In an age where information can travel instantly around the globe it is increasingly challenging to protect a company’s reputation, particularly in the case of consumer focused brands.

The internet, customer generated feedback and social media have created an environment in which corporate reputation can be put on public trial at high speed, potentially causing extensive damage to the brand and the business in general. Foreseeing such events is becoming even more difficult as new reputational risks appear, such as misinformation including ‘deep fakes’.

All it takes is for one customer or employee to upload a photo, with or without proper context, and a seemingly innocuous situation can turn combustible. Within moments that photo is making its way around the globe for users of social media platforms to draw their own conclusions, possibly harming a company’s brand in the process.

The value of reputation

The damage potential is significant. A report by strategic advisory network AMO (opens a new window) found that during the 12-month period ended March 31, 2019, corporate reputations accounted for 35.3% of total capitalisation of the world’s top 15 stock market indices.

Depending on how reputation is defined, its perceived importance for the business can be much higher. On average, global executives attribute 63% of their company’s market value to their company’s overall reputation, according to an online survey (opens a new window) among 2,227 executives worldwide conducted by public relations firm Weber Shandwick, in partnership with KRC Research.

Companies are being scrutinised on an extensive range of aspects including ethics, leadership and values. In a competitive market where consumers have options, changes in consumption behaviour can take place very quickly and dramatically impact a company’s cash flow.

Even if the quality of a company’s products and services are unaffected, the reputation can suddenly suffer a blow as the perception of an organisation’s character or the way it acts is subjective, creating difficult to control vulnerabilities and volatility. At the same time, a company’s reputation is highly important for counterparties who work with the organisation.

A recent case on trial

A recent case of reputational damage involving vote counting machine producers Smartmatic and Dominion has attracted much public attention (opens a new window) and is going to be decided in court. Despite no evidence of wrongdoing the companies were the target of allegations of election fraud during the 2020 US election. A conspiracy contrived by attorneys close to former President Trump claimed that Dominion installed Smartmatic software on its voting machines across the country, and that Smartmatic maintains allegiances to Venezuela’s socialist leaders, including the late former President Hugo Chavez, according to a lawsuit.

Smartmatic CEO said the company stands to lose $500 million in contracts and another $190 million in add-on services. The $2.7 billion Smartmatic is seeking is founded on estimates of harm to its “brand, reputation and enterprise value,” according to the complaint.

Smartmatic’s existing and potential clients around the world were getting cold feet because of the bogus claims, and in some cases have described (opens a new window) Smartmatic as “toxic,” according to CEO Antonio Mugica.

While in this case the alleged culprits have been identified, this is not always the case when misleading information or false news travel around the globe, making reputational damage difficult to address.

This is just one example within one industry. The circumstances that could lead to adverse media causing a loss of revenue are arguably endless with the unforeseen events potentially being the most damaging. So what solutions are available to assist organisations in protecting their reputation?

Horizon scanning

New technology applications using artificial intelligence (AI) can help signal sensing and horizon scanning. Such a platform can take data published online and bring together critical components of conversations, both good and bad, for the appraisal and management of risks affecting corporate environmental, social and corporate governance (ESG) and reputation.

This information can be visualized to allow businesses to identify what is important to the company. It also allows for rapid benchmarking of a company’s ESG and reputation profile and performance against competitors and peers. AI can distil massive amounts of live, open-source data into actionable reputation insights. Such bespoke data feeds enable companies to anticipate and manage potential and emerging risks as well as opportunities for their reputation.

The data can also be used to give a view of the reputation landscape of topics, stakeholders and peer performance on-demand and in real-time and uncover opportunities and perils that define business performance. It allows a company to gain foresight around issues happening on the horizon, plan a response and react in advance.

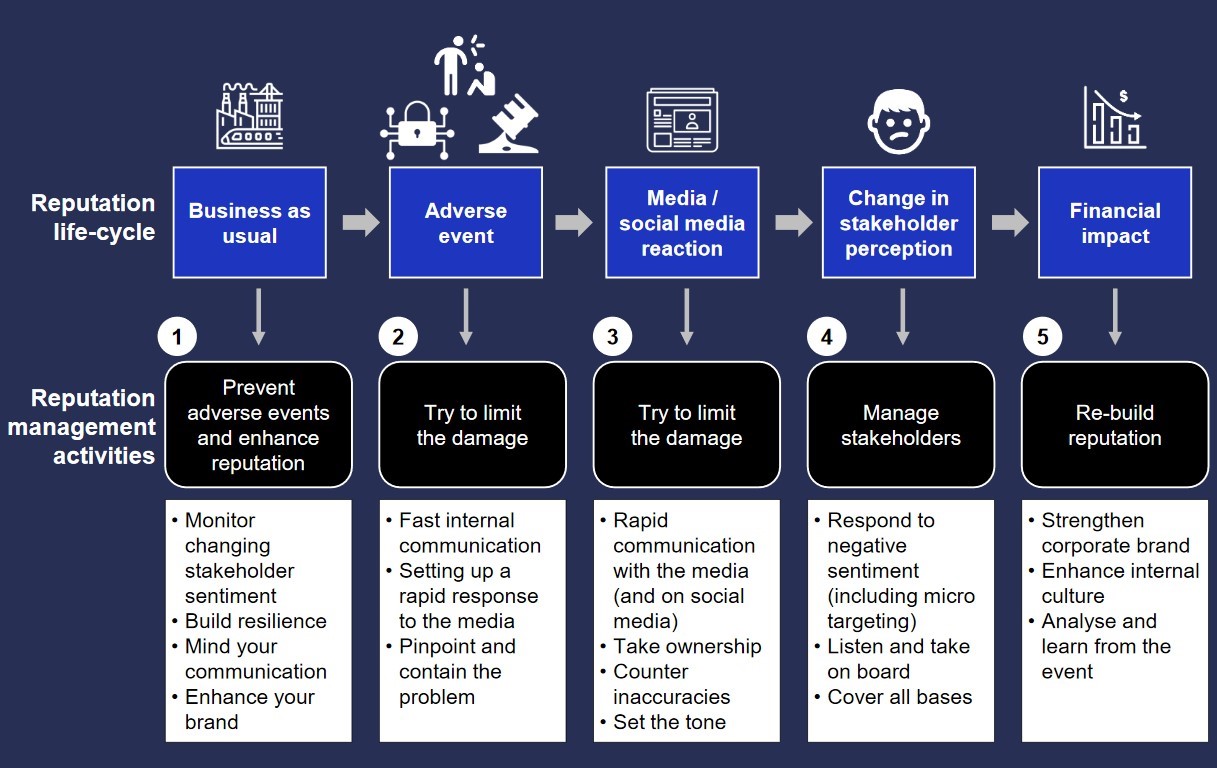

Horizon scanning should be part of a broader crisis management plan:

Source: Lloyd’s/KPMG

Insurance protection

Innovative insurance solutions are available. Reputational Risk policies either define the specific triggering event(s) that leads to adverse media causing a business interruption or an ‘all-risks’ approach where the triggering events are the adverse media and a reduction in revenue with some key exclusions.

Certain insurers target consumer-focused brands and can offer a straight-forward, pre-agreed basis for calculating business interruption (BI) that avoids adjusters by using expected revenue (based on prior financials) and a few additional pre-agreed metrics. There is the

possibility to include access to rapid support from a crisis consultant at the point an issue is identified. While reputational risk is usually included in cyber and recall policies, all risk policies are now offered as standalone reputational harm cover and include other adverse media events causing a drop in sales.

Potential events include but are not limited to:

Employee disgrace

Product Recall

Unacceptable or illegal working conditions

Celebrity disgrace

Attendant/Employee Negligence

Breach of Local Environment Regulations

Animal Cruelty

Breach of UN Global Compact Principles

At the same time, such policies generally exclude cyber, fraud/intentional criminal acts, corporate strategic decisions, systemic and macro-economic declines.