Skip to main content

Lockton is the world’s largest privately owned, independent insurance brokerage firm. Clients across the globe count on Lockton for risk management, insurance and employee benefits.

Lockton Insurance Brokers Ireland Limited

Lockton is committed to protecting the privacy of Internet users who visit our websites.

LOCKTON INSURANCE BROKERS (IRELAND) LIMITED PRIVACY NOTICE FOR CLIENTS – INSURANCE MEDIATION SERVICES

Last updated: 25 August 2021

What is the purpose of this document?

Lockton Insurance Brokers (Ireland) Limited is committed to protecting the privacy and security of your personal data.

This notice describes how we, as an intermediary, collect and use personal data about you during and after your engagement with us, in accordance with the Data Protection Laws. In particular this notice is designed to help you understand how we process your personal data through the insurance lifecycle. Insurance is the pooling and sharing of risk in order to provide protection against a possible eventuality. In order to do this, information, including your personal data, needs to be shared between different insurance market participants. The insurance market is committed to safeguarding that information.

For information on how Lockton collects and processes your personal data through your use of this website, including any data you may provide through this website, for example when you sign up to our newsletter or fill in our contact us form, please see the Privacy Notice (opens a new window) accessible at the footer of this website. In particular, the Privacy Notice accessible at the footer of this website, together with the Terms of Use (opens a new window) and Cookies Notice (opens a new window) (also accessible at the footer of this website) set out how we look after your personal data when you visit our website (regardless of where you visit it from) and tells you about your privacy rights and how the law protects you.

It is important that you read this notice, together with any other privacy notice we may provide on specific occasions when we are collecting or processing personal data about you, so that you are aware of how and why we are using such information. This privacy notice supplements the other notices and is not intended to override them.

Third Party Information Notice - Insurance Market Core Uses Information Notice

Insurance involves the use and disclosure of your personal data by various insurance market participants such as intermediaries, insurers and reinsurers. The London Insurance Market has produced a Core Uses Information Notice (LMA Notice) which sets out those core necessary personal data uses and disclosures throughout the insurance lifecycle, and in particular sets out how other insurance market participants process your personal data. Our core uses and disclosures are consistent with the LMA Notice. Although this is a notice produced by the London Insurance Market it provide useful information about the use of data in the insurance lifecycle and as such, in addition to reviewing our information notice, we recommend you review the LMA Notice. As at the time of publishing the LMA Notice can be found on the LMA website (www.lmalloyds.com (opens a new window)) at:

http://lma.informz.ca/LMA/data/images/Bulletin%20att/LMA17_038_MS_att1_information_notice.pdf (opens a new window)

Please note that we do not control the LMA website and are not responsible for the LMA Notice.

Controller

Lockton Insurance Brokers (Ireland) Limited is a “data controller”. This means that we are responsible for deciding how we hold and use personal data about you. We are required under the Data Protection Laws to notify you of the information contained in this privacy notice.

Our Data Protection Manager

We have appointed a data protection manager to oversee compliance with and questions in relation to this privacy notice.

If you have any questions about this privacy notice, including any requests to exercise your legal rights, please contact our Data Protection Manager using the details set out below:

CONTACT DETAILS

Data Protection Manager

Lockton Insurance Brokers (Ireland) Limited

Millennium House

55 Great Strand Street

Dublin 1

Email: dataprotection@ie.lockton.com (opens a new window)

Changes to this privacy notice and your duty to inform us of changes

This notice may be updated from time to time. We encourage you to review this notice regularly when you visit our website to learn more about how we are using your personal data and safeguarding your privacy.

This version is dated 25 August 2021 and historic versions can be obtained by contacting our Data Protection Manager.

It is important that the personal data we hold about you is accurate and current. Please keep us informed if your personal data changes during your relationship with us.

Defined Terms

In this notice:

we, us or our refers to Lockton Insurance Brokers (Ireland) Limited, a private company limited by shares with company number 594973 and its registered office at Hambleden House, 19-26 Pembroke Street Lower, Dublin 2, DO2 WV96, Ireland, an insurance intermediary regulated by the Central Bank of Ireland.

you or your, refers to the individual whose personal data may be processed by us and other insurance market participants (you may be a potential or actual policyholder, the insured, beneficiary under a policy, their family member, claimant or other person involved in a claim or relevant to a policy).

There are other terms in bold with specific meanings. Those meanings can be found in Section 11: Glossary of Key Terms.

Contents of this privacy notice

1 – INTRODUCTION – HOW THE INSURANCE MARKET WORKS

2 – THE DATA WE MAY COLLECT ABOUT YOU (YOUR PERSONAL DATA)

3 – WHERE WE MIGHT COLLECT YOUR PERSONAL DATA FROM

4 – THE PURPOSES, CATEGORIES, LEGAL GROUNDS AND RECIPIENTS, OF OUR PROCESSING OF YOUR PERSONAL DATA

5 – CONSENT

6 – PROFILING AND AUTOMATED DECISION MAKING

7 – DATA SECURITY

8 – RETENTION OF YOUR PERSONAL DATA

9 – INTERNATIONAL TRANSFERS

10 – YOUR RIGHTS AND CONTACT DETAILS OF THE ICO

11 – GLOSSARY OF KEY TERMS

SECTION 1: INTRODUCTION – HOW THE INSURANCE MARKET WORKS

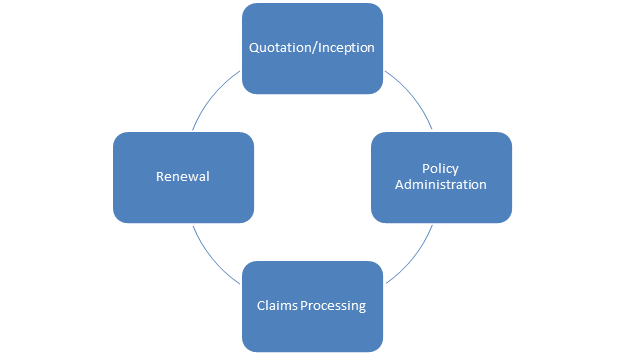

INSURANCE LIFECYCLE:

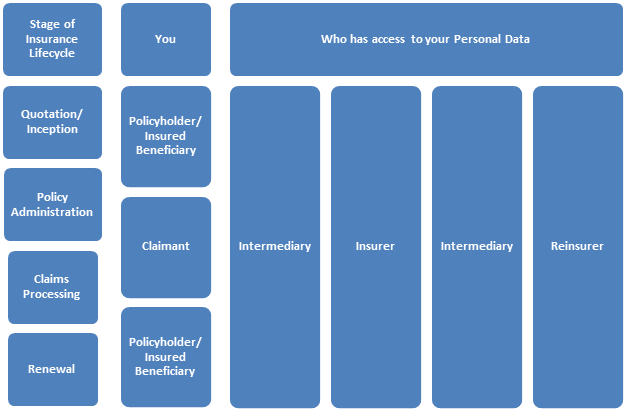

FLOWS OF PERSONAL DATA THROUGH THE INSURANCE LIFESTYLE:

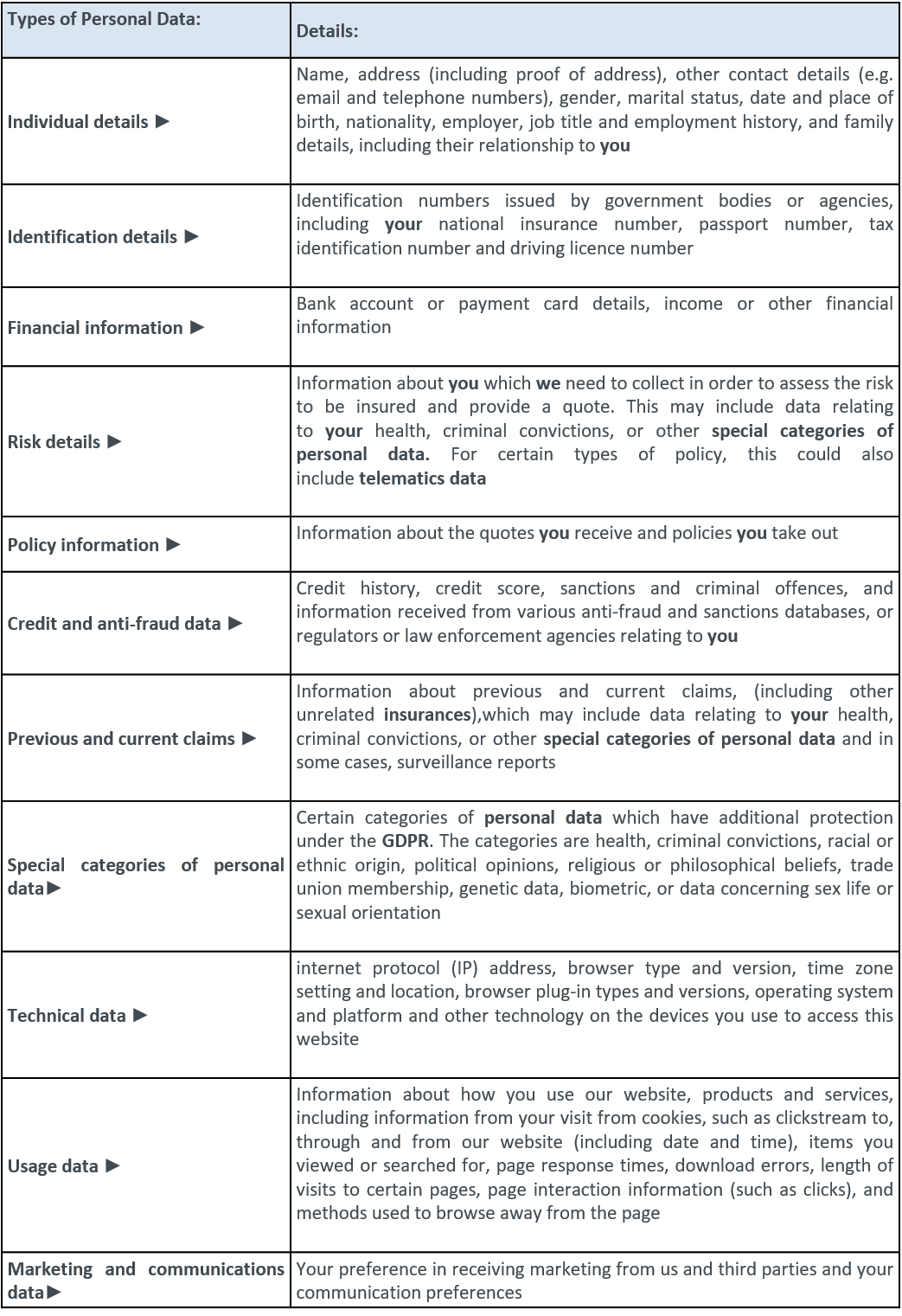

SECTION 2: THE DATA WE MAY COLLECT ABOUT YOU (YOUR PERSONAL DATA)

In order for us to obtain insurance quotes, place and administer insurance policies, and/or deal with any claims or complaints, we need to collect and process personal data about you.

The types of personal data that are processed may include:

Personal data does not include data where the identity has been removed (anonymous data).

We also collect, use and share aggregated data such as statistical or demographic data for any purpose. Aggregated data may be derived from your personal data but is not considered personal data in law as this data does not directly or indirectly reveal your identity. However, if we combine or connect aggregated data with your personal data so that it can directly or indirectly identify you, we treat the combined data as personal data which will be used in accordance with this privacy notice.

If you fail to provide personal data

Where we need to collect personal data by law, or under the terms of a contract we have with you and you fail to provide that data when requested, we may not be able to perform the contract we have or are trying to enter into with you (for example, to provide you with insurance broking services). In this case, we may have to cancel a service you have with us but we will notify you if this is the case at the time.

SECTION 3: WHERE WE MIGHT COLLECT YOUR PERSONAL DATA FROM

We might collect your personal data from various sources, including:

you (for example by filling in forms or by corresponding with us by post, phone, email or otherwise. This includes personal data you provide when you:

make enquiries about or request our services

subscribe to receive our newsletters or

publications;request marketing to be sent to you

give us some feedback);

your family members, employer (including trade or professional associations of which you are a member) or representatives

other insurance market participants;

credit reference agencies;

anti-fraud databases, sanctions lists, court judgements and other databases;

government agencies such as the Motor Tax Office, Revenue Commissioners and Companies Registration Office;

publicly available sources such as the open electoral register and Companies Registration Office;

claims forms;

third parties who introduce business to us; or

in the event of a claim, third parties including the other party to the claim (claimant/defendant), witnesses, experts (including medical experts), loss adjustors, solicitors, and claims handlers.

Which of the above sources apply will depend on your particular circumstances.

For example, we might collect your personal data where:

you have taken out an insurance policy through us (you are the policyholder),

in which case we might collect your personal data from you, credit reference agencies, anti-fraud databases, sanctions lists etc;a third party (such as a family member or your employer) has taken out an insurance

policy through us for your benefit (you are an insured or beneficiary), in which case we might collect your personal data from your family member, employer etc;you are a claimant or other person involved in a claim or relevant to a policy. E.g. you are making a claim against an insurance policy youhave taken out through us or that a third party has taken out through usfor your benefit, or you are making a claim against a third

party’s insurance policy that was taken out through us, or a third party is making a claim against an insurance policy you have taken out through us, in which case we might collect your personal data from you, other insurance market participants, witnesses, experts

(including medical experts), loss adjustors, solicitors, and claims handlers etc.

SECTION 4: THE PURPOSES, CATEGORIES, LEGAL GROUNDS AND RECIPIENTS, OF OUR PROCESSING OF YOUR PERSONAL DATA

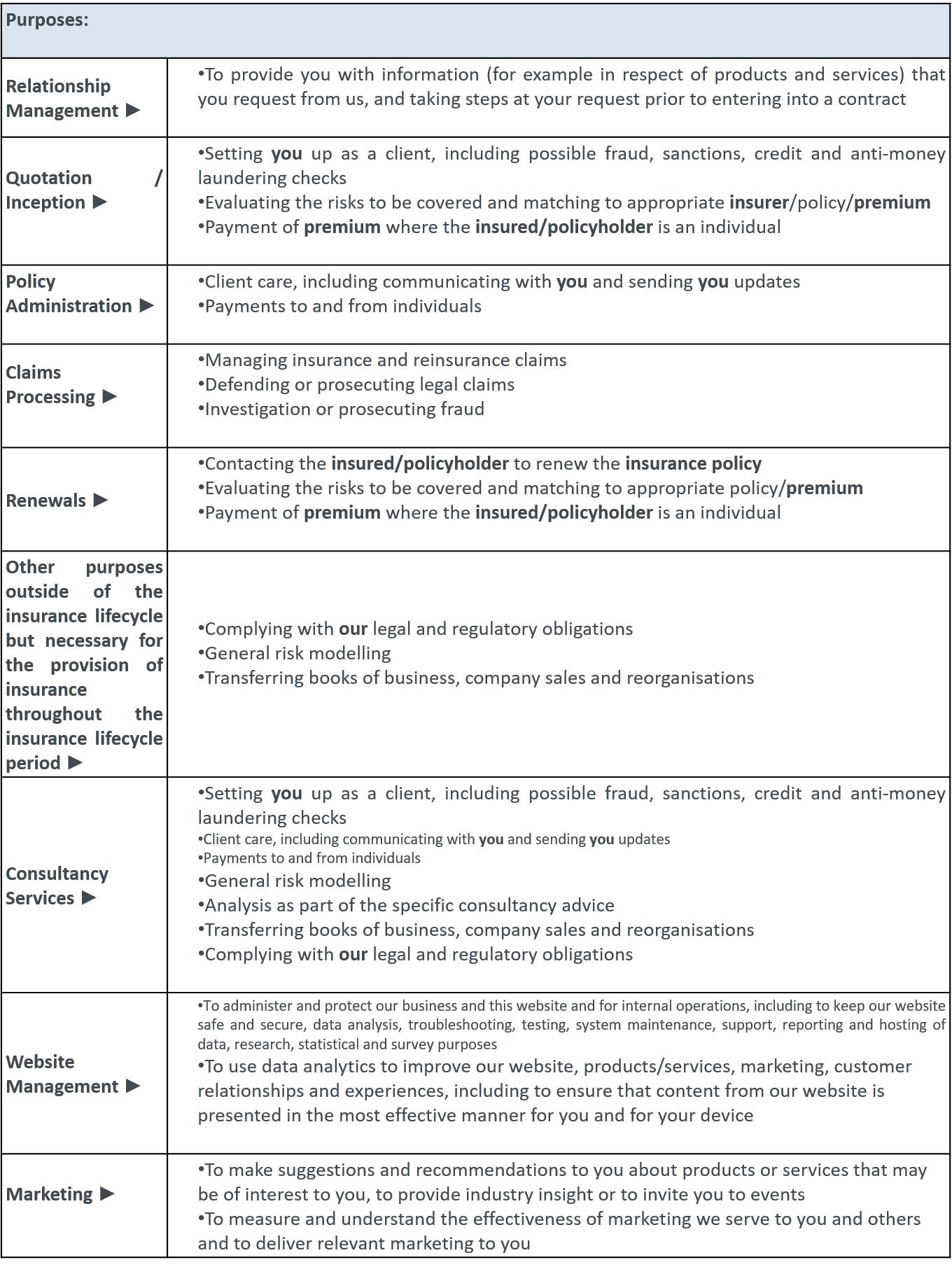

We set out below the purposes for which we might use your personal data:

Please note that in addition to the disclosures we have identified against each purpose, we may also disclose personal data for those purposes to our service providers, contractors, agents and group companies that perform activities on our behalf.

MARKETING

We strive to provide you with choices regarding certain personal data uses, particularly around marketing and advertising. We have established the following personal data control mechanisms:

Marketing communications from us

We may use your Individual Details and Policy Information to form a view on what we think you may want or need, or what may be of interest to you. This is how we decide which products, services, events and industry insight may be relevant for you.

You will receive marketing communications from us if you have requested information from us (including for example where you have provided your explicit consent by way of opting-in to receiving our marketing communications in accordance with applicable law) or purchased services from us, or (where you are a corporate entity) where we consider the marketing material to be relevant to you and, in each case, you have not opted out of receiving that marketing. Such marketing communications may include risk or insurance related information or details of services, or products, or events, which we think, may be of interest to you.

Third party marketing

We will get your express opt-in consent before we share your personal data with any company outside the Lockton group of companies for marketing purposes.

We may share your personal data with other companies in the Lockton group of companies, if allowed and appropriate, for marketing purposes.

Managing your Marketing Preference (including Opting out)

You can manage your marketing preferences or ask us or third parties to stop sending you marketing messages at any time by following the opt-out links on any marketing message sent to you or by contacting our Data Protection Manager at any time.

Where you opt out of receiving these marketing messages, this will not apply to personal data provided to us as a result of a product/service purchase, product/service experience or other transactions, and will not affect communications relating to any such matters on which we are advising you.

COOKIES

You can set your browser to refuse all or some browser cookies, or to alert you when websites set or access cookies. If you disable or refuse cookies, please note that some parts of this website may become inaccessible or not function properly. For more information about the cookies we use, please see our Cookies Notice (opens a new window) .

CHANGE OF PURPOSE

We will only use your personal data for the purposes for which we collected it, unless we reasonably consider that we need to use it for another reason and that reason is compatible with the original purpose. If you wish to get an explanation as to how the processing for the new purpose is compatible with the original purpose, please contact our Data Protection Manager.

If we need to use your personal data for an unrelated purpose, we will notify you and we will explain the legal basis which allows us to do so.

Please note that we may process your personal data without your knowledge or consent, in compliance with the above rules, where this is required or permitted by law.

LEGAL GROUNDS FOR PROCESSING

We will only use your personal data when the law allows us to. In particular, we will rely on the following legal grounds to use your personal data:

DISCLOSURES OF YOUR PERSONAL DATA

We may have to share your personal data with the parties set out below for the Purposes set out in the table above.

Internal third parties: other companies in the Lockton Group (which means our subsidiaries and ultimate holding company and its subsidiaries) who provide IT and system administration services and undertake leadership reporting

External third parties:

Service providers who provide IT and system administration services;

Professional advisers including lawyers, bankers, auditors and

insurers

who provide consultancy, banking, legal, insurance and accounting services;

Credit reference agencies;

Anti-fraud and sanctions database providers;

Other

insurance market participants

such as

intermediaries, insurers

and

reinsurers

;

Banks;

Claims handlers;

Solicitors;

Auditors;

Loss adjustors;

Experts;

Third parties involved in claims/investigations/prosecutions;

Private investigators;

Police;

Courts;

PRA, FCA, ICO and other regulators;

Third parties to whom we may choose to sell, transfer, or merge parts of our business or our assets. Alternatively, we may seek to acquire other businesses or merge with them. If a change happens to our business, then the new owners may use your personal data in the same way as set out in this privacy notice.

THE PURPOSES, CATEGORIES, LEGAL GROUNDS AND RECIPIENTS, OF OUR PROCESSING OF YOUR PERSONAL DATA

We have set out below, in a table format, a description of all the ways we plan to use your personal data, including the categories of personal data and which of the legal bases we rely on to do so. We have also identified what our legitimate interests are where appropriate, and the third parties with whom we need to share your personal data.

Note that we may process your personal data for more than one lawful ground depending on the specific purpose for which we are using your personal data. Please contact our Data Protection Manager if you need details about the specific legal ground we are relying on to process your personal data where more than one ground has been set out in the table below.

SECTION 5: CONSENT

In order to arrange and provide insurance cover and deal with insurance claims in certain circumstances we and other insurance market participants may need to process your special categories of personal data, such as medical and criminal convictions records, as set out against the relevant purpose.

Your consent to this processing may be necessary for us and the other insurance market participants to achieve this.

You may withdraw your consent to such processing at any time. However, if you withdraw your consent this will impact our, and the other insurance market participants’, ability to place, administer and provide insurance or pay claims.

SECTION 6: PROFILING AND AUTOMATED DECISION MAKING

When calculating insurance premiums insurance market participants may compare your personal data against industry averages. Your personal data may also be used to create the industry averages going forwards. This is known as profiling and is used to ensure premiums reflect risk.

Profiling may also be used by insurance market participants to assess information you provide to understand fraud patterns. Where special categories of personal data are relevant, such as medical history for life insurance or past motoring convictions for motor insurance, your special categories of personal data may also be used for profiling. Insurance market participants might make some decisions based on profiling and without staff intervention (known as automatic decision making). Insurance market participants will provide details of any automated decision making they undertake without staff intervention in their information notices and upon request including:

where they use such automated decision making;

the logic involved;

the consequences of the automated decision making;

any facility for you to have the logic explained to you and to submit further information so the decision may be reconsidered.

SECTION 7: DATA SECURITY

Unfortunately, the transmission of data over the internet or any website cannot be guaranteed to be completely secure from intrusion. However, we have put in place appropriate physical, electronic and procedural security measures to prevent your personal data from being accidentally lost, used or accessed in an unauthorised way, altered or disclosed.

We have put in place procedures to deal with any suspected personal data breach and will notify you and any applicable regulator of a breach where we are legally required to do so.

SECTION 8: RETENTION OF YOUR PERSONAL DATA

We will keep your personal data only for so long as is necessary and for the purpose for which it was originally collected. In particular, for so long as there is any possibility that either you or we may wish to bring a legal claim under or in relation to your insurance, or where we are required to keep your personal data due to legal, regulatory, accounting or reporting reasons.

To determine the appropriate retention period for personal data, we consider the amount, nature, and sensitivity of the personal data, the potential risk of harm from unauthorised disclosure of your personal data, the purposes for which we process your personal data and whether we can achieve those purposes through other means, and the applicable legal requirements.

In some circumstances you can ask us to delete your personal data: see Section 10

(Your Rights and Contact Details of the DPC) below.

In some circumstances we may anonymise your personal data (so that it can no longer be associated with you) for research or statistical purposes in which case we may use this information indefinitely without further notice to you.

SECTION 9: INTERNATIONAL TRANSFERS

We may need to transfer your data to insurance market participants or other companies within the Lockton group or their respective affiliates or sub-contractors which are located outside of the European Economic Area (EEA). Those transfers would always be made in compliance with the GDPR.

If you would like further details of how your personal data would be protected if transferred outside the EEA, please contact our Data Protection Manager.

SECTION 10: YOUR RIGHTS AND CONTACT DETAILS OF THE DPC

If you have any questions about this privacy notice or in relation to our use of your personal data, you should first contact our Data Protection Manager. Under certain conditions, you may have the right to require us to:

provide you with further details on the use we make of your personal data/special category of data;

provide you with a copy of the personal data that you have provided to us

update any inaccuracies in the personal data we hold;

delete any special category of personal data/personal data that we no longer have a lawful ground to use;

where processing is based on consent, to withdraw your consent so that we stop that particular processing;

object to any processing based on the legitimate interests ground unless our reasons for undertaking that processing outweigh any prejudice to your data protection rights;

object to direct marketing; and

restrict how we use your personal data whilst a complaint is being investigated.

In certain circumstances, we may need to restrict the above rights in order to safeguard the public interest (e.g. the prevention or detection of crime) and our interests (e.g. the maintenance of legal privilege).

If you wish to exercise any of the rights set out above, please contact our Data Protection Manager.

No fee usually required

You will not have to pay a fee to access your personal data (or to exercise any of the other rights). However, we may charge a reasonable fee if your request is clearly unfounded, repetitive or excessive. Alternatively, we may refuse to comply with your request in these circumstances.

What we may need from you

We may need to request specific information from you to help us confirm your identity and ensure your right to access your personal data (or to exercise any of your other rights). This is a security measure to ensure that personal data is not disclosed to any person who has no right to receive it. We may also contact you to ask you for further information in relation to your request to speed up our response.

Time limit to respond

We try to respond to all legitimate requests within one month. Occasionally it may take us longer than a month if your request is particularly complex or you have made a number of requests. In this case, we will notify you and keep you updated.

Your Right to Complain to the DPC

If you are not satisfied with our use of your personal data or our response to any request by you to exercise any of your rights in Section 10: Your Rights and Contact Details of the DPC, or if you think that we have breached the GDPR, then you have the right to complain to the Data Protection Commission (DPC), the Irish supervisory authority for data protection issues. Please see below for contact details of the DPC.

The DPC would expect you to allow us to address your concerns first before referring to them so please contact us in the first instance.

To refer a matter to the DPC you should use their website https://www.dataprotection.ie/docs/Raise-a-Concern/1716.htm (opens a new window) and complete the online form.

The contact details for the DPC are:

Republic of Ireland

Data Protection Commission

Canal House, Station Road,

Portarlington,

Co. Laois, R32 AP23,

Ireland.

Tel:

Phone +353 (0761) 104 800 |

LoCall 1890 25 22 31

Email:info@dataprotection.ie (opens a new window)

SECTION 11: GLOSSARY OF KEY TERMS

Key insurance terms:

Beneficiary is an individual or a company that an insurance policy states may receive a payment under the insurance policy if an insured event occurs. A beneficiary does not have to be the insured/policyholder and there may be more than one beneficiary under an insurance policy.

Claimant is either a beneficiary who is making a claim under an insurance policy or an individual or a company who is making a claim against a beneficiary where that claim is covered by the insurance policy.

Claims processing is the process of handling a claim that is made under an insurance policy.

Quotation is the process of providing a quote to a potential insured/policyholder for an insurance policy.

Inception is when the insurance policy starts.

Insurance is the pooling and transfer of risk in order to provide financial protection against a possible eventuality. There are many types of insurance. The expression insurance may also mean reinsurance.

Insurance policy is a contract of insurance between the insurer and the insured/policyholder.

Insurance market participant(s) or participants: is an intermediary, insurer or reinsurer.

Insured/policyholder is the individual or company in whose name the insurance policy is issued. A potential insured/policyholder may approach an intermediary to purchase an insurance policy or they may approach an insurer directly or via a price comparison website.

Insurers: (sometimes also called underwriters) provide insurance cover to insured/policyholders in return for premium. An insurer may also be a reinsurer.

Intermediaries help policyholders and insurers arrange insurance cover. They may offer advice and handle claims. Many insurance and reinsurance policies are obtained through intermediaries.

Policy administration is the process of administering and managing an insurance policy following its inception.

Premium is the amount of money to be paid by the insured/policyholder to the insurer in the insurance policy.

Reinsurers provide insurance cover to another insurer or reinsurer. That insurance is known as reinsurance.

Renewal is the process of the insurer under an insurance policy providing a quotation to the insured/policyholder for a new insurance policy to replace the existing one on its expiry.

We, us or our refers to Lockton Companies LLP, a limited liability partnership with company number OC353198 and its registered office at Hambleden House, 19-26 Pembroke Street Lower, Dublin 2, DO2 WV96, Ireland, an insurance intermediary regulated the Central Bank of Ireland

You or your refers to the individual whose personal data may be processed by us and other insurance market participants. You may be the insured, beneficiary, claimant or other person involved in a claim or relevant to an insurance policy.

Key data protection terms:

Data Protection Laws means all laws and regulations relating to the Processing of Personal Data, including the GDPR, as the same may be in force from time to time.

GDPR is the EU General Data Protection Regulation and the new UK Data Protection Act, which replaces the UK Data Protection Act 1998 from 25 May 2018.

Data Controller is an entity which collects and holds personal data. It decides what personal data it collects about you and how that personal data is used.

Information Commissioner’s Office (ICO) is the regulator (or National Competent Authority/Data Protection Authority) for data protection matters in the UK.

Personal Data is any data from you which can be identified and which relates to you. It may include data about any claims you make.

Processing of personal data includes collecting, using, storing, disclosing or erasing your personal data.