For fintech companies, providing clients with services in the digital asset space can be a great opportunity to expand business and attract new clients. For companies that are looking to integrate these activities into their offerings, a variety of potential risks need to be considered as part of the risk management process.

The crypto boom

Driven by lower fee payment costs, transparency owing to the immutable ledger and no need for verification by a third party (such as a bank), cryptocurrencies have disrupted the traditional financial system.

The advantages of cryptocurrencies continue to draw interest from investors and businesses, creating demand for crypto-related services. The global digital asset management (DAM) market is projected to grow from USD 4.2 billion in 2022 to USD 8.0 billion by 2027, at a compound annual growth rate (CAGR) of 13.6%, according to a March 2022 report by Reportlinker.com (opens a new window), a market research solution.

Another potential growth area is non-fungible tokens (NFTs) which create digital representations of a wide range of items, including art, virtual real estate in the Metaverse, memes, sneakers and clothing, to name a few. The Global NFT market (opens a new window) is expected to expand by USD 147.24 billion from 2021 to 2026 at a CAGR of 35.27%, according to a report by tech research company Technavio.

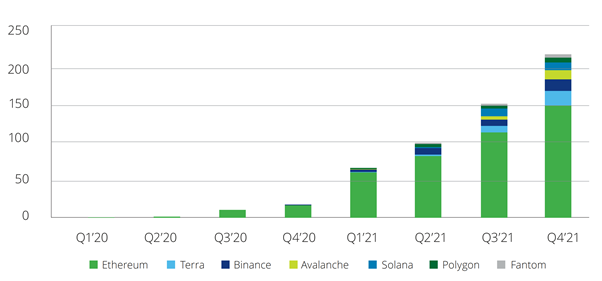

Total value of assets locked in smart contract platforms in USD billion

Source: Deloitte (opens a new window)

When fintech meets crypto

Many fintechs are exploring the integration of crypto functionalities as they look to expand into digital assets. Fintech companies seeking to provide such services to their customers should confirm that their risk management practices are reflective of new emerging risks.

Areas of consideration:

1. Technology risk

Vulnerabilities of the underlying technology may leave companies exposed to software and programming flaws, which will impact the ability to service customers should these be jeopardised.

2. Security risk

Appropriate controls are needed to prevent an array of different security risks such as fraud, conflicts of interest, money laundering and/or deceptive trading activity.

3. Operational and governance risk

Dependence on chosen blockchains and service providers can create strain on the firm from an operational perspective. Caution should be taken when choosing service providers such as custodians and the blockchain functionality being offered, to ensure a strong track record.

4. Compliance and legal risk

Regulation of the digital asset ecosystem continues to evolve, which has put additional strain on firms that are looking to enter this space. The absence of a clear regulatory framework means that firms must be constantly aware of various changes to legislation.

5. Financial risk

A lack of a structured regulatory regime exposes applications to greater financial risks, particularly when it comes to credit, liquidity, market and tax risks that can destabilise the financial system as a whole.

Transferring the risk

Many of the above risk exposures can be addressed through effective risk transfer. With appropriate risk transfer mechanisms in place, fintechs can free up capital and other resources to innovate and push the envelope in ways companies that retain all their risk cannot. Available insurance options include, but are not limited to:

Crime coverage

Custody insurance or “cold storage”/specie coverage

Directors and officers liability (D&O) coverage

Cyber insurance

Professional indemnity

Key person insurance

For further information, please contact:

April Bellchambers, Global Financial institutions fintech Vertical Lead

T +44 (0)207 933 2109

E April.Bellchambers@lockton.com

Neil Daly, Blockchain & Crypto Vertical Leader

T +44 (0)2079331445

E Neil.Daly@lockton.com