You can’t control the wind — but you can be sure your property insurance program responds as expected to a hurricane or tropical storm.

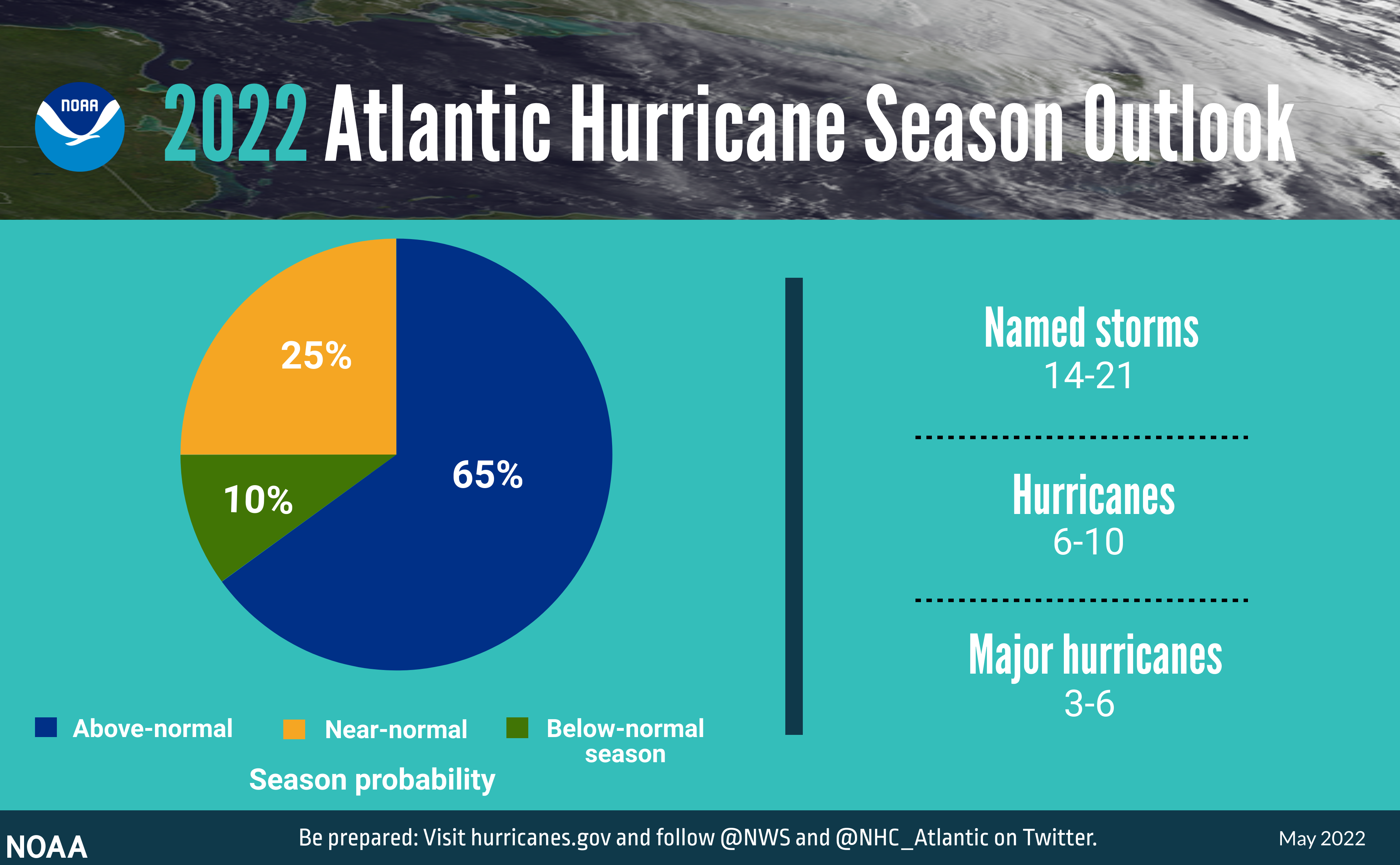

The National Oceanic and Atmospheric Administration (NOAA) today forecast above-normal activity (opens a new window) for the 2022 Atlantic hurricane season. For the coming season, which begins June 1 and concludes November 30, NOAA forecasts a likely range of 14 to 21 named storms, including six to 10 hurricanes. The agency expects three to six of these hurricanes to be major storms — category 3 or higher.

NOAA’s forecast today follows an earlier forecast of an active season (opens a new window) by Colorado State University researchers.

For businesses with properties in the U.S., windstorm season arrives at a particularly difficult time. Inflationary pressures are dramatically altering construction and labor costs, creating uncertainty around the adequacy of values, retentions and limits in property polices. But in this challenging environment, your Lockton team can help you become more confident about your property insurance program’s effectiveness.

Our property experts are prepared to help clients using a broad suite of modeling tools, including wind and surge stochastic models, geospatial risk assessments, and dynamic capital modeling.

We can provide customized analytics, work with you to strengthen policy wordings, and help you access global insurance markets to obtain the most competitive pricing.

Our property claims advocates can also work with you to update your crisis response plans as the season gets underway and provide valuable assistance to aid your recovery in the event of a loss.

Contact your Lockton representative today to learn more about how our property analytics can help you manage risk during this year’s hurricane season.