Prices in voluntary carbon credit markets have declined broadly, but there is growing evidence of price differentiation based on quality attributes. This suggests the market is maturing in how it values carbon credits beyond traditional pricing.

Voluntary carbon markets allow carbon emitters to offset their unavoidable emissions by purchasing carbon credits. These are generated by projects removing or reducing greenhouse gas (GHG) emissions from the atmosphere. The voluntary carbon credit market trades certified and transferrable instruments representing the avoidance or removal of one metric tonne of CO2 or equivalent GHG. It has recently faced a credibility crisis due to allegations that many credits don’t deliver the emissions cuts they promise.

Two studies have pointed to systemic problems with credits generated from nature-based projects. In January 2023, a report assessed credits certified by Verra (opens a new window), a leading carbon standard. The analysis found that more than 90 percent of their forestry credits (opens a new window) did not represent real emissions reductions. In August 2023, a study in Science concluded that forestry programmes significantly overestimated (opens a new window) their prevention of deforestation.

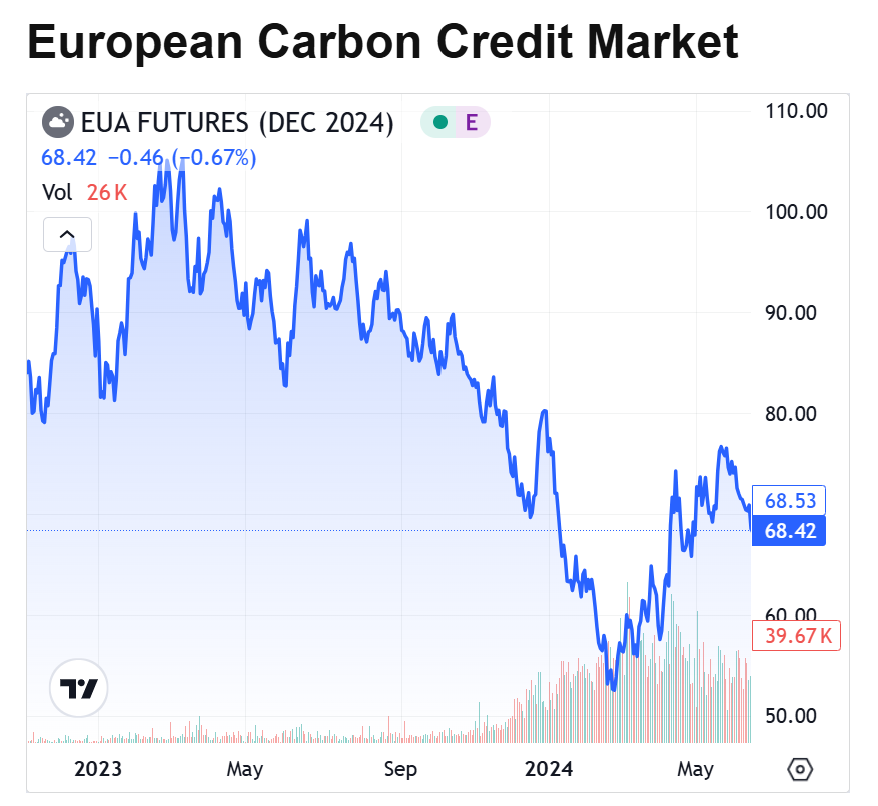

The revelations not only suggested that the investment generated no return but also exposed businesses purchasing carbon credits to the risk of greenwashing allegations and potential reputational damage. As a result, sales slumped dramatically in 2023 and 2024, creating an oversupply of credits that are perceived as low quality.

Source: Carbon Credits (opens a new window), 28.11.24

Initiatives to improve market conditions

Market participants have reacted to the challenges the voluntary carbon credit market is facing, and a number of international initiatives promise to address shortcomings and strengthen confidence:

Voluntary Carbon Markets Integrity (VCMI): The VCMI, established in 2021, is setting principles and frameworks for high-quality carbon credits.

Integrity Council for the Voluntary Carbon Market (ICVCM): The ICVCM, established in 2021, aims to enhance the overall efficiency and effectiveness of the voluntary carbon market.

Global Carbon Market Utility (GCMU): Launched at COP27 in 2022, the GCMU aims to enhance the quality and transparency of carbon credits and to scale the global carbon market.

International Sustainability Standards Board (ISSB): The ISSB’s first climate disclosure standards, published in 2023, encourage greater transparency and accountability, and enable a more informed comparison of the performance of companies.

In addition to the work that these institutions are doing, there are a number of further initiatives that could contribute to improve conditions in the voluntary carbon credit market.

On 20 September 2024, the Commodity Futures Trading Commission approved final guidance (opens a new window) regarding the listing for trading of voluntary carbon credit derivative contracts. It outlines factors for designated contract markets to consider when listing for trading of voluntary carbon credit derivative contracts.

Furthermore, at COP28, six of the largest independent crediting programmes, including Verra, Gold Standard, and the Global Carbon Council, agreed (opens a new window) to collaborate and better coordinate their approaches to certification. Aligning standards could also improve the efficiency and efficacy of auditing projects and crediting schemes.

In addition, there is a longer-term trend developing in which governments are taking larger roles in designing, moderating, and, to a limited extent, regulating voluntary markets. Many governments have set CO2 emissions goals for their countries and the voluntary CO2 credit market can help them achieve these goals. Their involvement can help setting expectations for the supply side of the market.

Establishing standards for quality

The carbon credit quality primarily refers to the confidence that a carbon credit represents genuine, additional, and permanent emission reductions or removals.

The ICVCM has developed Core Carbon Principles (opens a new window) defining key quality criteria that help assess the quality of projects generating carbon credits. Below is a summary:

The project needs to deliver measured, monitored, and verified emission reductions

The reductions need to go beyond what would have occurred without the project

The result needs to be set on realistic baselines

The reductions need to be either permanent or include comprehensive risk mitigation mechanisms

Any leakage needs to be accounted for and minimized

The CO2 effect can only be counted once

The project should not create a net harm

Attributes of projects that signal quality include:

Vintage

Newer credits, typically less than five years old, are often viewed as higher quality. This is because they are likely to reflect latest methodologies and measurement techniques and be based on most recent baseline calculations.

Project type (removal vs. avoidance)

Carbon removal projects, which actively remove CO2 from the atmosphere, are often valued higher than avoidance projects (which prevent emissions) because:

They deliver more permanent and measurable carbon reductions

Have clearer additionality claims

Are easier to verify and monitor

Align better with net-zero goals

Verification standard

Higher quality is indicated by:

Use of internationally recognized standards (e.g., Gold Standard, Verra VCS)

Regular updates to methodologies

Transparent verification processes

Independent third-party verification

Monitoring methodology

Quality is demonstrated through:

Real-time monitoring systems

Digital monitoring, reporting, and verification)

Satellite imagery for nature-based projects

Blockchain or IoT integration for data integrity

Co-benefits (e.g. sustainable development goals’ impacts)

Projects delivering multiple sustainable development benefits beyond carbon reduction are considered higher quality because:

They contribute to multiple UN sustainable development goals

Create local community benefits (jobs, education, healthcare)

Protect biodiversity

Enhance project permanence through community buy-in

Corresponding adjustments (accounting mechanisms that prevent double counting of emission reductions)

Ensure credits are only claimed once

Adjust national inventories when credits are transferred

Align with Paris Agreement Article 6 requirements

Provide transparent tracking of credit ownership

Geographic location and jurisdiction

Quality indicators include:

Political stability of host country

Robust environmental regulations

Clear land tenure rights

Strong governance frameworks

History of successful project implementation

Project developer track record

Quality can be assessed through:

Years of experience in carbon markets

Success rate of previous projects

Financial stability

Transparency in reporting

Community engagement history

Professional certifications and accreditations

Verification body reputation

Quality indicators include:

Accreditation by international bodies

Length of experience in carbon markets

Independence from project developers

Technical expertise in specific project types

Track record of identifying non-compliance

Reducing the invalidation risk

Adhering to established quality standards when selecting the carbon credits will substantially lower the risk of them being invalidated. Higher quality credits with robust measurement, reporting and verification (MRV) are less likely to face methodological challenges and credits with corresponding adjustments will reduce the double counting risk.

In addition, projects with strong community engagement have lower reversal risks as they are likely to also ensure higher quality for a number of reasons:

Local support ensures long-term project viability

Community benefits create incentives for project maintenance

Local knowledge can improve project design and implementation

Reduces the risk of social conflicts or project reversal

Better monitoring and early problem detection

Enhanced protection against illegal activities

In general, better baseline methodologies are likely to reduce additionality challenges, but despite a robust risk assessment, the risk of carbon credits being invalidated cannot be eliminated completely. Carbon credit insurance can protect buyers from unforeseen losses and unavoidable risks, providing financial compensation for carbon credit losses. Before offering a quote, underwriters will make their own assessment of the project. Among the aspects they will assess are:

Physical risks (e.g., forest fires, natural disasters)

Political risks (e.g., policy changes, ownership rights)

Methodological risks (e.g., baseline calculations, MRV processes)

Project developer risks (experience, track record, funding source)

Jurisdictional risks (legal framework, governance, and historical reputation)

The insurance market is constantly evolving to keep pace with new technologies applied in projects as well as the protection needs of clients. As a result, new insurance products are emerging for specific risks. These are targeted at a variety of stakeholders – apart from CO2 credit buyers they may help reducing the risks for lenders, developers, traders, or buffer pools. Some insurers also offer replacement credits if projects fail to deliver.

Insurance proposition

Insurers offer pre-agreed financial indemnity limits or replacement credits if projects fail to deliver. The coverage can include both physical and political risks. Premium prices will reflect project quality attributes.

For further information, please contact your Lockton representative or visit the Lockton Carbon Credit Insurance page (opens a new window).