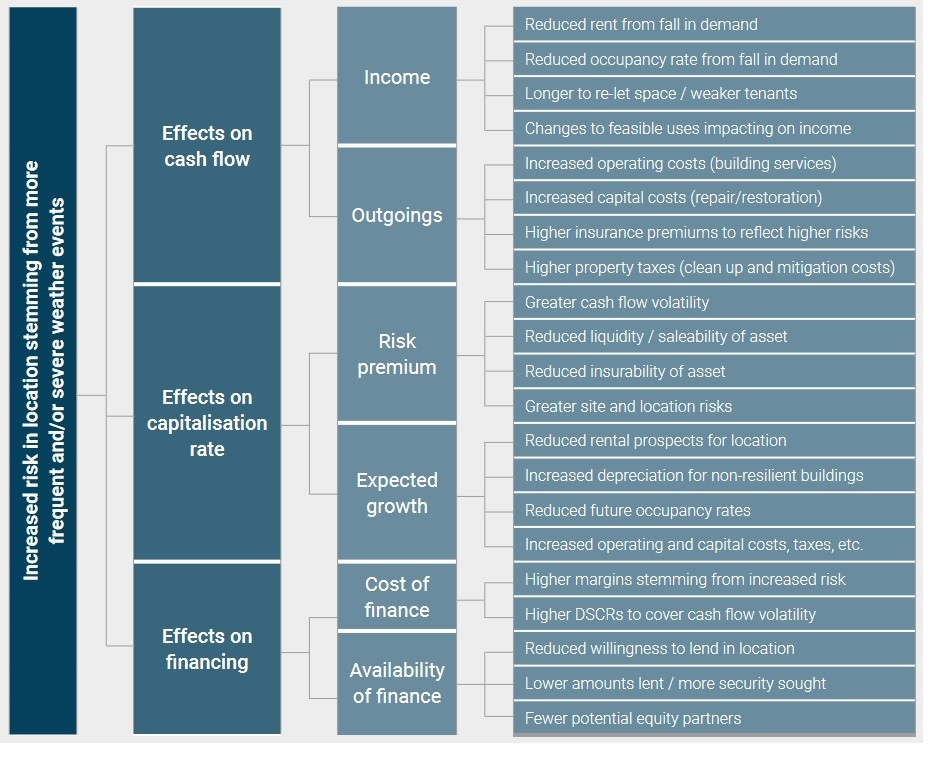

Severe floods swept Germany and the Benelux countries recently while wildfires ravaged the American West and parts of Southern Europe, driving home the reality that the world’s richest nations remain largely unprepared for the intensifying consequences of climate change. Some regions are more exposed to extreme weather than others, but the environment is changing rapidly, requiring an open mind and strategic thinking to understand both the direct and indirect impacts in the form of real estate demand, operating expenses, risks of damage, and changes in real estate value.

Extreme weather impact on real estate portfolios

Source: UNEP FI Report “Climate Risk & Commercial Property Values: A review and analysis of the literature (opens a new window)”

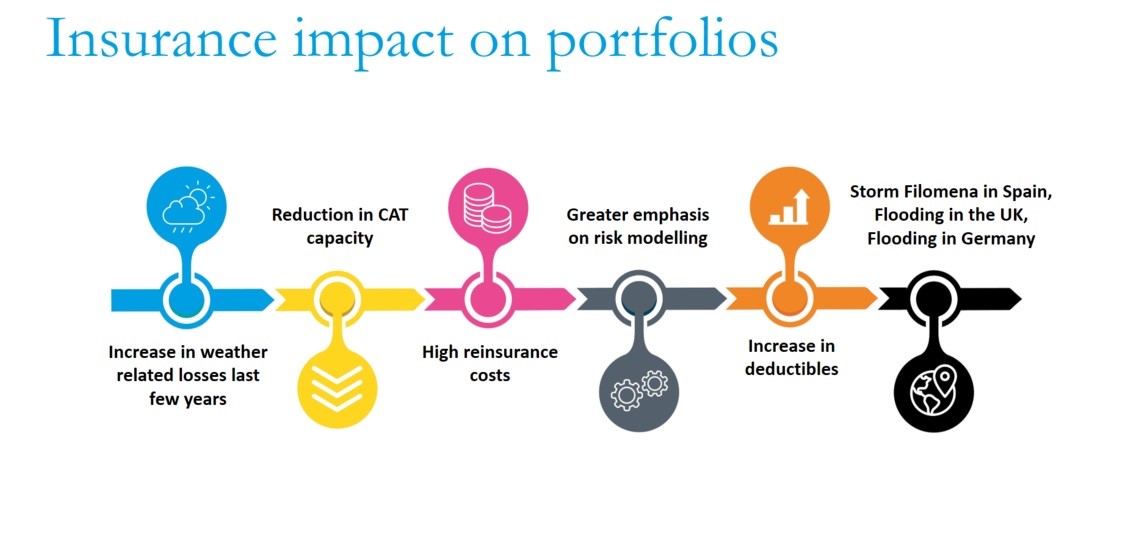

The insurance impact

The insurance industry is, of course, closely monitoring climate change and its consequences. As a result, insurers are adapting their underwriting approach. Extreme weather events can significantly increase insurance premiums or lead to substantial exclusions in specific regions as insurers’ risk appetites change.

Currently, some climate change related risks are insurable, but the risk appetite of primary insurers depends heavily on their reinsurer’s approach. As climate change losses rise, these will hit reinsurers, who will increase rates for primary insurers who will pass the cost on to insurance buyers such as property owners or their tenants. This has already materialised in many markets.

Taking a holistic approach

For large institutional real estate investors, it is becoming crucial to understand what climate risk and resilience mean for their portfolios. Because of the , these may have from an environmental, social and governance (ESG) perspective, the development of a coherent strategy will require a holistic approach.

Climate change related shareholder activism is on the rise. Major lawsuits have recently targeted large oil producers, but the focus may move to other sectors. Activism elements related to climate change are many and can involve, for instance, reputational risk linked to the protection buildings offer their occupiers against extreme weather events. An asset or fund manager’s approach to ESG and climate risk can impact relationships with investors, tenants, and other stakeholders. Furthermore, regulators are increasingly requiring companies to offer clear, comprehensive, high-quality information on the impacts of climate change. This may include the risks and opportunities presented by rising temperatures, climate related policy, impacts on present and future market growth as well as investment performance.

Rental demand may change for many reasons. Intensifying floods, storms, wildfires and heatwaves may impact business continuity and safety in some regions, and changing drought conditions and population growth could create water stress as water demand outstrips supply.

Damage to nearby infrastructure could prevent tenants from accessing a building, or the area may become so hot that it becomes unattractive for residents. Climate change can therefore affect real estate owners even if the building itself is structurally well protected against extreme weather events.

Developing a strategic plan

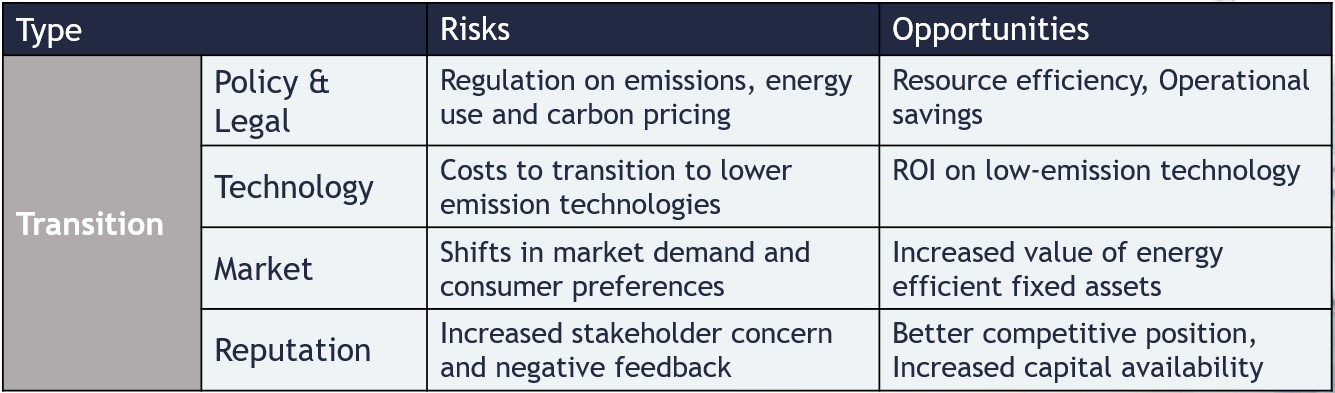

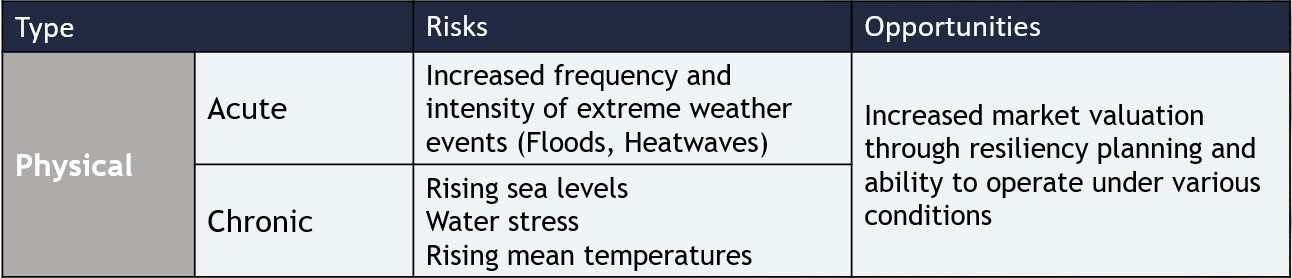

Recognizing the threat that climate risk poses to the global financial system, the Financial Stability Board created the Task Force on Climate-related Financial Disclosures (TCFD) to improve and increase reporting of climate-related financial information. The aim is to facilitate the identification, quantification, mitigation, and disclosure of climate change risks associated with a specific business. These risks may need to be expressed in a company’s profit and loss (P&L) account and balance sheet like other financial risks and be integrated into financial decision-making. While the TCFD itself does not have the authority to mandate such reporting, many governments and regulatory bodies around the world have begun requiring TCFD-aligned climate risk reporting, including the UK and Switzerland.

The TCFD recommendations provide an initial categorisation of climate-related risks and opportunities to consider split into two primary categories: physical and transition.

A consistent strategic risk management framework around climate risk can ensure a higher level of resilience. While some types of ESG or sustainability reporting focus on measuring the impact a business is having on the environment or on society, TCFD assesses the potential impact of climate change on the organization. This helps to ensure the future of the business while creating transparency around climate risks for investors and the public, as well as informing about measures to manage the risk and capitalise on opportunities.

Good risk management practices means having the tools to identify, assess, and manage climate risks and good data is a very important component.

Relevant data is crucial

To perform such an assessment, real estate owners therefore need to gather and interpret data sets related to the portfolio. Climate risk data comes in many forms, and users should consider characteristics such as:

Physical or transition risk data

Internal or external data

Historical records and forward-looking projections

Desktop-based or on-site due diligence

Range of hazards

Timeframes

Climate scenarios

Geographic coverage

Outputs as risk score, rating, or financial impact

Some data might be entirely external to the organization for example, location specific hazard data. Other data will have to be collected at the asset level, such as energy consumption and the carbon footprint.

Ideally, datasets will create a historical view of risks. Forward-looking projections are becoming increasingly important, particularly if they incorporate the hold period times. This allows real estate owners to include risks that future prospective buyers may face in an exit plan.

Ignoring climate risk is no longer an option for any real estate managers or their stakeholders. Fortunately, a holistic assessment of climate risks and opportunities and a thoughtful interpretation of climate data can help organisations build resilience into their

processes, strategies, and decision-making, resulting in better outcomes for investors and communities.

Lockton Global Real Estate and Construction has joined forces with Evora, an independent, pan-European sustainability consultancy and software provider with specialist expertise in the commercial real estate sector. Since 2011, Evora has been delivering sustainability consultancy services to many of Europe’s largest investment funds. Clients include Deutsche Asset Management, Schroders Real Estate, Standard Life Investments, and Hines. In July, Lockton and Evora hosted a joint webinar, which looked at the impact of climate risk on real

estate. Watch a full recording of the webinar here (opens a new window).

For further information, please contact:

Ian Blackadder, Partner Real Estate & Construction

T +44 (0)20 7933 2764