Technologies that capture and store carbon dioxide (CO2) to mitigate the impact of climate change are set to play a major role in the world’s ambitions to keep global warming at bay. These technologies have also created a business opportunity in the shape of tradeable carbon removal credits. To make these a stable and trusted currency, however, will require the support of the insurance market.

The carbon credit market

In 2015, 196 parties signed the terms of the Paris Agreement, signalling their commitment to limit global warming to below 2 degrees Celsius, and preferably to 1.5 degrees Celsius, compared to pre-industrial levels. To achieve this goal, participating countries must not only reduce their carbon dioxide (CO2) emissions, but also accelerate the removal of greenhouse gases from the atmosphere (opens a new window), according to experts.

Many political entities like the EU, the UK or the state of California are already driving the decarbonisation of specific industry sectors and gases through the establishment of mandatory carbon offset markets. These ‘compliance’ cap and trade markets function by allowing regulated entities to purchase carbon offset credits – equivalent to one metric ton of reduced, avoided or removed CO2 or equivalent greenhouse gases (GHGs) – in order to meet pre-determined emission obligations. Those credits can then be traded via an emissions trading scheme (ETS).

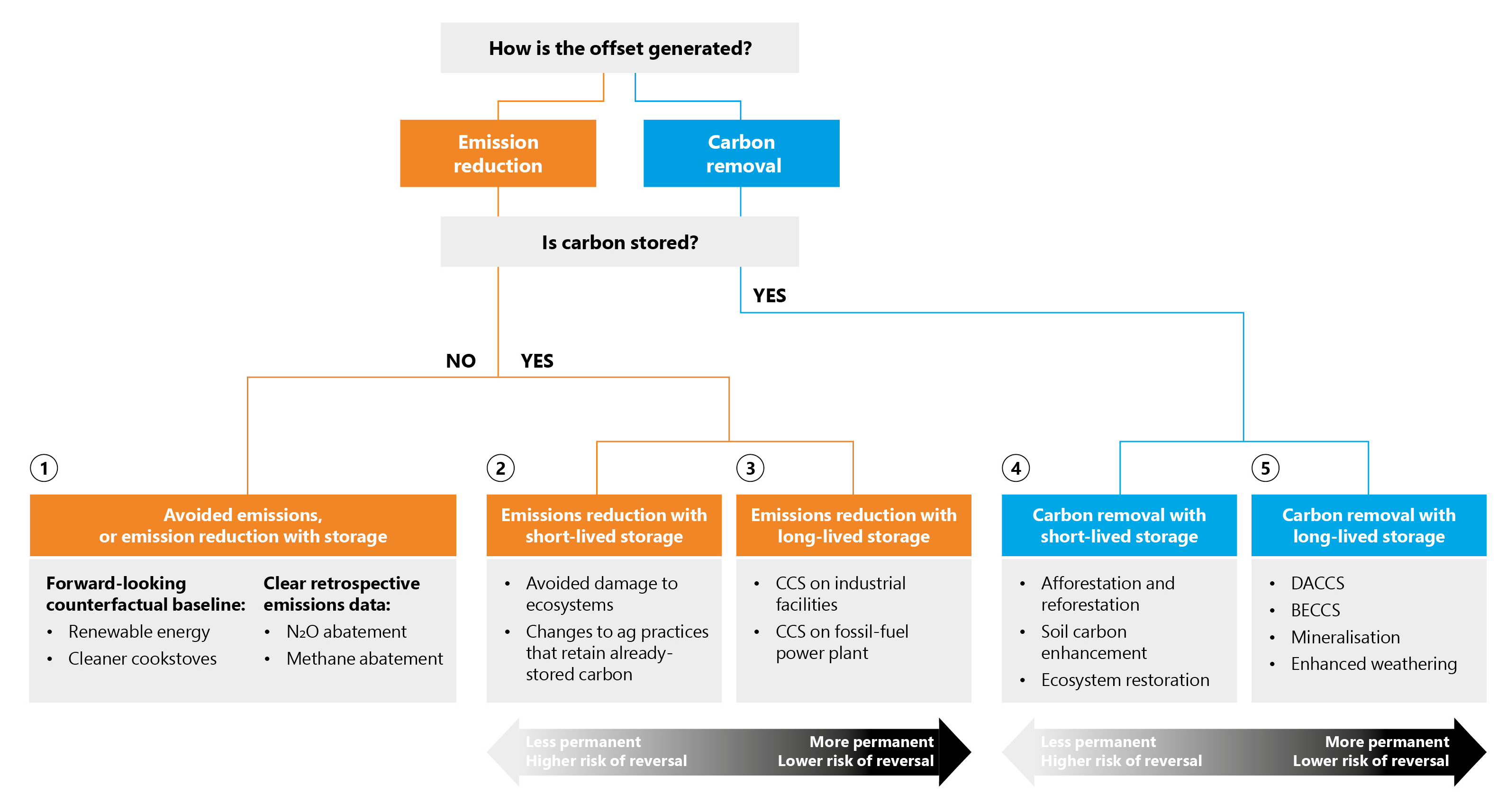

Co-existing with compliance markets are voluntary carbon markets. Accessible to every sector globally, these unregulated markets allow companies to sell or purchase carbon credits from climate action projects. These projects may take the form of carbon emission reduction or carbon removal.

Source: The Oxford Principles for Net Zero Aligned Carbon Offsetting (opens a new window)

Rising demand for carbon removal credits

The value of the voluntary carbon market has grown 4x year on year to USD2bn in 2021, and is expected to reach USD10-49bn by 2030, according to a report by Shell and BCG (opens a new window).

Much of this can be attributed to rising demand for carbon removal credits. These credits have accounted for less than 20% of the market since 2015, but are expected to grow to 35% by 2030 driven by maturing technologies and methods, improving affordability, and net-zero requirements.

The precise drivers for this growth will likely vary from region to region. In the US, for example, there is an additional incentive for businesses to participate in the carbon capture, utilization and storage (CCUS) market. Recent modifications to Section 45Q tax credits (opens a new window) in the Inflation Reduction Act (IRA) significantly increase the tax credit value for CCUS operations.

In conjunction with innovative technology and a supportive framework, the IRA is expected to provide the financial foundation for carbon capture to realise large-volume penetration into a wide range of industrial processes across the US.

Similarly, the European Commission has recently unveiled its Green Deal Industrial Plan (opens a new window), which will mobilise more than USD270bn toward cutting red tape and delivering tax breaks for net-zero investments.

Risk to carbon removal credits

Because of the financial values involved, buyers and sellers of carbon removal credits are likely to face increased scrutiny from both consumers and regulators.

Risks may include:

CO2-escape from storage, such as well and pipeline failures or catastrophic seismic activity

Destruction of forests planted to absorb CO2 for example by fire, wind, or drought

Non or under-delivery of forward purchased carbon removal credits

Carbon credits for removal operations are currently only available on the unregulated voluntary carbon market, which at present lacks complete transparency

Newly developed technology may not perform as expected

Fraud and negligence

Start-ups involved in the voluntary carbon market may face insolvency risks

Covering the risk

In light of such risks, many buyers of carbon removal credits will seek to limit their balance sheet exposures. By purchasing insurance protection, buyers can ensure they have indemnity for non- or under-performance of the carbon removal credit at specified delivery dates. Likewise, sellers of carbon removal credits can protect those credits for instance, against total or partial failure of the CO2 geological storage site.

Other potential coverage options include:

Export licence cancellation — Covering the risk of host countries keeping carbon within borders, meaning non delivery of carbon and / or inability to retire carbon credits

Regulatory invalidation — Covering the risk that regulatory bodies change the rules on which carbon credits can be applied, meaning carbon credits lose eligibility for retirement

Credit for carbon sellers — Protecting carbon sellers against the risk of default on long term offtake agreements, enabling them to receive better terms of financing

Parametric carbon yield — A parametric product, similar to a crop yield policy, which tracks above ground carbon biomass and pays out when pre-agreed triggers are hit signifying a carbon loss

Surety bonds — Surety or performance bonds which ‘wrap’ a carbon credit and can be sold part and parcel; particularly relevant as carbon financial markets become more sophisticated

For further information, please contact:

David Briscoe – Head of Digital Integration & Special Projects P&C Specialties

T: +44 (0)207 933 2648