Over the past year, the real estate insurance market has seen a significant increase in property damage claims costs. This so-called claims inflation has contributed to the emergence of a hardening insurance market.

As claims costs rise, insurers have looked to apply rate increases and enforce cover restrictions. As they attempt to keep loss ratios down to a level where they can make a profit, insurers have applied rate increases, not just to poorly performing portfolios, but also those that have remained claims-free.

A whole array of different factors contribute to the increased costs of claims. These are briefly set out in this article.

Increased materials costs

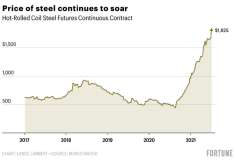

The costs of materials, including timber, copper and steel, have increased significantly over the past 12-18 months. In August 2021, the price of steel peaked at USD 1,945 (per metric tonne), compared with USD 500-800 pre-pandemic. The closing price for steel as of 26th October 2021 was USD 1,665[1 (opens a new window)].

The past 12-18 months have also seen a significant increase in demand for timber and steel. Measures introduced to curb the spread of Covid-19 have meant people are spending more time at home than ever before, with many people undertaking home improvements. This has coincided with a restricted supply of timber and steel resulting from the pandemic.

Outbreaks of Covid-19 in steel and saw mills led to temporary closures, causing supply disruptions. This was only exacerbated by a longer-term trend towards employee shortages flowing from a general transition away from blue-collar jobs, with rising numbers opting to attend college or university.

At the start of the pandemic, many steel mills closed due to fears a global recession would see demand for steel fall away[2 (opens a new window)]. When many economies bounced back faster than expected, the resulting mismatch between supply and demand inevitably pushed steel and timber prices upwards, increasing the cost of property insurance claims.

Shipping disruption

The combination of Brexit and Covid-19 has led to a spike in the cost of shipping goods from Asia to the UK, Europe, and the rest of the world. A prime illustration of this emerged back in January 2021, when the price of shipping goods from Asia to the EU quadrupled in the space of just eight weeks[3 (opens a new window)], with businesses being quoted more than £10,000 for a container that would have cost just £1,600 to ship before the pandemic[4 (opens a new window)].

Lockdowns around the globe led to a shortage of empty shipping containers. These ended up stranded at ports around the world, as businesses and logistics facilities were forced to shut down at the height of the pandemic. Demand for shipping also increased, as locked down individuals took to shopping online like never before, especially in the early phases of the pandemic. Increased demand combined with a reduced supply of empty containers led to substantial increases in shipping rates. This in turn saw many small businesses going under, unable to compete against the global giants[5 (opens a new window)].

Labour shortages

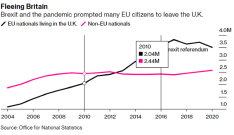

Labour costs have also been inflated by the combined effects of Brexit and Covid-19, which led to more than 200,000 EU citizens leaving the UK during 2020, seeking more attractive employment opportunities in their home countries[5]. Brexit also made it harder for EU workers to secure the visas they needed to return to the UK, even after Covid-19 restrictions were eased. The resulting labour shortages have led to salary inflation, which again has contributed to the rising cost of claims.

As detailed in the Lockton Companies LLP H2 2021 Insurance Update (opens a new window), all these factors have been driving increased claims costs, which has contributed to a ‘hard’ real estate insurance market. There are early signs, however, to suggest the market is beginning to stabilise. We are now seeing new carriers enter the market, looking to transact business. This creates more capacity and competition on premium rating.

If you have any questions arising from the topics mentioned above, we would be happy to hear from you and discuss these issues in more detail.