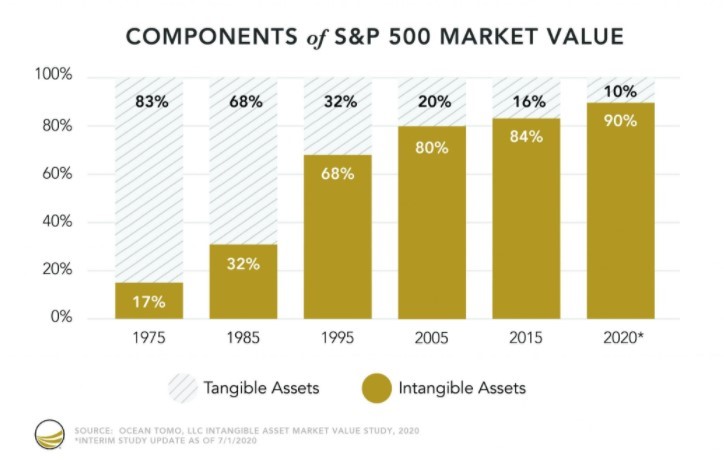

Over the past decades, companies have experienced a massive shift from tangible to intangible assets in their balance sheet exposures, which needs to be reflected in their risk management strategies.

Intangible assets currently account for 90% of the S&P 500’s total assets, according to the Ocean Tomo Intangible Asset Market Value Study (opens a new window). This compares to 17% in 1975.

Pandemic accelerates the trend

Driven by the impact of the Covid-19 pandemic, the past 18 months have seen this shift accelerate for almost all businesses: Organisations had to adopt broad and rapid digital change in order to facilitate remote working and to stay in touch with and continue to service their customers. As a result, businesses have accelerated the adoption of digital infrastructure, e-commerce expansion and the use of cloud based technology solutions.

The rising threat

The value and the importance of intangible assets has grown in tandem with emerging risks and threats. The last 12 months have seen a dramatic increase in cyber-criminal activity.

30bn data records were stolen (opens a new window) in 2020, more than in the previous 15 years put together, according to tech market analysis firm Canalys.

Source: Canalys (opens a new window)

When it comes to protecting intangible assets, this is clearly an area of increased exposure, with the theft of intellectual property and patents on the rise. The National Cyber Security Centre (NCSC) has warned (opens a new window) of the attraction of emerging technologies to foreign states, in particular Russia and China, and has highlighted the increased security risk as hacking groups seek competitive technological advancement over UK companies.

Last year US authorities advised of a compromised British AI business (opens a new window), whose network was infiltrated by a Chinese hacking group searching for technology intellectual property (IP). Certain emerging technologies have been offered lucrative investment from foreign states, causing the NCSC to issue a warning (opens a new window) to tech start-ups.

While protecting physical, tangible assets such as buildings, plant and equipment, remains of critical importance, the facts laid out above show that it is increasingly pertinent to find ways of securing and insuring intangible assets such as intellectual property, copyright, patents and increasingly so the value of a brand and its reputation.

A fast paced environment

The ultra-connected world we now find ourselves in, with the meteoric rise of social media and the influence that it now has on consumers and society as a whole, has contributed to a heightened awareness of both consumers and employees towards ethical and social responsibility of companies with more public scrutiny than ever before. Getting this wrong in today’s society can have far-reaching ramifications, directly impacting a business’s value and its social standing.

While not a new concept in the field of risk management, risk velocity, should feature more prominently in a company's risk identification and quantification process of producing risk registers. It is essentially the measurement of the time that passes between the occurrence of an event and the point at which the organisation first feels its effects. Businesses should consider this concept when looking to identify the risks and uncertainties that could impact their reputation and brand value. An incident that may have seemed trivial and could be contained quickly in the past can now become viral in a matter of hours through the power of social media.

Developing a strategy

After identifying the intangible assets that are critical to the business, a company should consider the following steps:

Develop the ability to assess and quantify intangible assets’ value.

Identify the events and risks that could cause a major incident.

Assess the likelihood of these events occurring and what the tangible impact could be to the business.

Consider which controls are in place or could be deployed to protect the asset and the business' position.

Understand what the residual exposures and impacts would be even with controls in place and explore how or if these can be transferred off the balance sheet.

Insurable solutions

Intangible assets can be tricky to insure with insurers’ traditional indemnity-based underwriting approach. There are however, a number of products and solutions in the market for insuring the likes of intellectual property, patents and more recently, reputational risks (opens a new window). However, the market for some emerging and the more complex traditional intangible assets can be more limited and has certain challenges. For one, there is the difficulty to quantify the asset and potential loss without a reliable methodology for doing so. Further, insurers struggle to fully assess the potential risk due to the absence of historical data on events’ frequency and the specific risk at an individual business level. Nevertheless, there are a number of innovative alternative solutions available to businesses that are concerned about their exposure to intangible assets and want to take action and we will be exploring these in future specific asset based articles.

This article is part of a series that aims to delve deeper into specific intangible asset classes including intellectual property, patents and copyright, digital currency, brand value/reputational risk, to explore how these assets can be valued, how risks can be managed or mitigated and transferred off the balance sheet. If you'd like to receive the next article straight after it is published, please send Luke an email with "Intangible Assets Series" in the subject line.

For further information, please contact:

Luke Withers

Senior Vice President

T: +44 (0)121 2324508