On 1 January 2019, the General Association of Retirement Institutions for Executives (AGIRC) and the Association of Supplemental Pension Plans for Employees (ARRCO) merged into a single unified program called “AGRIC-ARRCO.” The unified mandatory supplementary plan is now managed by a single federation of employers and trade unions.

Before the merger, ARRCO covered all employees, including executives, managers and nonexecutives, while AGIRC covered only executives and managers. The new single pension plan is part of a broader effort to simplify supplemental pensions in France and remove the inequalities between social categories.

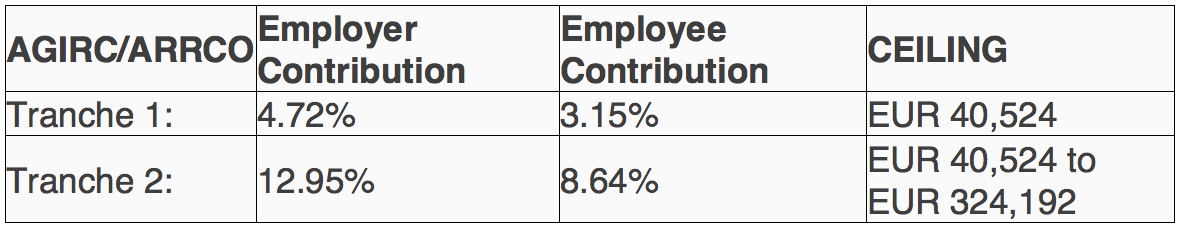

The merger increased total supplementary pension contributions. The new rates and salary brackets now apply to both executives and non-executives, as shown in the table:

Contributions are converted into pension points and then credited to an account opened in the name of each employee. While ARRCO points have simply become AGRIC-ARRCO points (1 ARRCO point = 1 AGRIC-ARRCO point), AGIRC points have been converted to AGIRC-ARRCO points (AGIRC points x 0.347798289 = AGRIC-ARRCO points).

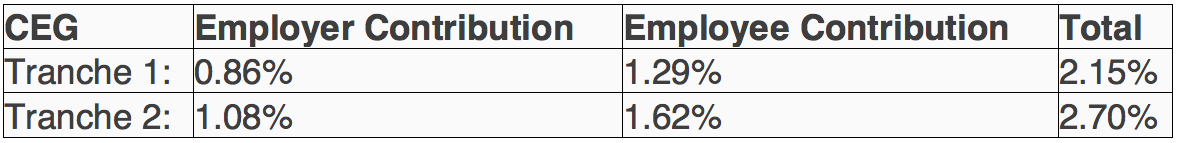

The pension fund management contribution, previously covered separately by the Association for the Fund Management and Financing of AGRIC and ARRCO (AGFF), and the minimum points guarantee contribution (GMP) are now consolidated into the general equilibrium contribution (CEG). The CEG rates are shown in the table:

The merged program also includes a new technical equilibrium contribution (CET) that applies to employees earning above the social security ceiling: 0.14 percent for employees and 0.21 percent for employers.

Pension payout according to age

Incentives are provided for employees born in or after 1957 to encourage them to claim their old-age pensions after the legal minimum age for retirement (age 62). As of 2019, the variations on the amount of supplementary pension that can be collected are as follows:

If the old-age supplementary pension is claimed at the same time as the social security old-age pension, the supplementary pension will be reduced by 10 percent for a three-year period. The reduction does not apply after age 67.

If the old-age supplementary pension is subject to a reduced rate of general social contribution (CSG) based on the employee’s salary, and if the supplementary pension is claimed at the same time as the social security pension, then the supplementary pension will only be reduced by 5 percent for a three-year period. The reduction does not apply after age 67.

No reduction applies in situations when: 1) the employee is exempt from CSG, 2) the supplementary old-age pension is claimed one year after the social security old-age pension is received, or 3) the employee received an early pension due to a disability.

The supplementary old-age pension is increased by 10 percent for one year if claimed two years after receiving the social security old age pension (20 percent increase if claimed after three years and 30 percent if claimed after four years).

Useful resources

Inter-professional National Agreement (opens a new window)– AGIRC-ARRCO pension scheme – 17 November 2017